kitejunkiee

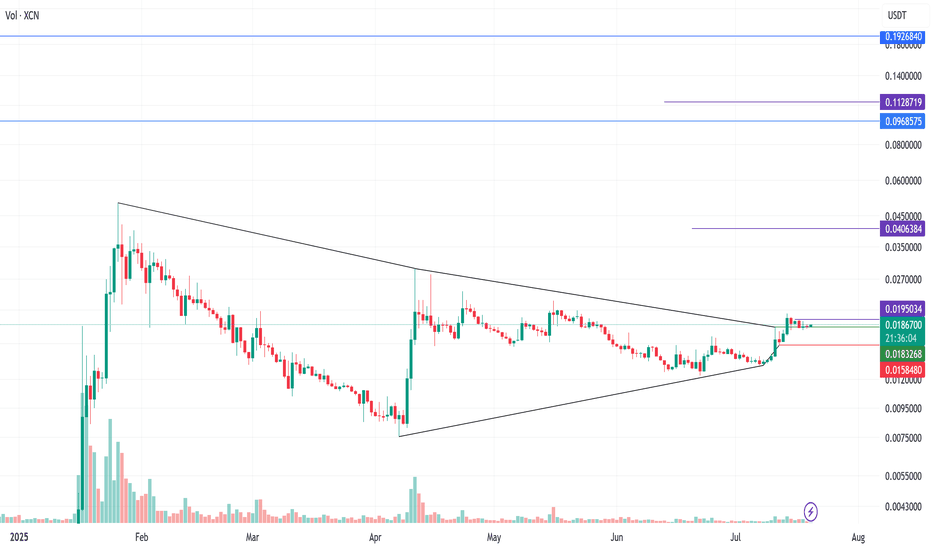

PlusThis coin had a 18x pump in Jan 25 and has been forming this pattern for months. It looks like it wants to continue higher. I have entered with spot only, too much volatility for me on this token. R/R 38 and a Target 0.1128 is a 5x from here. The pattern has trigged hit interval 1 and returned to entry. I have added more on this return move. Entry -...

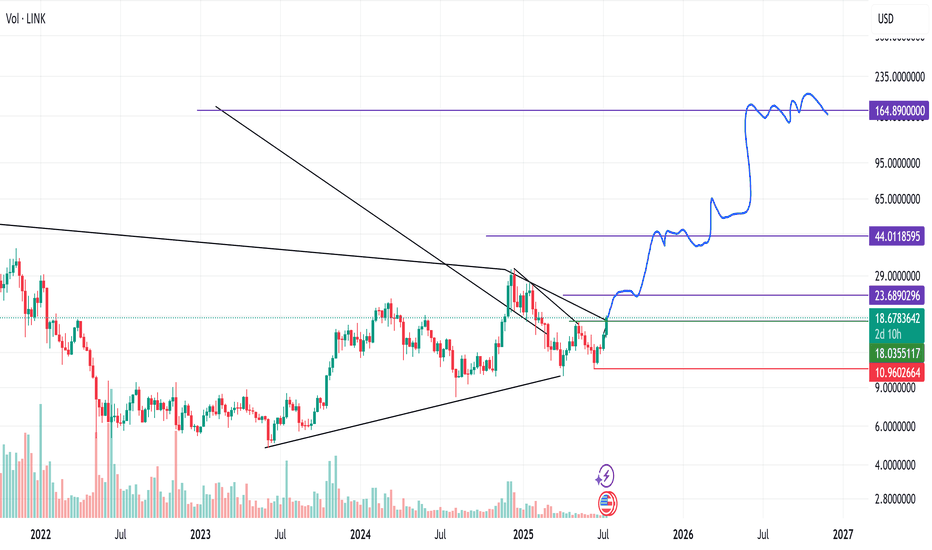

Huge R/R 50+, a bit of a wild card as in the pattern maybe still forming and developing. It appears to be bottomed, with supporting OBV (buying volume rising). I will take a 2x leverage on this one. Entry - 10.924 Stop - 9.778 Interval 1 - 11.7 Interval 2 - 20.36 Target - 112.79

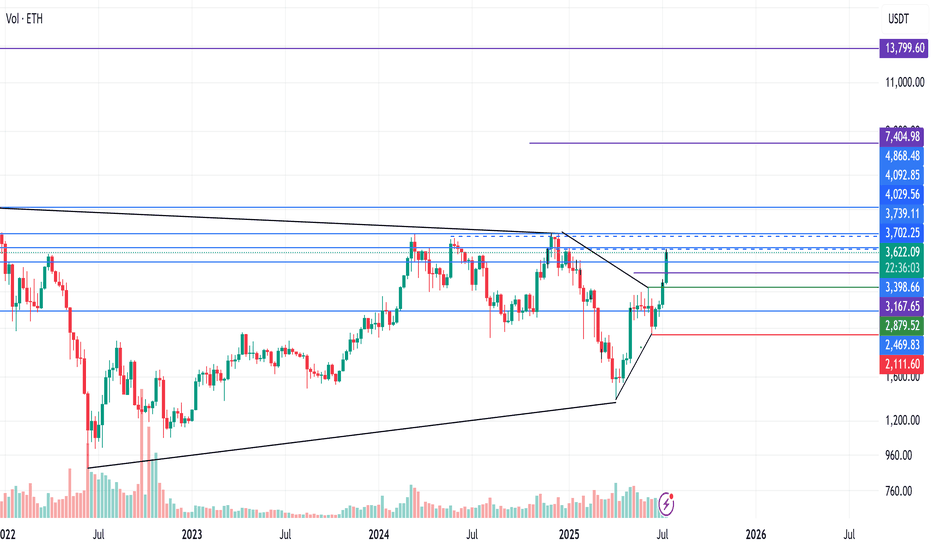

Taking this trade as its normally the first one to run in Alt Season, and although there is higher beta trades, this being a large cap should have smaller pullbacks. Entry - 2879 Stop - 2111.6 Interval 1 - 3190 Interval 2 - 7405 Target - 13799.6

SUI has had upside buying pressure since its inception around Jun 23. I have been looking for a chance to get in and this symmetrical triangle shows it is likely to give upside continuation with a great R/R of 26. Entry - 3.5818 SL - 3.3094 Interval 1 - 3.79 Interval 2 - 6.45 Target - 10.755

Chianlink macro pattern triggered, fundamentally strong. Even though link is known for wild swings this is a spot hold to target $164.

TA looks great for YFI/BTC. With Eth and DEFI growing (funds locked increasing), fundamentals at looking strong too. Can also stake YFI on Binance for 4.6%. Targets 1.49, 2.86, 4

YFI had its sell off, had its exploit, and increased supply from 30k to 36k. Sold off, now we are looking to go higher. The project team have used the newly minted 6,000 coins to pay anyone who lost money in the exploit (which will be paid back to the project through usage fees). Almost every defi project has seen gains, YFI being the one the started it all is...

Bull flag, if breaks and we get a hourly close buy.

Cup and handle pattern on 15min, also shown on 1hr, 4hr charts.

Adding more eth from btc, taking this as a false breakdown

ETH/BTC pair is riding on the bottom of the support channel and horizontal resistance.

Dollar index has a double bottom, could be a short term bounce before heading lower

OMG going parabolic after Tether decided to use OMG network due to ETH high fees. I've mapped out major resistance levels, setting wide stops below each one.

IF BTC Dominance falls and closes below $62 we should have the start of an ALT season.

Cup and handle formation formed and breakout, target $2

Looks like this cup and handle will help break 400 level. After 400 maintains, it can go much higher ~550.

Placed this short early last week, going to add to the position if it bounces back to $86. With the recent oil sell off and given 15% of this HYG debt is in oil, it is another sign a sell off is due.

CME futures closed on Friday at $9110, very high chance the gap is filled. Time frame unknown could be few days or few weeks. Long trade with no lev entered at $7800, target sell at $9100.