The Gold price trades in negative territory on the day. The bullish tone of the precious metal remains intact in the longer term, with the price holding above the key 100-day Exponential Moving Average (EMA) on the daily chart. The upward momentum is supported by the 14-day Relative Strength Index (RSI), which stands above the midline near 60.50. This displays the bullish momentum in the near term.

The upper boundary of the Bollinger Band of $3,425 acts as an immediate resistance level for XAU/USD. Sustained trading above this level could take the yellow metal to $3,439, the high of July 23. The next upside target to watch is $3,500, the psychological level and the high of April 22.

On the downside, the initial support level for Gold is seen at $3,373, the low of August 27. Red candlesticks closing below the mentioned level could expose $3,351, the low of August 26. The additional downside filter is located at $3,310, the lower limit of the Bollinger Band.

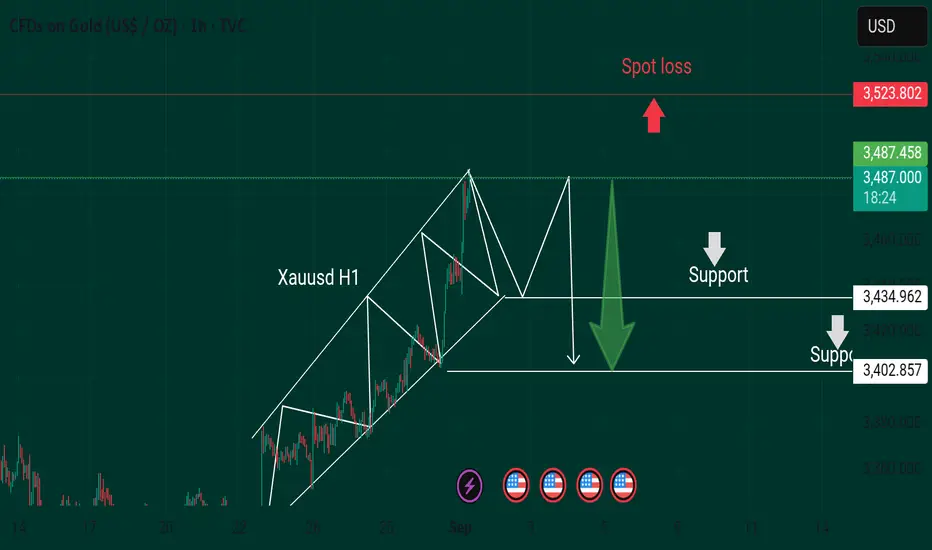

Xauusd signal sell 3488

Support 3460

Support 3440

Support 3420

Stop loss 3530

The upper boundary of the Bollinger Band of $3,425 acts as an immediate resistance level for XAU/USD. Sustained trading above this level could take the yellow metal to $3,439, the high of July 23. The next upside target to watch is $3,500, the psychological level and the high of April 22.

On the downside, the initial support level for Gold is seen at $3,373, the low of August 27. Red candlesticks closing below the mentioned level could expose $3,351, the low of August 26. The additional downside filter is located at $3,310, the lower limit of the Bollinger Band.

Xauusd signal sell 3488

Support 3460

Support 3440

Support 3420

Stop loss 3530

Trade active

Xauusd signal sell 140 pips running Trade closed: target reached

Xauusd signal sell 200 pips signal sell Note

Xauusd signal sell Note

Xauusd next target 3420 Note

Xauusd signal sell Note

Next target 3350Note

Xauusd sell Note

Gold sell signal Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.