__________________________________________________________________________________

Technical Overview – Summary Points

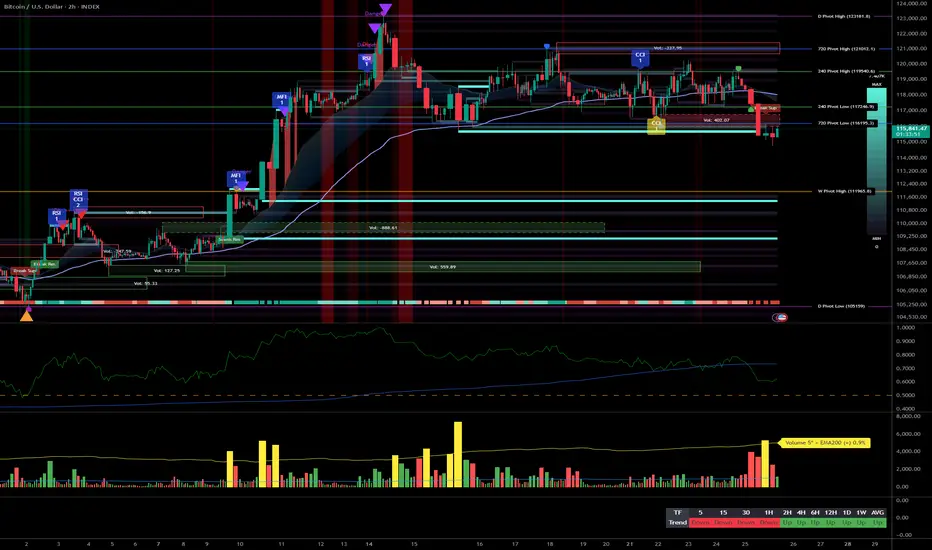

➤ Bullish momentum across all higher timeframes (1H to 1W) supported by Risk On / Risk Off Indicator (Strong Buy).

➤ Major supports: 116,128 and 111,980 (multi-timeframe pivots). Key resistance at 123,218.

➤ Very high intraday volumes, pointing towards probable capitulation zones.

➤ Multi-timeframe behaviors: Technical rebound anticipated on the 116,128–115,600 zone, caution if 111,980 breaks.

__________________________________________________________________________________

Strategic Summary

➤ Global Bias: Bullish confirmed mid/long-term.

➤ Accumulation opportunities on key pullbacks near 116,128 and 111,980.

➤ Risk zone: sustained closes below 111,980 = invalidation of bullish outlook (target 105,100).

➤ Macro catalysts: FOMC meeting (July 29-30), heightened event-risk period.

➤ Action plan: favor entries after FOMC volatility resolution, stop-loss adjusted below 111,980.

__________________________________________________________________________________

Multi-Timeframe Analysis

Key Indicators:

__________________________________________________________________________________

Cross Timeframe Synthesis

__________________________________________________________________________________

Operational synthesis & macro context

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

Technical Overview – Summary Points

➤ Bullish momentum across all higher timeframes (1H to 1W) supported by Risk On / Risk Off Indicator (Strong Buy).

➤ Major supports: 116,128 and 111,980 (multi-timeframe pivots). Key resistance at 123,218.

➤ Very high intraday volumes, pointing towards probable capitulation zones.

➤ Multi-timeframe behaviors: Technical rebound anticipated on the 116,128–115,600 zone, caution if 111,980 breaks.

__________________________________________________________________________________

Strategic Summary

➤ Global Bias: Bullish confirmed mid/long-term.

➤ Accumulation opportunities on key pullbacks near 116,128 and 111,980.

➤ Risk zone: sustained closes below 111,980 = invalidation of bullish outlook (target 105,100).

➤ Macro catalysts: FOMC meeting (July 29-30), heightened event-risk period.

➤ Action plan: favor entries after FOMC volatility resolution, stop-loss adjusted below 111,980.

__________________________________________________________________________________

Multi-Timeframe Analysis

- Daily (1D): Compression under 123,218 resistance, primary bullish trend, no extreme signals.

- 12H: Healthy consolidation under resistance, no euphoria or panic, normal volumes.

- 6H: Price squeezed between major supports (116,128–111,980), uptrend confirmed.

- 4H: Institutional volumes on supports, favors technical rebound.

- 2H: Speculative rebound underway, confirmation needed for short-term bottom.

- 1H: Strong capitulation signal, record volumes, immediate retest of 116,128 support.

- 30min: Local oversold status, extreme sentiment, high technical reversal probability.

- 15min: Phase of panic likely ending, short-term rebound anticipated.

Key Indicators:

- Risk On / Risk Off Indicator: Strong buy on 1D–4H, neutral on 30min and 15min.

- ISPD DIV: Neutral to Buy (capitulation signaled on 1H+30min).

- Volumes: Very high at lows = capitulation + potential bottom.

- MTFTI: Up momentum above 1H, down on lower timeframes (30–5min).

__________________________________________________________________________________

Cross Timeframe Synthesis

- High timeframe alignment confirms bullish bias, supported by buyer volumes.

- Key zone 116,128–111,980 = multi-timeframe support, tactical focus.

- Main risk: break of 111,980.

__________________________________________________________________________________

Operational synthesis & macro context

- Bullish bias validated unless breakdown below 111,980.

- Tactical accumulation window on pullbacks, 1H confirmation needed.

- Volatility risk increases ahead/during FOMC, dynamic stop management essential.

- Altcoins fragile: extra caution if BTC triggers Risk Off.

- Calendar to watch: FOMC (July 29–30), Durable Goods (July 25).

__________________________________________________________________________________

- On-Chain (Glassnode):

BTC consolidates, no extreme signs; ETH outperforming but caution on alts (elevated leverage).

__________________________________________________________________________________

⏳ *Decision Recap for July 25, 2025, 10:56 CEST:*

— BUY ZONE tactical at 116,128–115,600 (BTC), 1H confirmation required.

— Stop-loss below 111,980 / Swing target >120,000–123,218.

— Risks: Fed announcements, flushes on supports, altcoins at risk.

__________________________________________________________________________________

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.