Kwaku_As

Essentialsome fundamental analysts have chalked DTK as a stock to buy with significant upside potential. we like to focus more on the technicals. price is currently digesting the recent run-in price. the wicks on the above timeframe indicate that the bulls are still in the game. the support region is quite visible on the daily timeframe. entry triggers include: 1....

we believe ALMU is mimicking AEVA's recent move. the broader market is due for a pullback, but we expect ALMU's relative strength to pull through. a clear break out of the flag will be our entry signal. a strong close below the recent higher low would invalidate the pattern.

if our memory serves us correctly, UXIN was derived from a proprietary screen called "runner takes a breather." the screen in question looks to going, long on stocks that have experienced significant gains, after a reasonable pullback period. UXIN has been range-bound since we entered the position. we believe the next earnings date could serve as the...

highly speculative with earnings in a few days. a high ADR stock with a history of explosive moves. we are big fans of the tightening price action as earnings approach. it's worth noting that our stop losses are partially symbolic. we typically close trades when price prints a strong bearish candle below chart patterns or indicative stop loss levels.

we have been consuming a lot of Kristjan Qullamaggie content lately and thought we could put it into practice. AREN appears to have held up well post "episodic pivot" and during the recent market pullback. the relevant moving averages (10 & 20 SMA), though not visible in the chart, are in the right position. also relevant is the tightness of recent price action....

we have been keen observers of Moroccan real estate stocks since June 2023. after a spectacular two-year run, they have (ADH, ADI, & RDS) started showing signs of exhaustion. ADI has formed a classic Head & Shoulder pattern signifying a potential reversal of the bullish trend. we will be looking to short once the recent retracement is complete. bonus: ADH is...

another Qullamaggie-type trade. AZ has held up quite well during this turbulent period. the 10, 20, and 50 moving averages (not depicted) have tightened coupled with a higher low. a breakout of the chart pattern will trigger an entry. the stop loss level is a bit more complicated. we will consider closing the trade if this pattern fails. we concede that market...

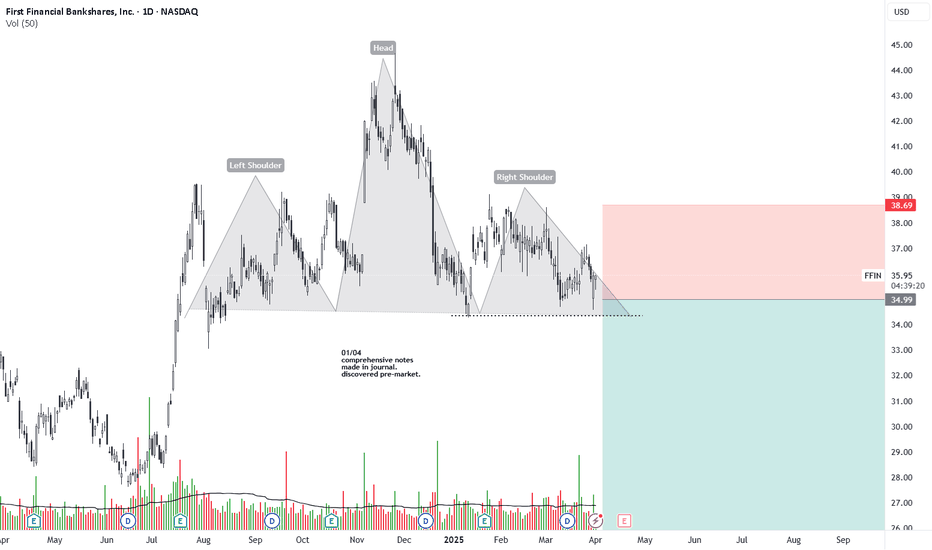

we are probably marking the bottom by posting this. current US market conditions have prompted us to scout for shorts. FFIN provides us a classic (arguably) Heads & Shoulders pattern. a close above the right shoulder could invalidate the pattern. PT of $25.65 was derived by measuring the distance between the neckline and the head and transposing it to the...

EABL has been in a decade-long downtrend. however, we appear to on the cusp of a change in trend. the next few days will prove pivotal. in the event of a breakout, we forecast a 20% upside to the 180-190 KES region - resistance level. we are of the view that the sky is the limit, though we expect sizable pullbacks at various key resistance areas. this will...

the chart says it all. Carbacid is a phenomenal company with a leading market position in the East African region. this moat is reflected in the company's stable financial metrics. Mr Patel, a prominent investor on the NSE has increased his stake from approx. 25% to 49.9% over the past decade. One would be hard-pressed to find a company with a much stronger...

the market may have gotten ahead of itself after the CMA gave CARB clearance to acquire BOC. we still remain bullish and maintain our price target. we could get a second bite at the cherry as price nears the "golden zone" (50%-61.8%) of the fibonacci retracement.

breaking out of a base. as for me, i just like the stock.

KCB has experienced a series of higher lows. price is just about interacting with the trendline for the third time. we anticipate a bounce off that trendline. a firm candlestick closure below the trendline would invalidate the setup.

the US Dollar has been quite strong for a couple of weeks now, and even showed resilience in the face weak NFP numbers. per the economic calendar, there is little to no activity until wednesday. this would provide market participants with ample time to take some profits. if the head and shoulders pattern remains intact, the DXY would fall to the 95 level. This...

last week's massive drop in price resulted in a change in trend on the daily timeframe. using both trendline rejection and a breakout of the triangle pattern as confluence, I am setting a long-term take profit at the 95.50 region - weekly trendline & the next major support level