USDIDR has fallen since early April 2020 from Rp17,000/USD to Rp15,150/USD. In my opinion, this move is to end a weakening trend of Rupiah that started in early 2020. To do that, Rupiah must continue to move below Rp14,700/USD. If somehow Rupiah stays within Rp15,000/USD range, there is a possibility that a weakening trend of Rupiah will still happen anytime...

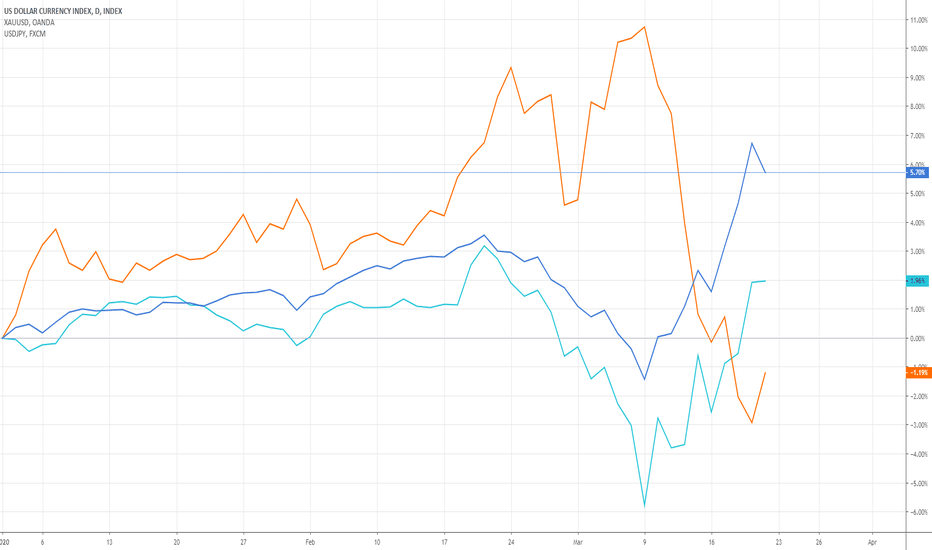

If Gold, that has risen since 2018, is falling since the beginning of 2020, I think Investors are selling it. On the side, the USD Index and USDJPY are seen as another Safe Heaven a.k.a Cash and those assets are rising in March 2020 after Corona Virus spread across the world. I think Investors are really scared and they want to hold Cash and avoid Market Risk...

VIX Index broke Up Trendline which might lead to reaching a level similar to GFC 2008. By broking Up Trendline, VIX now has a tendency to fall to a level that indicates a normal risk during the normal period, not a risk during a crisis. I expect VIX keep falling to a level of 50.

The current advance of JKSE might be a Technical Rebound or a temporary rise during Downtrend. Since Downtrend is still intact, the future drop might be deeper than this advance. I predict JKSE will fall below its lowest point (at 3,911) and could reach 3,750. However, I believe this is one last drop before JKSE starts to form the Bottom or Bullish Reversal...

JKSE (Composite) moved in a small downtrend since April 2020 but this I think this move was part of Bullish Continuation that should continue a Rally from the end of March 2020 (from ~3,900 to ~4,900). However, I still yet to see Bullish Reversal Pattern that can reverse Downtrend of JKSE that started in early 2020. In that case, the potential upward move to...

Big Bank tends to be Bullish because of Indonesia's economic structure. So when Big Bank was kept rising, it didn't show the problem that already boiled (in 2019). I watch Other Big Caps to better gauge Composite's movement which consists of more Index Sectoral that just Banking Sector. Other Big Caps already showed Downtrend since early 2019 where Bank just...

Consumer Goods Stocks (Food, Staples and even Cigarettes) is expectedly Outperform Composite at a bad time. Cyclical Stocks (ASII and surprisingly TLKM - during this WFH trend) Underperform Composite from the beginning. Finance Stocks as a backbone of Composite move closely with Composite but in the early days before Market Crash, Finance Stocks was Outperform Composite.

Rupiah is the weakest currency in South East Asia. Even though Indonesia relatively has lower Debt to GDP Ratio amongst SEA countries, Indonesia's reliance on import and lack of export variance might be the risk aspect. However, Indonesia's economy that mostly based on Consumption might be healed relatively quick compared to other SEA Countries that rely on...

Japan and German Bond Yield just recently enter a positive area. These Bond Yields previously have moved in a negative area since Investors keep buying those assets. But since the outbreak, Investor seems to ignore safe heaven and hoard cash. They sold Japan and German Bond so those bond yields are increasing since the prices are decreasing. France Bond Yield is...

These are the charts that I'm monitoring in order to see the Inverted Yield Curve. The Blue Line is a spread between ID10Y and ID05Y that indicate Benchmark and Short Term Yield. The Red Line is a spread between ID20Y that represents Long Term Yield and ID10Y as Benchmark.

ID10Y tend to rise to 9 : But US10Y tend to fall below zero level following other developed countries Bond Yield : I believe the spread between ID10Y and US10Y will be larger and might breach the highest spread since 2015 at this current spread of 7.5%. I don't believe the spread could reach a level in 2009 (a recovery after GFC) but the spread could...

What Trade War? S&P500, DJIA and Shanghai Composite are making profits by rising 15% to 25% since the beginning of 2019. If this year's Trade War is in full effect then shouldn't the stock market is in a crash? Even Economist predicts that in 2020 there will be a recession but then, US Economy in 3Q19 recorded higher than prediction. Some say that this is the...

If JKSE breaks Support at 5,900, the bullish continuation pattern that has been forming since 2015 fails and there is a good chance that instead Long Term Uptrend, JKSE might enter an early stage of Long Term Downtrend. The Primary Trade is monitoring a break of minor support at 6,100. The threat of breaking down Support at 5,900 is significantly increased if...

Oil (Brent and WTI) has been continuously lower since OPEC and Russia disagreed with each other at the same time as the first outbreak of Corona in Wuhan, China. The dispute continues, Arab Saudi pumps more oil and pushes oil price to reach lower at $20 - $30 per barrel. I think this is a holding breath contest. A country that can withstand lower oil (without...

I believe when oil reaches a low level, the end is near because other players will not accept losing. What does the action they take so they don't lose? Flip the table. Lower oil also coincides with the bottoming of stock markets : Gold also starts to rise so it seems that the Investor has found their risk appetite after Hoarding Cash (shows they are really...

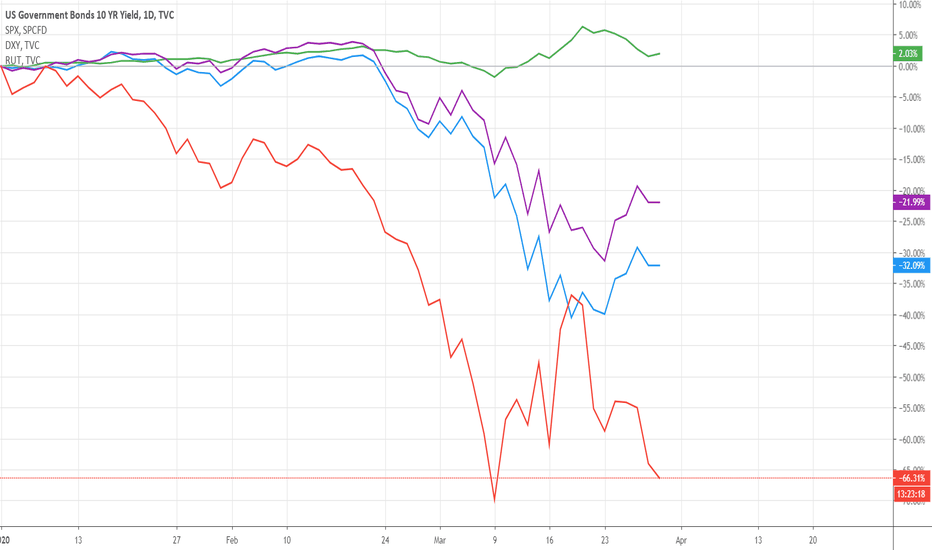

After falling -40% since the beginning of 2020, SPX - DJI - DJT and RUT start to rise. The story behind why they are rising might be because Investor see the reason why the market is crash at the first place is almost over. I am not expecting to see those four indexes are rising continuously. At least there will one more fall before we can expect they rise.

SPX and RUT (as a better US Stock Market Indicators - to me) seem are meeting their Bottom which I think those indexes are about to form a Bottom Patter. US10Y may go lower but maybe will not reach below zero. Strengthening DXY is more likely to fall since The Fed releases unlimited QE that should end US Dollar scarcity. Overall, I believe Bear Market is on its...

COMPOSITE movement is negatively correlated with ID10Y. USDIDR is positively correlated with ID10Y. I'm trying to catch the time when COMPOSITE starts to go up and ID10Y starts to go down.