EUR/USD Sell Setup – Technical Breakdown Aligning with Eurozone Macro Weakness.

Chart Analysis – Bearish Structure and Trade Plan

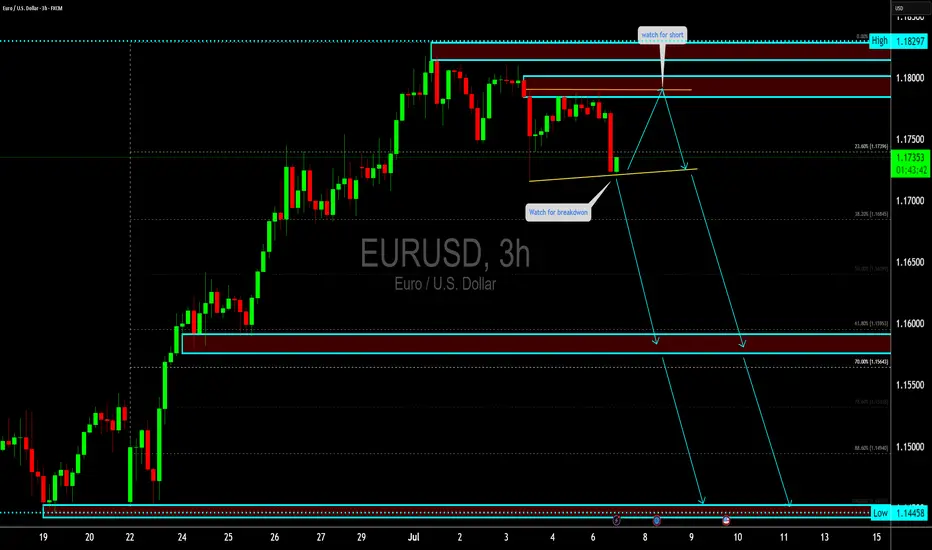

This 4H EUR/USD chart outlines a potential sell setup based on both technical structure and macroeconomic fundamentals:

🔹 Technical Zones

Resistance Zone (1.1800 - 1.1830): Strong supply zone marked by previous swing highs. The note “if test top watch for short” signals a potential reversal area.

Support Zone (1.1720 - 1.1700): Price is currently testing this zone. A breakdown from here activates a bearish continuation setup.

Fibonacci Levels: Drawn from the swing low to swing high, we see:

Breakdown targets aligned with 38.2% (1.1685), 50% (1.1640), 61.8% (1.1596), 70% (1.1566), and even 100% at 1.1445.

Bearish Price Action: Large bearish candles, lack of follow-through from bulls, and failure to make a new high all indicate selling pressure.

📌 Trade Plan

Entry #1: On breakdown and close below 1.1700 zone.

Entry #2: If price retests 1.1800–1.1830 and gets rejected, enter a short.

Targets: Gradual TP levels at key Fibonacci levels – 1.1650, 1.1600, 1.1550, 1.1450.

Stop Loss: Above the 1.1830 resistance.

Fundamental Justification – Why This Trade Makes Sense

🔻 1. Eurozone Inflation ≈ 2% & Falling

Inflation at or below target removes pressure on the ECB to hike further.

This removes interest rate support for the Euro.

🔻 2. ECB Rate is Already at 2%

Relatively low compared to the Fed, which keeps the rate differential in favour of USD.

Market expects ECB to pause or cut before the Fed, adding downward pressure on EUR.

🔻 3. Strong Euro Hurts EU Exports

As the Euro strengthens, European goods become more expensive globally, reducing competitiveness.

In a fragile post-inflation economy, this further increases the risk of recession or slowdown.

🔻 4. Slowing Growth in Europe

A stronger Euro is counterproductive, and market participants may start pricing in future ECB cuts, leading to EUR/USD downside.

📝 Summary

This is a high-probability bearish setup on EUR/USD combining both technical breakdown structure and macro fundamentals. With the ECB's dovish stance, weak inflation, and the threat of economic slowdown in Europe, the Euro is fundamentally weak, and the chart reflects this through a likely downward move toward the 1.1550–1.1450 area.

Chart Analysis – Bearish Structure and Trade Plan

This 4H EUR/USD chart outlines a potential sell setup based on both technical structure and macroeconomic fundamentals:

🔹 Technical Zones

Resistance Zone (1.1800 - 1.1830): Strong supply zone marked by previous swing highs. The note “if test top watch for short” signals a potential reversal area.

Support Zone (1.1720 - 1.1700): Price is currently testing this zone. A breakdown from here activates a bearish continuation setup.

Fibonacci Levels: Drawn from the swing low to swing high, we see:

Breakdown targets aligned with 38.2% (1.1685), 50% (1.1640), 61.8% (1.1596), 70% (1.1566), and even 100% at 1.1445.

Bearish Price Action: Large bearish candles, lack of follow-through from bulls, and failure to make a new high all indicate selling pressure.

📌 Trade Plan

Entry #1: On breakdown and close below 1.1700 zone.

Entry #2: If price retests 1.1800–1.1830 and gets rejected, enter a short.

Targets: Gradual TP levels at key Fibonacci levels – 1.1650, 1.1600, 1.1550, 1.1450.

Stop Loss: Above the 1.1830 resistance.

Fundamental Justification – Why This Trade Makes Sense

🔻 1. Eurozone Inflation ≈ 2% & Falling

Inflation at or below target removes pressure on the ECB to hike further.

This removes interest rate support for the Euro.

🔻 2. ECB Rate is Already at 2%

Relatively low compared to the Fed, which keeps the rate differential in favour of USD.

Market expects ECB to pause or cut before the Fed, adding downward pressure on EUR.

🔻 3. Strong Euro Hurts EU Exports

As the Euro strengthens, European goods become more expensive globally, reducing competitiveness.

In a fragile post-inflation economy, this further increases the risk of recession or slowdown.

🔻 4. Slowing Growth in Europe

A stronger Euro is counterproductive, and market participants may start pricing in future ECB cuts, leading to EUR/USD downside.

📝 Summary

This is a high-probability bearish setup on EUR/USD combining both technical breakdown structure and macro fundamentals. With the ECB's dovish stance, weak inflation, and the threat of economic slowdown in Europe, the Euro is fundamentally weak, and the chart reflects this through a likely downward move toward the 1.1550–1.1450 area.

For Training visit.

Website wave-trader.com

Website techtradingacademy.com

Slack: wavetraders.slack.com

Telegram: t.me/Wavetraders

X: twitter.com/Wave__Trader

FB: facebook.com/WTimran

Website wave-trader.com

Website techtradingacademy.com

Slack: wavetraders.slack.com

Telegram: t.me/Wavetraders

X: twitter.com/Wave__Trader

FB: facebook.com/WTimran

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

For Training visit.

Website wave-trader.com

Website techtradingacademy.com

Slack: wavetraders.slack.com

Telegram: t.me/Wavetraders

X: twitter.com/Wave__Trader

FB: facebook.com/WTimran

Website wave-trader.com

Website techtradingacademy.com

Slack: wavetraders.slack.com

Telegram: t.me/Wavetraders

X: twitter.com/Wave__Trader

FB: facebook.com/WTimran

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.