Stiven088

Gold price retreats slightly from near $3,500, or a fresh all-time highs in the early European session on Tuesday as bulls pause for a breather amid overbought conditions on short-term charts. Any meaningful corrective downfall, however, still seems elusive on sustained US Dollar weakness If Gold sellers manage to fight back control, Gold price could initially...

In the near term, and according to the 4-hour chart, XAU/USD has room to extend its advance. Technical indicators eased modestly from their recent highs but lack any bearish momentum. Particularly, the Relative Strength Index (RSI) indicator hovers at around 81 with no signs of giving back. Finally, the 20 SMA accelerated north above the longer ones, while...

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

Gold price builds on the previous day's breakout momentum above the $3,300 mark and touches a fresh all-time peak during the Asian session on Thursday. Tariff uncertainty, the escalating US-China trade war, global recession fears, and expectations of more aggressive Fed easing continue to support XAU/USD. Sell 3330 Target 3300

The daily chart shows that the 14-day Relative Strength Index (RSI) has re-entered the overbought region, currently near 71, warranting caution for buyers. If they manage to sustain above the $3,275 level on a daily closing basis, a test of the $3,300 mark will be inevitable, opening the door toward the $3,350 psychological mark. Conversely, the initial support...

GBP/USD could face immediate resistance at 1.3200 (static level) ahead of 1.3270 (static level) and 1.3300 (round level). On the downside, first support could be spotted at 1.3150 (static level) before 1.3100 (round level, static level) and 1.3040 (static level). GBP/USD rose three-quarters of one percent on Monday, climbing for a fifth straight trading session...

EUR/USD spun in a messy circle on Monday, touching the 1.1400 and 1.1300 levels before settling somewhere in the midrange. The US Dollar continues to soften across the board following the Trump administration’s latest about-face on its own tariff threats, but market sentiment remains tepid as investor fears of continued trade tensions simmer in the background.

Gold is holding steady near the $3,250 mark, fuelled by robust safe-haven demand, trade war concerns, and a softer-than-expected US inflation gauge. The US Dollar keeps trading with heavy losses around three-year lows. The daily chart shows that the 14-day Relative Strength Index (RSI) is prodding the overbought region at 70, suggesting more room for upside...

Technically, the XAU/USD pair's daily chart shows that additional gains are likely, given the strong upward momentum. Technical indicators head north almost vertically, while still far from overbought levels. At the same time, the bright metal extended its advance beyond a now bullish 20 Simple Moving Average (SMA), currently at $3,052. Finally, the 100 and 200...

GBP/USD tested higher on Wednesday, climbing back over the 1.2800 handle after broad-market sentiment recovered across the board. The Trump administration has once again pivoted away from its own “no exceptions, no delays” tariff policy, and has again delayed tariffs, this time for 90 days. The Relative Strength Index (RSI) indicator on the 4-hour chart stays...

EUR/USD keeps its bullish stance well in place, adding to Tuesday's uptick and retesting the vicinity of the 1.1100 neighbourhood on the back of the intense sell-off in the Greenback, all amid steady concerns over the impact of the China-US trade war.

Gold preserves its bullish momentum and trades near $3,050 in the second half of the day. Further escalation in the trade conflict between the US and China force markets to remain risk-averse midweek, allowing the precious metal to capitalize on safe-haven flows. XAUUSD signal 3082 Support 3068 Support 3047 Support 3020 Resistance 3109 From a technical...

On the downside, the pivotal level of the March 14 high at $3,004 roughly coincides with the $3,000 round number and is trying to provide support as writing. If this area does not hold as support, bears can target $2,955, where clearly many buyers were interested in scooping up Gold on Monday. Further down, the S2 support at $2,899 is the last line of defence,...

Gold price attracts some sellers near the $3,055 support-turned-resistance and stalls its intraday recovery from the $2,972-2,971 area, or a nearly four-week low touched earlier this Monday. Investors continue to unwind their bullish positions to cover losses from a broader meltdown across the global financial markets XAUUSD signal 3025 Support 3003 Support...

Bitcoin (BTC) traded above $84,000 on Friday, showing strength despite the stock market experiencing significant declines. The market reaction stems from United States (US) President Donald Trump's clash with the Federal Reserve (Fed) Chairman Jerome Powell over interest rate decisions. In the wake of imposing reciprocal tariffs on international trading patterns,...

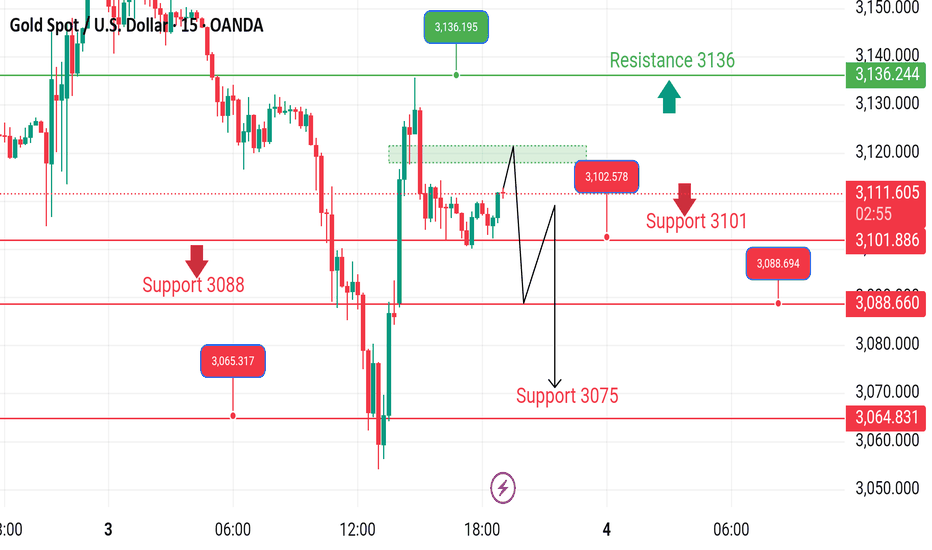

Prices of Gold remain on the defensive on Thursday, hovering around the $3,100 region per troy ounce and retreating from earlier all-time peaks near the $3,170 level, all against the backdrop of investors' assessment of "Liberation Day". XAUUSD sell signal 3112 Support 3101 Support 3088 Support 3064 Resistance 3136

Again, this is a “parental advisory” just ahead of the main event for this Wednesday. With the primary tailwind for the Goldrush set to be officially announced, the “buy the rumour, sell the fact” rule of thumb should be considered. The risk could be that once the reciprocal tariffs take effect on Wednesday, only easing due to profit-taking in Gold could occur...

Gold is easing from its fresh record high near $3,150 but remains well supported above the $3,100 mark. A generalised pullback in US yields is underpinning the yellow metal, as traders stay on the sidelines awaiting clarity on upcoming US tariff announcements XAUUSD buy 3115 Support 3131 Support 3162