🔍 Key Concepts in This Setup:

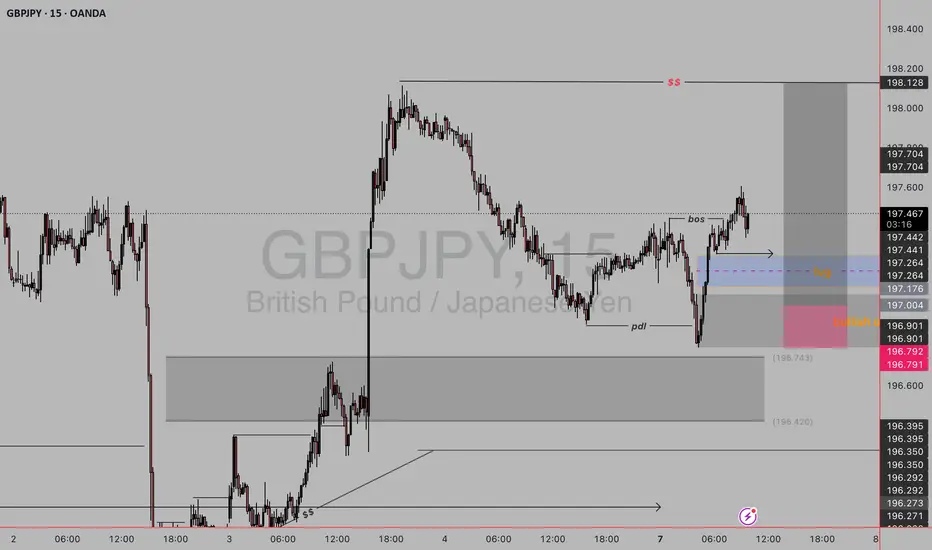

1. Break of Structure (BOS) – Bullish Shift

The BOS shows that price has broken above a previous swing high, signaling a shift from bearish to bullish market structure.

This confirms bullish intent and opens the door for pullback buys.

2. Fair Value Gap (FVG) – Blue Zone

This imbalance zone is created when price aggressively moves up, leaving a gap.

Price is expected to return to this area to fill orders before continuing up.

3. Bullish Order Block – Orange Zone

A bullish order block (OB) is marked just below the FVG.

It represents the last bearish candle before a bullish impulse — an area where institutions may re-enter long positions.

4. PDL Sweep (Previous Day Low)

Price took out the previous day’s low (PDL) and then reversed.

This is a liquidity grab – a classic smart money move before shifting bullish.

5. Premium to Discount Retracement

Price moved from a discount zone after sweeping lows and breaking structure.

Now waiting for a retracement back into a discounted FVG/OB zone to enter a buy.

✅ Buy Entry Plan:

Entry Zone: Around the FVG + OB confluence (196.90–197.10 area).

Confirmation: You might wait for bullish PA (price action) like a bullish engulfing or lower-timeframe BOS at the FVG.

Stop Loss: Below the order block or just under 196.79.

Target: Back to recent highs near 198.10 or even the supply zone (SS) above it.

1. Break of Structure (BOS) – Bullish Shift

The BOS shows that price has broken above a previous swing high, signaling a shift from bearish to bullish market structure.

This confirms bullish intent and opens the door for pullback buys.

2. Fair Value Gap (FVG) – Blue Zone

This imbalance zone is created when price aggressively moves up, leaving a gap.

Price is expected to return to this area to fill orders before continuing up.

3. Bullish Order Block – Orange Zone

A bullish order block (OB) is marked just below the FVG.

It represents the last bearish candle before a bullish impulse — an area where institutions may re-enter long positions.

4. PDL Sweep (Previous Day Low)

Price took out the previous day’s low (PDL) and then reversed.

This is a liquidity grab – a classic smart money move before shifting bullish.

5. Premium to Discount Retracement

Price moved from a discount zone after sweeping lows and breaking structure.

Now waiting for a retracement back into a discounted FVG/OB zone to enter a buy.

✅ Buy Entry Plan:

Entry Zone: Around the FVG + OB confluence (196.90–197.10 area).

Confirmation: You might wait for bullish PA (price action) like a bullish engulfing or lower-timeframe BOS at the FVG.

Stop Loss: Below the order block or just under 196.79.

Target: Back to recent highs near 198.10 or even the supply zone (SS) above it.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.