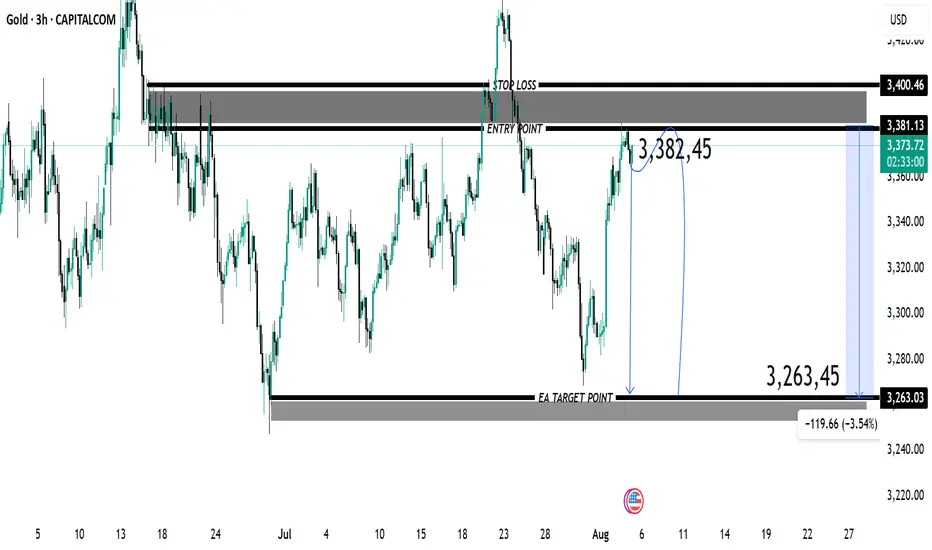

Bias: Bearish (short setup)

Current Price: 3,372.02

Entry Zone: Around 3,381.13 – 3,382.45

Stop Loss: 3,400.46 (above recent resistance)

Target Point: 3,263.45

Projected Move: –119.66 USD (–3.54%)

🟢 Key Technical Elements

Resistance Zone

Strong supply between ~3,381 and 3,400.

Repeated rejection from this zone in past price action.

Acts as a clear invalidation level for the short bias.

Support Zone

Target near 3,263 aligns with previous accumulation and reaction area.

Significant buying interest historically.

Price Action

Recent rally back into the resistance after a corrective downtrend.

This setup anticipates the rally failing and price rotating back down to retest support.

Risk–Reward Profile

Approximate risk: ~19 USD (3,400.46 – 3,381)

Potential reward: ~119 USD (3,381 – 3,263)

Risk–Reward Ratio: ~1:6, which is favorable if price reacts sharply from the resistance.

⚠️ Considerations

✅ Strengths of the Setup:

Clear rejection area (resistance).

Defined stop-loss and target.

Strong downside potential relative to risk.

⚠️ Risks:

If price closes above 3,400, invalidation is triggered.

Momentum is currently bullish; a breakout through resistance may extend higher.

Watch for consolidation near the entry point before committing to the short.

📌 Action Plan (Hypothetical)

Sell Limit near 3,382

Stop Loss: 3,400

Take Profit: 3,263

Current Price: 3,372.02

Entry Zone: Around 3,381.13 – 3,382.45

Stop Loss: 3,400.46 (above recent resistance)

Target Point: 3,263.45

Projected Move: –119.66 USD (–3.54%)

🟢 Key Technical Elements

Resistance Zone

Strong supply between ~3,381 and 3,400.

Repeated rejection from this zone in past price action.

Acts as a clear invalidation level for the short bias.

Support Zone

Target near 3,263 aligns with previous accumulation and reaction area.

Significant buying interest historically.

Price Action

Recent rally back into the resistance after a corrective downtrend.

This setup anticipates the rally failing and price rotating back down to retest support.

Risk–Reward Profile

Approximate risk: ~19 USD (3,400.46 – 3,381)

Potential reward: ~119 USD (3,381 – 3,263)

Risk–Reward Ratio: ~1:6, which is favorable if price reacts sharply from the resistance.

⚠️ Considerations

✅ Strengths of the Setup:

Clear rejection area (resistance).

Defined stop-loss and target.

Strong downside potential relative to risk.

⚠️ Risks:

If price closes above 3,400, invalidation is triggered.

Momentum is currently bullish; a breakout through resistance may extend higher.

Watch for consolidation near the entry point before committing to the short.

📌 Action Plan (Hypothetical)

Sell Limit near 3,382

Stop Loss: 3,400

Take Profit: 3,263

Join my telegram (COPY_TRADE)

t.me/TOP1INVEESTADMEN

Join my refrel broker link

one.exnesstrack.org/a/l1t1rf3p6v

t.me/TOP1INVEESTADMEN

Join my refrel broker link

one.exnesstrack.org/a/l1t1rf3p6v

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join my telegram (COPY_TRADE)

t.me/TOP1INVEESTADMEN

Join my refrel broker link

one.exnesstrack.org/a/l1t1rf3p6v

t.me/TOP1INVEESTADMEN

Join my refrel broker link

one.exnesstrack.org/a/l1t1rf3p6v

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.