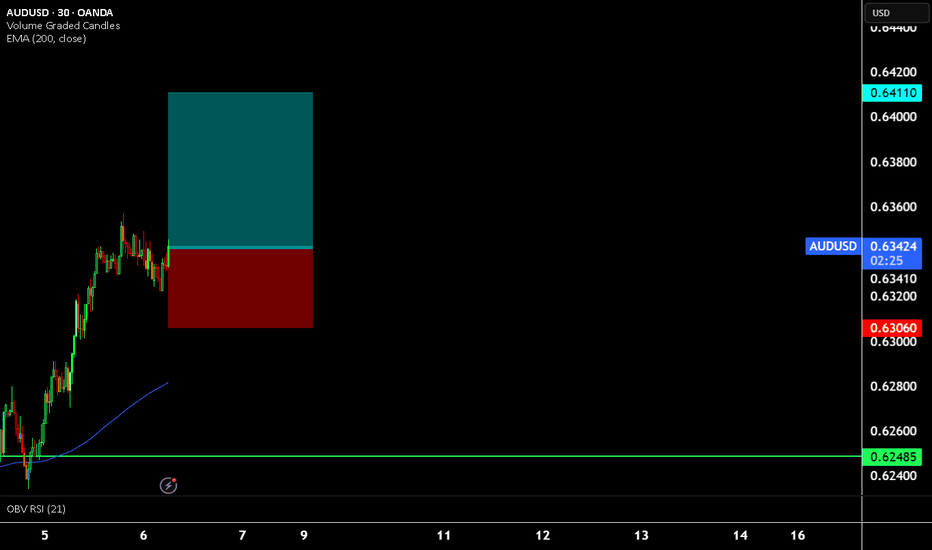

AUDUSD: Wait for AB=CD pattern to get completed before buying! AUDUSD is currently making AB=CD pattern where AB pattern already formed, however, for CD pattern to be completed we need to wait NFP data to be published which will give inside data of future trend.

Like and comment for more

Thank you

❤️

USDAUD trade ideas

Aussie H4 | Approaching overlap resistanceThe Aussie (AUD/USD) is rising towards an overlap resistance and could potentially reverse off this level to drop lower.

Sell entry is at 0.6356 which is an overlap resistance that aligns close to a 78.6% Fibonacci retracement.

Stop loss is at 0.6420 which is a level that sits above a swing-high resistance.

Take profit is at 0.6247 which is an overlap support that aligns close to a 61.8% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

BlkRk Says Buy USD on Dips... AUD sell with TRAILING STOP!!!The view from fund managers is still very bullish USD, and this Aussie rally gives a great opportunity to sell the Aussie dollar at a relatively high price to recent trading.

This trade has a potentially fantastic risk to reward. We're looking to trail the stop, and secure 50% of the position at a 1:1 risk reward.

Please note that using a trailing stop loss has been proven to be a winning strategy of itself - adding your own analysis can add further edge.

Here' we're looking at a recent bearish structure break combined with trading below the 1H 21 period moving average.

For more follow!

AUDUSD → Retest of the imbalance zone before growth FX:AUDUSD on the back of strong dollar decline has all chances for further growth, but today, Friday, the risks are quite high, as NFP is ahead...

The currency pair is forming a local uptrend, in tandem with the falling dollar the Aussie may continue its strengthening course.

On the 4H a local correction to the imbalance zone is forming, where a rather strong support line 0.63 is just passing. The price is forming a false breakout and after capturing liquidity is trying to consolidate higher. If the bulls can keep the defense above 0.63 - 0.633, the price will be able to continue the growth phase in the short and medium term.

Support levels: 0.63, 0.6255

Resistance levels: 0.633, 0.6363

Consolidation above 0.63, subsequent rise and consolidation above 0.633 is an ideal scenario that could confirm the bulls' intentions to go higher. But, NFP and other news are ahead. Risks are rising and we should expect high volatility in the markets

Regards R. Linda!

AUDUSD - Potential SHORT to take advantage of AUD weaknessHigher timeframe trend = down

Retail traders = long

Therefore bias = down

NOTE : Not in yet - Entry order set below the structure that is forming currently. We are at a resistance turned support zone (marked with white rectangle) and have seen a reaction which may entice buyers to get involved - at which point we can get involved if their stops get taken out.

Target is close to the low that was recently created (marked with white dotted horizontal ray).

Stops where my personal backtesting has suggested they be placed to invalidate the trade. If price gets to stops before triggering in, entry order is cancelled.

Please keep in mind that there is another layer of analysis that goes into this that is part of my personal plan.

AUD/USD at a Crossroads: Trend Reversal or Just a Dip?Alright y’all, let’s talk AUD/USD because this setup is looking interesting. We’ve been in a strong bullish run, climbing straight up from the lows around 0.62150 and topping out near 0.63607. But now, I’m seeing a potential shift. Price has broken below that short-term ascending trendline, which could be an early sign that momentum is slowing down and sellers are creeping in.

Right now, I’m watching 0.63150 closely. If price closes below this level and confirms rejection, I’ll be looking for a sell setup down toward the next key level at 0.62150. However, if buyers step in and we see a strong bullish reaction, then I’d wait for a break and retest of 0.63607 for a potential continuation to the upside.

👀 My Play:

✅ If we break below 0.63150 and hold, I’m looking to short down to 0.62150.

✅ If buyers reclaim control and we close strong above 0.63607, I’ll wait for a pullback and look to long.

Either way, we let price tell us the story and move with it, not against it. Stay patient and be ready to execute when the confirmation hits. Let’s see how this plays out!

AUD/USD Reversing? Major Buy Signal on H4 Chart

AUD/USD is showing strong bullish momentum after bouncing from a key support zone near 0.61760. The price has broken above the 50-period moving average, indicating a potential trend reversal. A long position has been entered with:

🔹 Entry: 0.63494

🔹 Stop Loss (SL): 0.61760

🔹 Take Profit (TP): 0.66570

If the bullish momentum continues, AUD/USD could target 0.66570 in the coming days. Watch for further confirmations!

💬 What’s your outlook on AUD/USD? Bullish or Bearish? Comment below! 👇

#AUDUSD #ForexTrading #PriceAction #ICT #MarketAnalysis #TradingView

AUD/USD Long Trade IdeaAUD/USD Long Trade Idea

Considering a long position on AUD/USD, supported by the following fundamental and technical factors:

Fundamental Factors:

Commodity Prices: Australia's economy is heavily reliant on commodity exports. Recent stability in commodity prices, particularly iron ore and coal, supports the Australian dollar, as sustained demand from key trading partners maintains export revenues.

Monetary Policy Outlook: The Reserve Bank of Australia (RBA) has maintained a steady monetary policy stance, contrasting with the U.S. Federal Reserve's recent indications of a more cautious approach to future rate hikes. This divergence could favor the AUD over the USD.

Technical Factors:

Support Levels: The AUD/USD pair has shown resilience around the 0.6270 level, suggesting a strong support zone that could provide a foundation for a bullish move.

Moving Averages: The pair is attempting to break above the 9-day exponential moving average (EMA), indicating increasing short-term momentum.

Elliott Wave Analysis: The 4-hour chart highlights a bullish trend, with the market currently in an impulsive mode, suggesting potential for further upside.

Given these factors, a long position on AUD/USD appears favorable. As always, ensure proper risk management and stay updated with economic developments that could impact this trade.

Note: All trading strategies involve risk, and past performance is not indicative of future results.

AUD/USD "The Aussie" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/USD "The Aussie" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / swing low level Using the 4H timeframe (0.62000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 0.64500 (or) Escape Before the Target

Secondary Target - 0.66000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook before start the plan.

AUD/USD "The Aussie" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

🟠Fundamental Analysis

Australian Economic Growth: Australia's economic growth is expected to remain steady, driven by the country's strong mining sector.

US Economic Growth: The US economic growth is expected to slow down, due to the ongoing trade tensions and weak domestic demand.

Interest Rate Differential: The interest rate differential between Australia and the US is expected to narrow, with Australia's interest rate at 3.1% and the US interest rate at 5.25%.

🟣Macro Economics

Inflation Rate: Australia's inflation rate is expected to remain steady at 2.5%, while the US inflation rate is expected to decrease to 2.2%.

Unemployment Rate: Australia's unemployment rate is expected to remain steady at 3.7%, while the US unemployment rate is expected to increase to 3.7%.

Global Trade: The ongoing trade tensions between the US and China are expected to have a minimal impact on the AUD/USD market.

🟡Global Market Analysis

Forex Market: The global forex market is experiencing a moderate increase in volatility, with the AUD/USD pair experiencing a 0.5% increase in the last 24 hours.

Commodity Market: The global commodity market is experiencing a moderate increase, with iron ore prices increasing by 1.2% in the last 24 hours.

Stock Market: The global stock market is experiencing a moderate decrease, with the S&P 500 index decreasing by 0.3% in the last 24 hours.

🔵COT Data

Speculators (Non-Commercials): 60,000 long positions and 40,000 short positions.

Hedgers (Commercials): 40,000 long positions and 60,000 short positions.

🟠Intermarket Analysis

Correlation with NZD/USD: AUD/USD has a positive correlation with NZD/USD, indicating that a strong New Zealand dollar could boost AUD/USD prices.

Correlation with Commodities: AUD/USD has a positive correlation with commodities, indicating that an increase in commodity prices could boost AUD/USD prices.

🟣Quantitative Analysis

Moving Averages: The 50-day moving average is at 0.62600, and the 200-day moving average is at 0.61800.

Relative Strength Index (RSI): The RSI is at 54, indicating a neutral market sentiment.

🔴Market Sentiment Analysis

The overall sentiment for AUD/USD is neutral, with a mix of positive and negative predictions.

58% of client accounts are long on this market, indicating a bullish sentiment.

🟢Positioning

The long/short ratio for AUD/USD is currently 1.2.

The open interest for AUD/USD is approximately 150,000 contracts.

🟡Next Trend Move

Bullish Prediction: Some analysts predict a potential bullish move, targeting 0.64000 and 0.64500, due to the interest rate differential and the weak dollar.

Bearish Prediction: Others predict a potential bearish move, targeting 0.62500 and 0.62000, due to the ongoing trade tensions and the strong dollar.

🔵Real-Time Market Feed

As of the current time, AUD/USD is trading at 0.63300, with a 0.5% increase in the last 24 hours.

⚪Future Prediction

Short-Term: Bullish: 0.63800-0.64300, Bearish: 0.62800-0.62300

Medium-Term: Bullish: 0.64800-0.65300, Bearish: 0.61800-0.61300

Long-Term: Bullish: 0.66300-0.66800, Bearish: 0.60300-0.59800

🟤Overall Summary Outlook

The market is expected to experience a moderate fluctuation, with some analysts predicting a potential bullish move targeting 0.64000 and 0.64500.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

AUDUSD InsightHello, dear subscribers!

Please share your personal opinions in the comments. Don't forget to like and subscribe!

Key Points

- U.S. Secretary of Commerce Howard Lutnick stated that President Trump is listening to proposals from Canada and Mexico. He mentioned that by April 2, relief measures may be considered for certain market sectors, adding that the tariff exemption could apply to automobiles or other items.

- The White House officially announced a one-month tariff exemption for automobiles imported from Canada and Mexico.

- Markets view Germany's establishment of a €500 billion special fund and its attempt to ease the "debt limit" as a historic shift.

- In Australia, the Q4 growth rate hit its highest level in two years, with annual GDP growth recovering slightly to 1.3% last year. The Reserve Bank of Australia (RBA) projects GDP growth will rise to 2.4% this year.

Key Economic Events This Week

+ March 6: ECB Interest Rate Decision

+ March 7: U.S. February Nonfarm Payrolls, Unemployment Rate, Fed Chair Powell's Speech

AUDUSD Chart Analysis

The pair previously faced strong resistance at the 0.64000 level, leading to a significant pullback. It now appears to be making another attempt to break through this resistance. If the 0.64000 level is successfully breached, the price is expected to rise toward 0.66000. However, if it fails to break resistance, a decline toward the 0.60000 level is likely.

AUD/USD Update - Correction Then Continue "LONG"How I see it:

78.60% FIB @ 0.63607

Potential Correction - "SHORT"

TP 1 = 0.62550

and / or

If key support @ 62350 Holds - Continue "LONG"

TP 1 = 0.64080

Keynote:

Pair shows quality bullish strength at this time.

Price can also just power on to 0.64000 or beyond, with only minor dips

until a key resistance is reached.

This will indicate a much higher TF FIB is required.

I will update and calibrate as required.

Thank you for taking the time to study my analysis.

AUD/USD - Austrailian Dollar / US Dollar 2/27/2025Fundamental Context

The Australian dollar held its recent decline to around $0.63 on Thursday, hovering at a two-week low as US President Donald Trump’s latest tariff escalation weighed on risk sentiment. On Wednesday, Trump outlined plans for 25% “reciprocal” tariffs on European autos and other goods, while confirming that tariffs on Mexico and Canada would take effect on April 2, rather than the previously set deadline of March 4. Given Australia’s heavy reliance on exports, the currency remains vulnerable to the risks of a global trade war. Domestic data also showed an unexpected decline in private capital expenditure for the fourth quarter, fueling expectations of further interest rate cuts by the Reserve Bank of Australia. However, RBA Deputy Governor Andrew Hauser said on Thursday that the central bank would need to see more positive inflation data before considering additional rate cuts.

Technical Overview

Support Zones

First Major Support around 0.6200 – Price is currently hovering around this psychological level. A bounce here could trigger short-term recovery, but failure to hold suggests deeper downside.

Secondary Support around 0.5950–0.5910 – Historical support, providing a deeper line of defense for buyers.

Tertiary Support around 0.5650–0.5600 – A key zone visible from prior cycle lows.

Buy Limit Orders

The chart highlights staggered buy-limit levels within these support zones, suggesting a strategy to average into long positions if the Aussie continues to weaken.

BLO 1 @ 0.61939

BLO 2 @ 0.59172

BLO 3 @ 0.56378

Take-Profit Targets (TP)

TP1 @ 0.63741

TP2 @ 0.66979

TP3 @ 0.71315