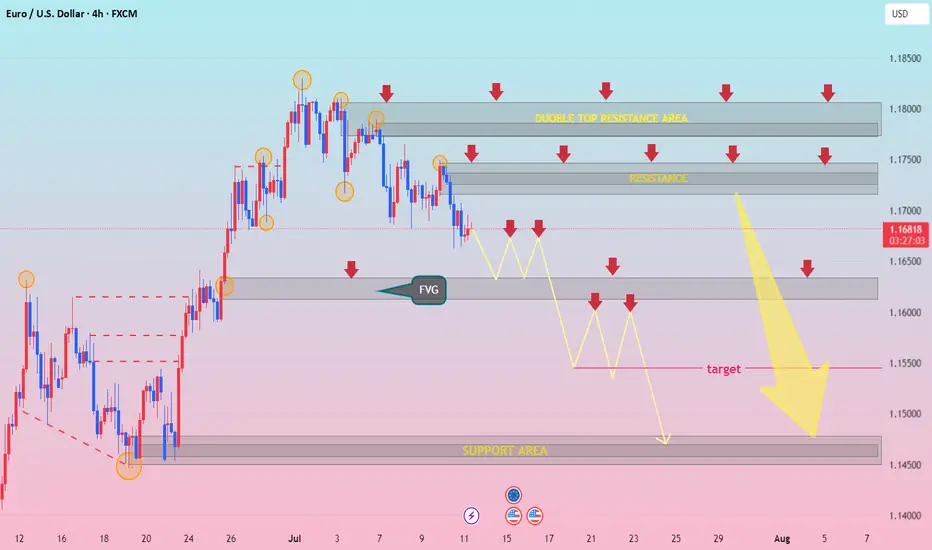

Current Price: 1.16822

Price is under:

Double Top Resistance Area (1.17800+)

Multiple lower highs and rejection arrows marked

Path expectation:

Choppy drop into FVG (Fair Value Gap) at 1.16200

Then break lower → final target at ~1.15300

Possibly deeper move into the Support Area (~1.14500–1.14700)

⚡ Disruption Scenario (Bullish Counter-Narrative)

✅ 1. FVG as a Reversal Catalyst

Fair Value Gaps are not always continuation zones — they often attract reversals when paired with:

Oversold RSI

Bear exhaustion

Strong hourly bullish engulfing near 1.16200

→ The FVG zone might actually spring the price higher, not lower.

✅ 2. Hidden Bullish Divergence Possibility

Price is making lower highs and lower lows

But if momentum indicators (like MACD or RSI on the 4H) show bullish divergence, a bounce becomes likely

→ That would make the selloff a bear trap before reversion

✅ 3. Overextended Bearish Sentiment

The many rejection arrows suggest an overcrowded short bias

Crowded trades tend to unwind explosively — especially if:

Price sweeps the FVG low

Then immediately reclaims 1.1700

🔄 Bullish Disruption Path

Drop into 1.16200 (FVG zone)

Quick bounce → reclaim 1.16800

Push toward 1.17500

If cleared → retest the Double Top Resistance zone (~1.18000)

🧨 Invalidation of Disruption

Clean 4H close below 1.1600

Breakdown structure confirming continuation toward 1.15300

Price is under:

Double Top Resistance Area (1.17800+)

Multiple lower highs and rejection arrows marked

Path expectation:

Choppy drop into FVG (Fair Value Gap) at 1.16200

Then break lower → final target at ~1.15300

Possibly deeper move into the Support Area (~1.14500–1.14700)

⚡ Disruption Scenario (Bullish Counter-Narrative)

✅ 1. FVG as a Reversal Catalyst

Fair Value Gaps are not always continuation zones — they often attract reversals when paired with:

Oversold RSI

Bear exhaustion

Strong hourly bullish engulfing near 1.16200

→ The FVG zone might actually spring the price higher, not lower.

✅ 2. Hidden Bullish Divergence Possibility

Price is making lower highs and lower lows

But if momentum indicators (like MACD or RSI on the 4H) show bullish divergence, a bounce becomes likely

→ That would make the selloff a bear trap before reversion

✅ 3. Overextended Bearish Sentiment

The many rejection arrows suggest an overcrowded short bias

Crowded trades tend to unwind explosively — especially if:

Price sweeps the FVG low

Then immediately reclaims 1.1700

🔄 Bullish Disruption Path

Drop into 1.16200 (FVG zone)

Quick bounce → reclaim 1.16800

Push toward 1.17500

If cleared → retest the Double Top Resistance zone (~1.18000)

🧨 Invalidation of Disruption

Clean 4H close below 1.1600

Breakdown structure confirming continuation toward 1.15300

Trade active

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.