A Return To A Bitcoin 1.09% Bull Market May Be Coming Soon

The price of bitcoin 1.09% may soon recover back towards its 2017 peak based on several key catalysts that may help propel the cryptocurrency markets back up. While prices have definitely come down from its all-time highs, Bitcoin 1.09% is now a much safer bet than back in December when Bitcoin 1.09% was selling at nosebleed prices.

It is clear that while Bitcoin 1.09% is backed by a promising blockchain technology, the price of Bitcoin 1.09% itself may have gotten ahead of itself in the latter part of 2017. With limited adoption and few actual use cases, Bitcoin 1.09% arguably had risen far too fast too soon.

In order for Bitcoin 1.09% to be considered as a valid currency or as a means of store of value, we will have to grow in a steady organic pace. Sudden growth spurts and bubble cycles will only validate the point of view that Bitcoin 1.09% is not suitable as a valid currency or even as a good store of value.

While sudden growth spurts can bring outsized gains to investors looking to beat traditional markets, it can also work inversely as seen in recent months with Bitcoin 1.09% losing a significant amount of value from its all-time highs. Luckily for investors, Bitcoin 1.09% has several important key catalysts that could end the current bear market.

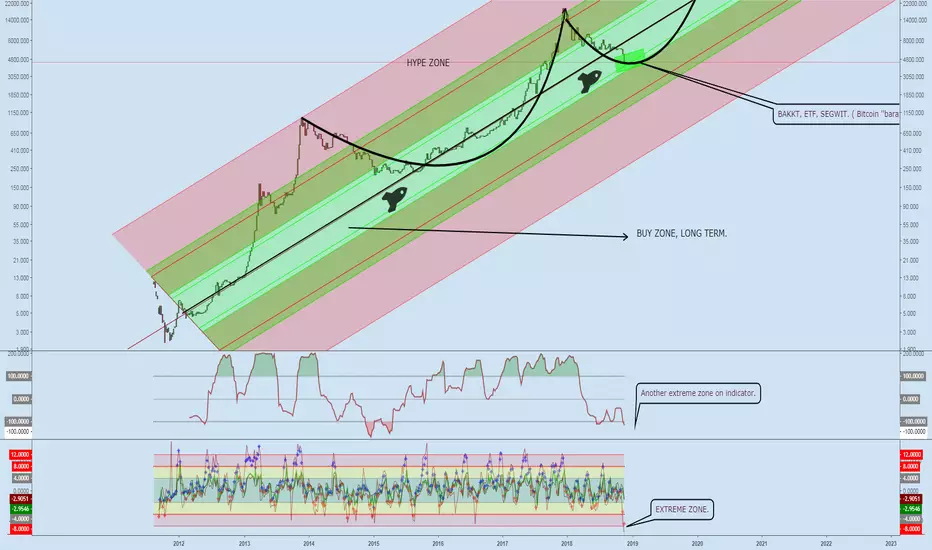

BAKKT :

Bakkt plans to enter the cryptocurrency market with an open platform for all manner of cryptocurrency services, including trading and warehousing.

The price of bitcoin 1.09% may soon recover back towards its 2017 peak based on several key catalysts that may help propel the cryptocurrency markets back up. While prices have definitely come down from its all-time highs, Bitcoin 1.09% is now a much safer bet than back in December when Bitcoin 1.09% was selling at nosebleed prices.

It is clear that while Bitcoin 1.09% is backed by a promising blockchain technology, the price of Bitcoin 1.09% itself may have gotten ahead of itself in the latter part of 2017. With limited adoption and few actual use cases, Bitcoin 1.09% arguably had risen far too fast too soon.

In order for Bitcoin 1.09% to be considered as a valid currency or as a means of store of value, we will have to grow in a steady organic pace. Sudden growth spurts and bubble cycles will only validate the point of view that Bitcoin 1.09% is not suitable as a valid currency or even as a good store of value.

While sudden growth spurts can bring outsized gains to investors looking to beat traditional markets, it can also work inversely as seen in recent months with Bitcoin 1.09% losing a significant amount of value from its all-time highs. Luckily for investors, Bitcoin 1.09% has several important key catalysts that could end the current bear market.

BAKKT :

Bakkt plans to enter the cryptocurrency market with an open platform for all manner of cryptocurrency services, including trading and warehousing.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.