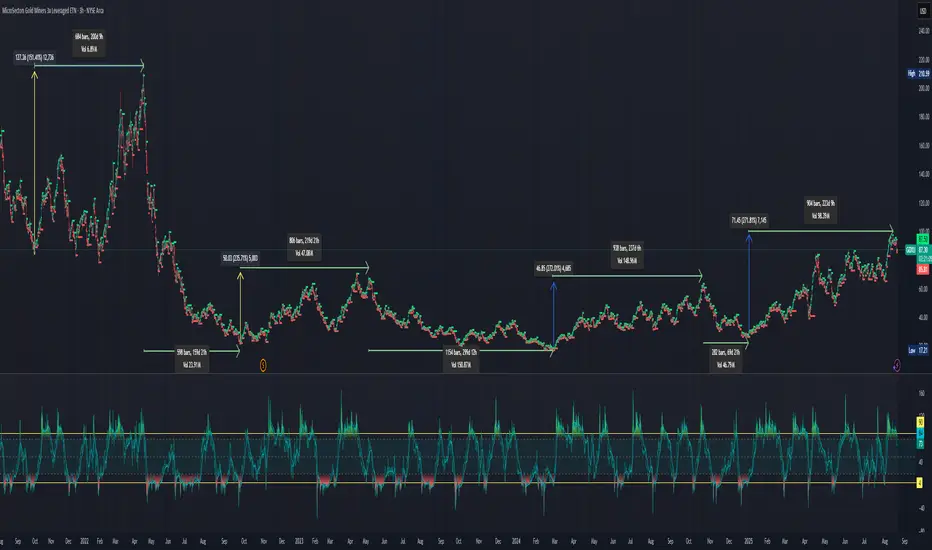

SHORT: Short term GDXU 2X pull back, is it now time to go GDXD

I've laid out the major run ups and pull backs. The last 3 run ups have lasted 219 - 237 days. If the last peak was put in by GDXU it would put it at 225 days. I'm looking at this as a potential repeating pattern. Note the GDXU run ups based on a % gain from the bottom, assuming, the most recent peak was the final high in this run up. The run ups were +241%, +270%, and +279%. The run up also reasonable for the peak.

Big question, what about the draw downs. The last 2 have been -54%, -42%, and-60%. In GDXD, the inverse gold miners ETF 2X levered resulted in a gain of +90%, +58%, and +95%. The run up on the inverse side lasted 53, 20, and 22 days. GDXD is currently up +13% in the last 7 days.

Take aways, reduce/eliminate position in long GDXU and wait for a better buy in position and potential upside in the inverse gold miners etf.

Big question, what about the draw downs. The last 2 have been -54%, -42%, and-60%. In GDXD, the inverse gold miners ETF 2X levered resulted in a gain of +90%, +58%, and +95%. The run up on the inverse side lasted 53, 20, and 22 days. GDXD is currently up +13% in the last 7 days.

Take aways, reduce/eliminate position in long GDXU and wait for a better buy in position and potential upside in the inverse gold miners etf.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.