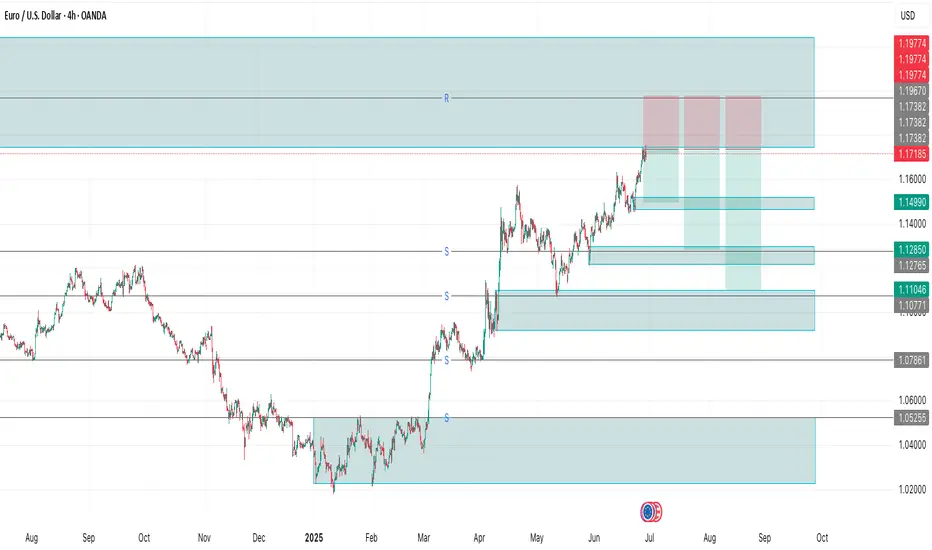

EUR/USD 4H – Approaching Major Supply Zone | Potential Mid-Term Reversal

Euro has extended its bullish rally into a historically strong supply/resistance zone around 1.17185 – 1.19774, which aligns with the previous rejection zone from mid-2024. Price is showing signs of slowing down near this upper boundary.

🔍 Key Technical Highlights:

Strong Supply Zone (1.1718 – 1.1977): A major resistance area that previously triggered sharp sell-offs. This zone is now retested after months of bullish recovery.

Momentum Divergence Potential: Price has climbed aggressively, but with signs of exhaustion visible on the lower timeframe candles.

Demand Zones Below:

First support at 1.15998

Followed by deeper demand areas at 1.14990, 1.12850, and 1.11046 – all marking clean reaction zones.

📊 Trade Setup:

Bias: Short (swing position)

Sell Entry Zone: 1.17185 – 1.19774

Stop Loss: Above 1.19800 (above key supply zone)

Take Profit Targets:

TP1: 1.15998

TP2: 1.12850

TP3: 1.11000

🧠 Tactical Note:

Watch for bearish confirmation (engulfing candle / structure break) before executing entries. A clean rejection from the supply zone could provide an attractive swing setup with a favorable risk-reward profile.

Euro has extended its bullish rally into a historically strong supply/resistance zone around 1.17185 – 1.19774, which aligns with the previous rejection zone from mid-2024. Price is showing signs of slowing down near this upper boundary.

🔍 Key Technical Highlights:

Strong Supply Zone (1.1718 – 1.1977): A major resistance area that previously triggered sharp sell-offs. This zone is now retested after months of bullish recovery.

Momentum Divergence Potential: Price has climbed aggressively, but with signs of exhaustion visible on the lower timeframe candles.

Demand Zones Below:

First support at 1.15998

Followed by deeper demand areas at 1.14990, 1.12850, and 1.11046 – all marking clean reaction zones.

📊 Trade Setup:

Bias: Short (swing position)

Sell Entry Zone: 1.17185 – 1.19774

Stop Loss: Above 1.19800 (above key supply zone)

Take Profit Targets:

TP1: 1.15998

TP2: 1.12850

TP3: 1.11000

🧠 Tactical Note:

Watch for bearish confirmation (engulfing candle / structure break) before executing entries. A clean rejection from the supply zone could provide an attractive swing setup with a favorable risk-reward profile.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.