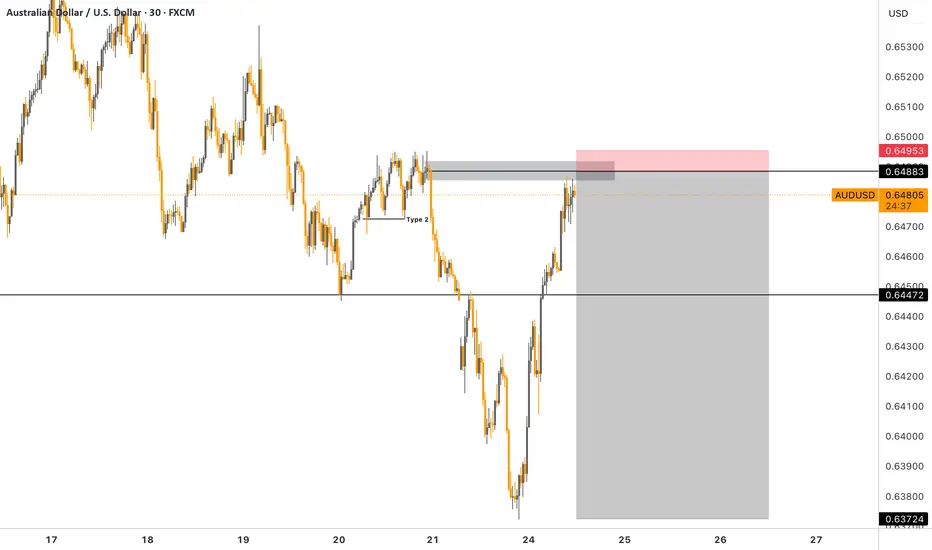

Price is rejecting from a precision-based Type 2 Area of Liquidity (AOL) — a textbook scenario under the AUTH model, backed by higher-timeframe direction.

Breakdown

• Bias: Weekly momentum remains bearish with clean lower highs and fresh structure breaks

• AOL Type 2: Price taps into refined supply zone within premium, mid-volume zone — no excess, no noise

• Execution: Entry confirmed on lower timeframes after micro shift or rejection wick

• Stop Loss: 7 pips only — precise risk, nothing emotional

• Target: Continuation into inefficiency zones and previous internal demand

• Invalidation: Close above AOL structure – no hesitation, no negotiation

Disclaimer: This setup is shared for educational purposes only. It is not financial advice. Always apply proper risk management and trade responsibly.

Breakdown

• Bias: Weekly momentum remains bearish with clean lower highs and fresh structure breaks

• AOL Type 2: Price taps into refined supply zone within premium, mid-volume zone — no excess, no noise

• Execution: Entry confirmed on lower timeframes after micro shift or rejection wick

• Stop Loss: 7 pips only — precise risk, nothing emotional

• Target: Continuation into inefficiency zones and previous internal demand

• Invalidation: Close above AOL structure – no hesitation, no negotiation

Disclaimer: This setup is shared for educational purposes only. It is not financial advice. Always apply proper risk management and trade responsibly.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.