https://www.tradingview.com/x/Uhs3VNML/

📊Technical aspects

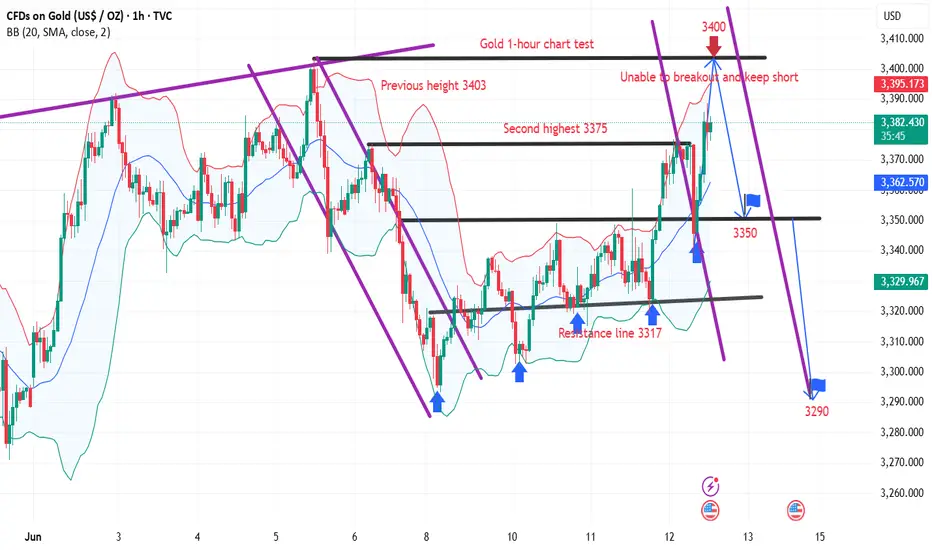

1. The daily line pattern continues to close. The previous three days relied on the lifeline to lift the space. Now the lifeline position is in the 3317 area, which is close to the early morning low point 3319 and becomes the support range

The upper rail resistance position 3405 coincides with the previous high point 3403.5 area

Comprehensive support 3317-3319, resistance 3403-3405

2. The four-hour surge of more than 50 US dollars has pulled the pattern upward, but the European session just fell sharply by 37 US dollars, and the market has been pulled back to the exit again. Pay attention to the lifeline position and the double line superposition at 3335-3330, which also coincides with the lower track of the small channel 3330-3325 area, and together become the nearest support area

The upper track overlaps with the upper track of the small channel 3370 area

Comprehensive support 3320-3330, resistance 3370-3380

Currently, under multiple favorable factors, gold has repeatedly failed to break the previous high (3403).

From the technical pattern, it can be seen that the upper resistance line is still strong. On the contrary, the sharp drop just echoes the weakness of the bulls. Gold is still dominated by shorts.

Finally, let me talk about the current international situation that is favorable to gold. If you simply trade based on news, I don’t think everyone will become a millionaire by reading the news.

💰 Strategy Package

Short Position:3370-3385

📊Technical aspects

1. The daily line pattern continues to close. The previous three days relied on the lifeline to lift the space. Now the lifeline position is in the 3317 area, which is close to the early morning low point 3319 and becomes the support range

The upper rail resistance position 3405 coincides with the previous high point 3403.5 area

Comprehensive support 3317-3319, resistance 3403-3405

2. The four-hour surge of more than 50 US dollars has pulled the pattern upward, but the European session just fell sharply by 37 US dollars, and the market has been pulled back to the exit again. Pay attention to the lifeline position and the double line superposition at 3335-3330, which also coincides with the lower track of the small channel 3330-3325 area, and together become the nearest support area

The upper track overlaps with the upper track of the small channel 3370 area

Comprehensive support 3320-3330, resistance 3370-3380

Currently, under multiple favorable factors, gold has repeatedly failed to break the previous high (3403).

From the technical pattern, it can be seen that the upper resistance line is still strong. On the contrary, the sharp drop just echoes the weakness of the bulls. Gold is still dominated by shorts.

Finally, let me talk about the current international situation that is favorable to gold. If you simply trade based on news, I don’t think everyone will become a millionaire by reading the news.

💰 Strategy Package

Short Position:3370-3385

Trade active

If gold cannot break through the 3400 resistance level, our strategy is still to short at high levels.Through scientific and rigorous financial analysis and personalized strategy formulation, we help you achieve stable growth of wealth. At the same time, in a complex and changing economic environment, we help you avoid potential risks and protect the saf

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Through scientific and rigorous financial analysis and personalized strategy formulation, we help you achieve stable growth of wealth. At the same time, in a complex and changing economic environment, we help you avoid potential risks and protect the saf

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.