USDJPY Analysis Continuing the previous analysis Although the main trend remains bearish with targets at 138.70, 136.15, and potentially lower, a temporary bullish correction is expected. Short-term bullish targets: ◾ 144.76 ◾ 146.87 With a lower probability: ◾ 148.24

Gold Analysis Continuing the previous analysis The market faces a critical test at 3340. A confirmed break and stabilization above this level would invalidate today's analysis and shift the trend bullish. However, based on precise mathematical modeling, the expectation is clear: The market is likely to fail in breaking above 3340, opening the way for a strong...

EUR/USD Analysis In the previous analysis , the market movement was predicted with high precision, and the market moved exactly according to the forecast. However, surprisingly, it did not receive the attention it deserved. Now, the market has reached a level where, similar to gold, many participants are anticipating the end of the rally and the entry of...

Gold Analysis | Weekly Update Timeframes: 4H & Daily Gold has continued its bullish momentum without significant seller pressure. Based on the geometry of the current move, new targets have been identified: ◾️ The 3670–3750 range is a key area to watch for a potential market reaction or pause. ◾️ The main bullish target for this rally is $4080...

Dow Jones Analysis The overall trend on Dow Jones remains bearish. Although a short-term correction toward 39,840 may occur at the market open, this is not my primary scenario. Main Scenario: ◾ Continuation of the downtrend toward 36,880 ◾ A corrective move back to the 39,460 area ◾ Further decline toward the final target at 35,050 Note: The trend has been...

EUR/USD Analysis After testing and failing to break the previously announced 1.08 level , the market turned bullish, which is surprising when checking the sharp move that quickly hit the targets with the given levels. This is due to how these levels were broken and how the price reacted to the pullbacks, showing respect as if the price gave a "goodbye kiss" to...

Lower Timeframes and Plan B Based on previous daily analysis , the 3075 and 3000 levels are key levels in the lower timeframe. It is anticipated that a breakout of the 3075 level will lead to an upward trend. However, if the 3000 level is broken, the bearish target at 2960 will become active. Mathematical Analysis: 3000 level: This level is considered a key...

Mathematical Analysis of Gold (XAUUSD) Following up on my two previous analyses (linked here and here ), gold reached the precise $3135 target, accurately identified based on mathematical calculations. The rally was driven by central bank buying and tariff-related actions by Trump. What’s next? The levels mentioned below are mathematically derived and...

USDJPY Analysis The previous bearish outlook was invalidated early in the week with a break above 149.4, confirming a bullish trend. The uptrend is expected to continue toward 152.73. However, on the higher timeframe, an unusual price structure suggests a bearish formation, aligning with my projected setup.

Price initially moved up as expected but retraced later in the week. Given upcoming news, a breakout and confirmation beyond the 27-pip range will determine the trading direction. For now, staying neutral is preferable, but I remain cautiously bullish in line with the previous analysis.

EUR/USD Analysis As expected from the previous analysis , the price dropped by 90 pips. Moving forward, despite the important tariff news on Wednesday, technical analysis remains ahead. I anticipate a bullish move and expect the market structure to follow the outlined formation. Invalidation of the analysis: A break below 1.0800 What do you think? Will...

#USDJPY 1H Last week, the target of 150 was seen with high accuracy. The analysis of the market is bearish with a target of 147.8 and will be analyzed if it consolidates above 149.4. Beware of fake moves and market deception

AUDUSD Analysis For an uptrend to continue, the level 0.625 must hold. The next important level that could reverse the trend is 0.635, which is 100 pips higher. Key targets ahead: 0.6373 0.6433 0.6510 0.6560 These targets are crucial and may present trend reversals, so it’s important to manage risk and secure profits. Opportunities in the market are...

EURUSD Analysis Bearish direction expected with the key support at 1.0783. If this level breaks, targets of 1.0726 and 1.0685 will be in play. If the price bounces back from 1.0783, the market direction will shift to bullish.

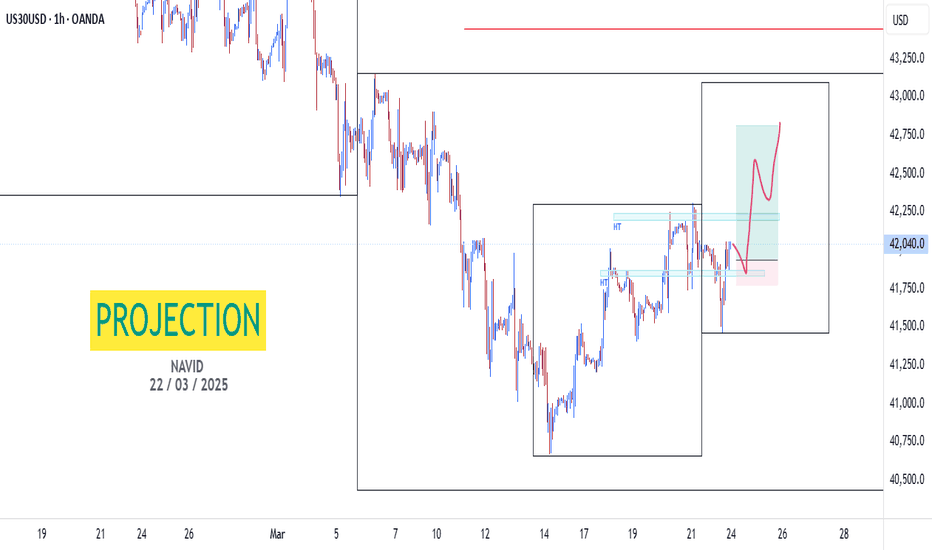

Following the previous analysis ... #DowJones Analysis As long as 41825 holds, an upward move is expected with potential resistance at 42200. The market movement is anticipated to follow the sketched schematic.

The previous analysis hit the exact 3055 level with precision! #XAUUSD Analysis Gold is trading within a key range between 3026 resistance and 3006 support. A breakout or failure to break these levels will determine the next move. 📉 Bearish Scenario: A rejection from 3026 could trigger a short setup targeting 2990. Invalidation above 3033. 📈 Bullish...

USDJPY – Bullish Outlook Continues 📈 Expecting further upside with targets: 🔹 149.16 → 150 → 151.25 ❌ Bearish invalidation: Break below 148.18. Let’s see if we can catch a solid 1:6 R:R trade in the Asian session! What’s your take? Disclaimer: Trading involves risk, and you are responsible for your own decisions. Always do your own research and manage your...

#DOWJONES – Key Levels & Trade Setups 🔻 Sell Setup: If price fails to hold above resistance, targeting 39400. 🔹 Risky Buy: If no lower low forms, possible buy with reduced size. 🚀 Bullish Confirmation: Break & retest of 41760 activates 42800 → 43000 → 44300. ⚡ Market conditions favor quick reactions—stay sharp!