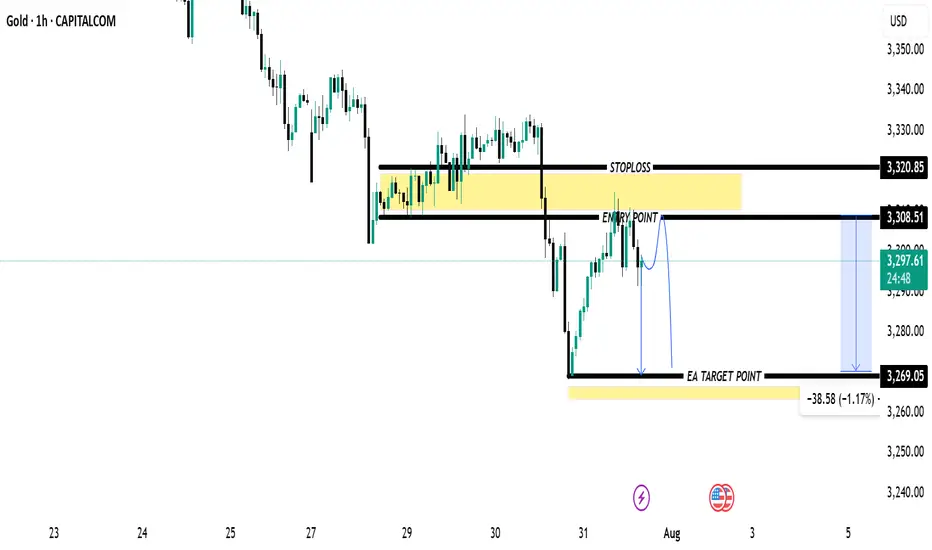

Gold (XAU/USD) – 1H Chart Analysis

Date: July 31, 2025

Broker: Capital.com

Instrument: Gold/USD

Timeframe: 1-hour

🔍 Technical Overview:

Current Price: $3,295.51

Planned Short Entry: $3,308.51

Stop Loss: $3,320.85

Target (TP): $3,269.05

Risk-Reward Ratio: Approximately 1:3

🟨 Key Zones:

Supply Zone (Resistance):

$3,308.51 – $3,320.85

Previous consolidation area.

Price broke down sharply from this zone.

Demand Zone (Support):

Around $3,269.05

Previous support level where price showed a bounce.

📉 Trade Idea: Bearish Setup

Entry Logic:

Price is expected to retest the broken support (now resistance) near $3,308.51 before continuing downward.

A rejection from this zone offers a good entry for a short trade.

Price Projection:

The blue path anticipates a small bounce before a drop to the target level at $3,269.05.

⚠️ Trade Management Notes:

Confluence:

Break of structure to the downside confirms bearish bias.

Rejection wicks and consolidation near resistance indicate exhaustion.

Confirmation Needed:

Wait for bearish candlestick patterns at entry zone for safer execution.

📌 Summary:

Bias: Bearish

Strategy: Sell on pullback to $3,308.51

Stop Loss: $3,320.85

Take Profit: $3,269.05

Reward: ~38.5 points

Risk: ~12.3 points

Date: July 31, 2025

Broker: Capital.com

Instrument: Gold/USD

Timeframe: 1-hour

🔍 Technical Overview:

Current Price: $3,295.51

Planned Short Entry: $3,308.51

Stop Loss: $3,320.85

Target (TP): $3,269.05

Risk-Reward Ratio: Approximately 1:3

🟨 Key Zones:

Supply Zone (Resistance):

$3,308.51 – $3,320.85

Previous consolidation area.

Price broke down sharply from this zone.

Demand Zone (Support):

Around $3,269.05

Previous support level where price showed a bounce.

📉 Trade Idea: Bearish Setup

Entry Logic:

Price is expected to retest the broken support (now resistance) near $3,308.51 before continuing downward.

A rejection from this zone offers a good entry for a short trade.

Price Projection:

The blue path anticipates a small bounce before a drop to the target level at $3,269.05.

⚠️ Trade Management Notes:

Confluence:

Break of structure to the downside confirms bearish bias.

Rejection wicks and consolidation near resistance indicate exhaustion.

Confirmation Needed:

Wait for bearish candlestick patterns at entry zone for safer execution.

📌 Summary:

Bias: Bearish

Strategy: Sell on pullback to $3,308.51

Stop Loss: $3,320.85

Take Profit: $3,269.05

Reward: ~38.5 points

Risk: ~12.3 points

Join my telegram (COPY_TRADE)

t.me/TOP1INVEESTADMEN

Join my refrel broker link

one.exnesstrack.org/a/l1t1rf3p6v

t.me/TOP1INVEESTADMEN

Join my refrel broker link

one.exnesstrack.org/a/l1t1rf3p6v

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join my telegram (COPY_TRADE)

t.me/TOP1INVEESTADMEN

Join my refrel broker link

one.exnesstrack.org/a/l1t1rf3p6v

t.me/TOP1INVEESTADMEN

Join my refrel broker link

one.exnesstrack.org/a/l1t1rf3p6v

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.