Scrollz

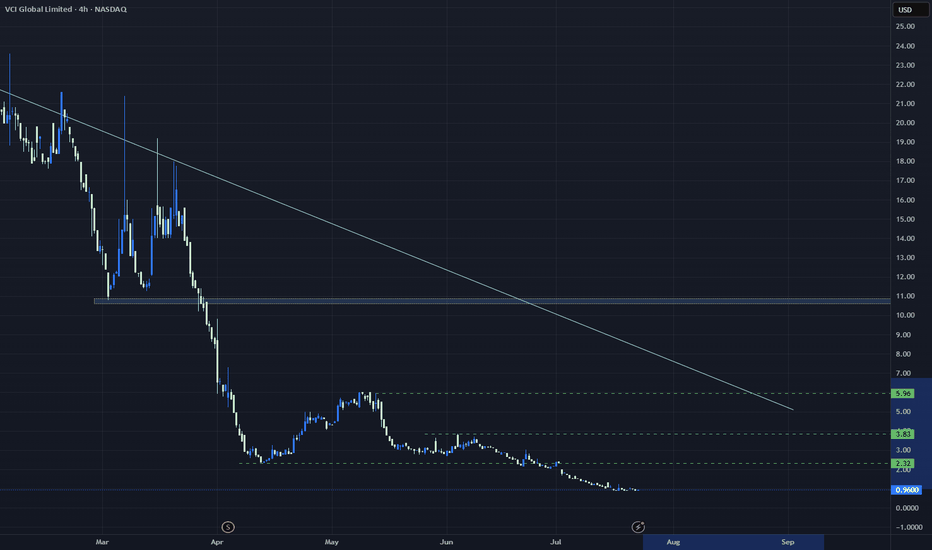

VCIG is a microcap play that exploded in 2023 due to aggressive speculation around its AI, Web3, and consulting ventures — and while it retraced heavily, the foundation for a sharp rebound to $6+ exists if the company delivers even modest traction or sentiment returns to risk-on. 1. Low Float + History of Spikes = Ideal Setup VCIG’s float remains tiny (under 10M...

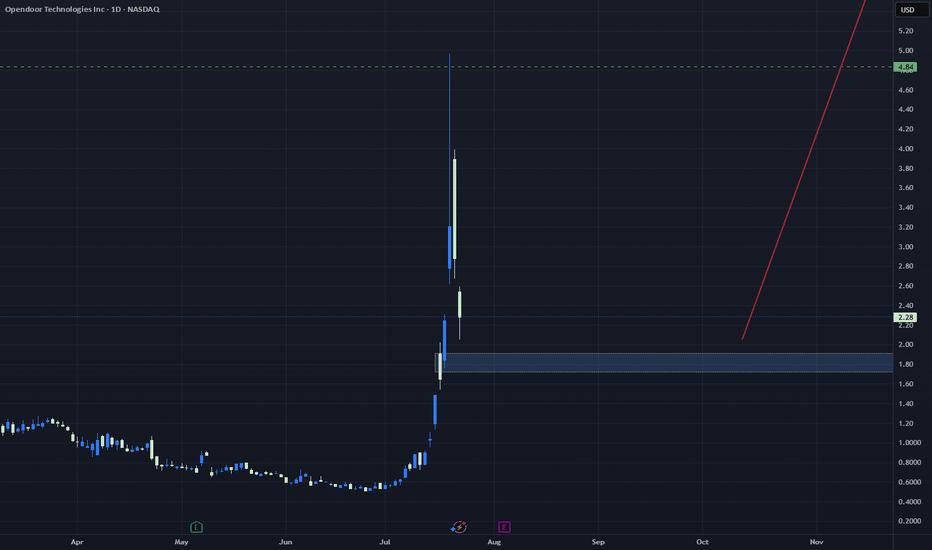

Opendoor (OPEN) is emerging from a brutal real estate cycle with a leaner, smarter operation and a business model that could thrive as the housing market finds footing. While the company is still working toward consistent profitability, the current setup offers asymmetric upside due to improving fundamentals and a high short interest that could fuel a sustained...

SharpLink Gaming (SBET) is an under-the-radar play in the evolving sports betting and iGaming infrastructure sector, and while it's a micro-cap with high risk, the upside is significant if the company continues to execute. My bullish case rests on three pillars: 1. Niche Focus in Affiliate Conversion SBET is positioning itself not as a sportsbook, but as the tech...