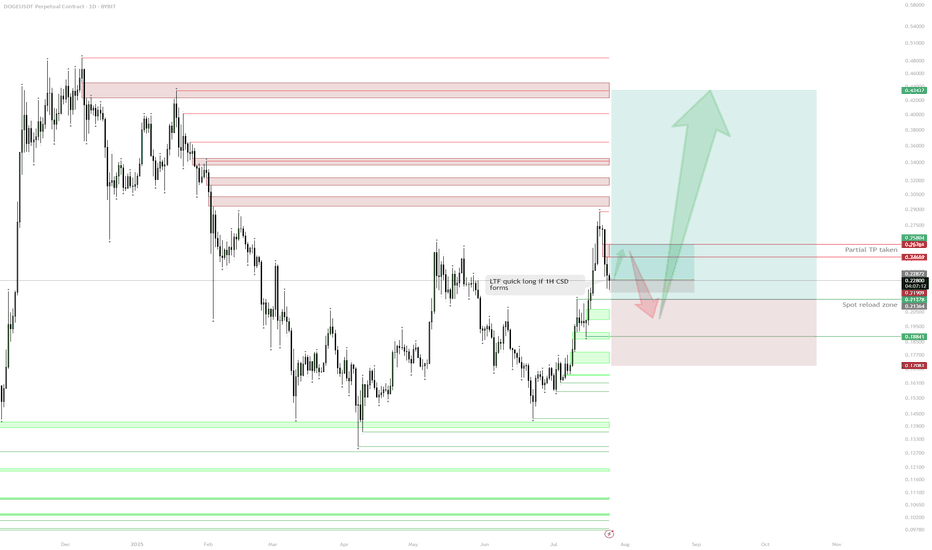

- Price is currently testing the H4 demand zone (~0.227–0.254).

- Watch for price to reclaim the demand zone and close back above 0.254.

- If confirmed, expect a move up toward the red resistance cluster at 0.271–0.275.

- Consolidation above this area (highlighted in blue) would be a strong signal for continuation.

- Invalidation: clean breakdown and acceptance below 0.227 signals failure of demand and deeper retrace.

This setup aims to capitalize on a classic liquidity sweep and demand reclaim. Typically, after taking out the flat open and collecting late shorts/stop losses, strong buying often steps in if demand is genuine. A successful reclaim and consolidation above the previous resistance will set the stage for bullish continuation. If this zone fails to hold, the move is invalidated and lower targets come into play. Waiting for confirmation reduces the risk of a failed bounce.

Trade active

Order cancelled

Entry required a trigger (confirmation).

The trigger would be a reclaim of the high that took out this level — a classic sign of buyers stepping in and invalidating the breakdown.

This did not occur: price failed to reclaim the level, showing no clear sign of demand returning.

No trigger = No trade.

Since the required confirmation wasn’t printed, there was no entry. This disciplined approach prevents random bottom-picking and avoids getting caught in further sell-offs.

Forward scenario:

Price may continue lower into deeper demand zones (such as the 0.21 area).

If a new bullish structure forms — such as a sweep of the lows, followed by a strong reclaim and hold — that’s the next opportunity for a swing long.

Until a valid trigger appears, best to stay sidelined and wait for structure and volume confirmation.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.