GBP/USD Trading Idea - Long Position

Fundamental Context:

- US inflation is expected to decline today, which could weaken the USD and support the GBP.

- The Bank of Canada is also expected to lower its interest rate, impacting overall market sentiment.

- Other key economic events throughout the day may increase volatility in the forex market.

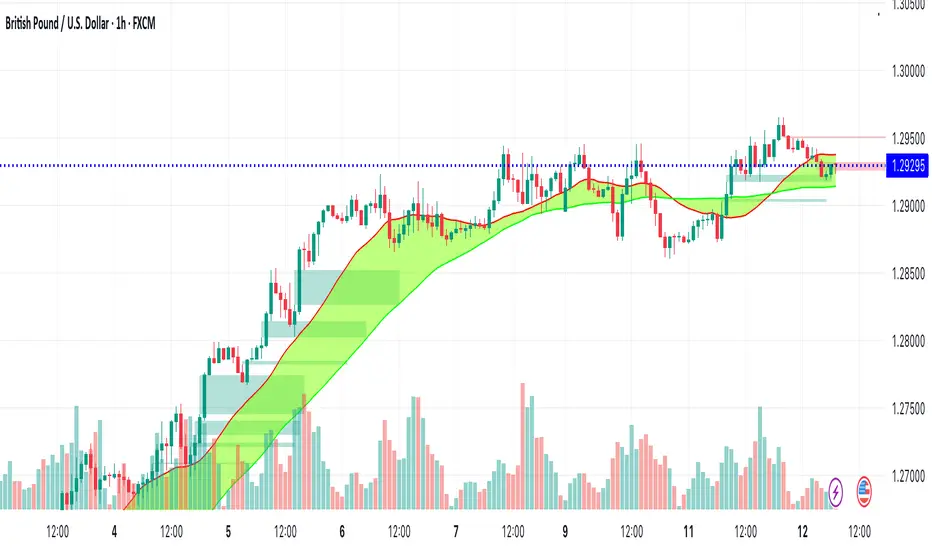

Technical Analysis:

- The trend remains upward, indicating bullish momentum for GBP/USD.

- The US dollar is weakening, favoring a continuation of the uptrend.

- Key buy-the-dip levels:

- 1.2915 as the first buy entry

- 1.2875 as a key support zone for additional buys

Trading Strategy:

- Buying on dips around the mentioned levels

- Stop-loss adjusted based on volatility and technical confirmations

Market Bias: Bullish

Risk management remains crucial in case of trend reversals.

What are your thoughts? Share your views in the comments.

Fundamental Context:

- US inflation is expected to decline today, which could weaken the USD and support the GBP.

- The Bank of Canada is also expected to lower its interest rate, impacting overall market sentiment.

- Other key economic events throughout the day may increase volatility in the forex market.

Technical Analysis:

- The trend remains upward, indicating bullish momentum for GBP/USD.

- The US dollar is weakening, favoring a continuation of the uptrend.

- Key buy-the-dip levels:

- 1.2915 as the first buy entry

- 1.2875 as a key support zone for additional buys

Trading Strategy:

- Buying on dips around the mentioned levels

- Stop-loss adjusted based on volatility and technical confirmations

Market Bias: Bullish

Risk management remains crucial in case of trend reversals.

What are your thoughts? Share your views in the comments.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.