Current Price & Trend

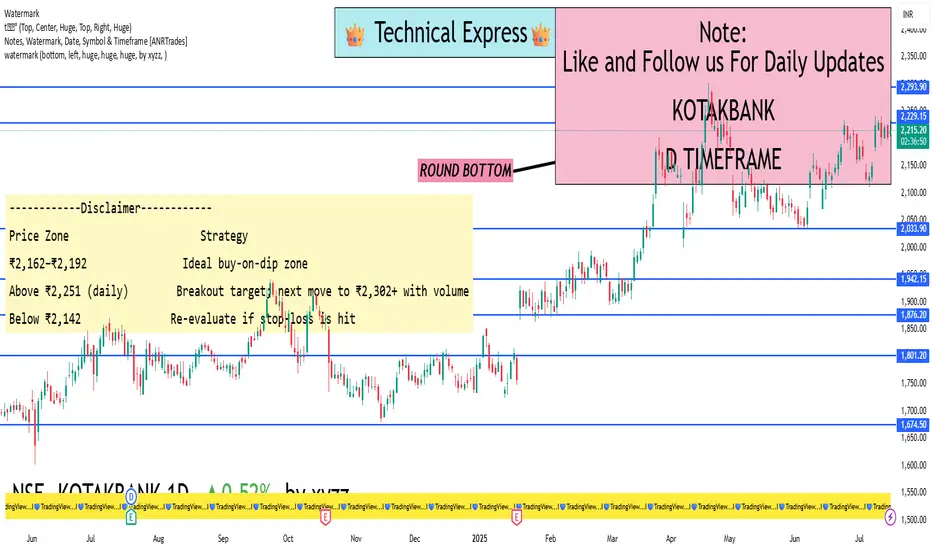

Current Trading Range: Roughly ₹2,216–₹2,227 (today’s range: ₹2,204–₹2,233)

The stock is in a positive trend, but not yet extended drastically—making now a reasonable entry moment .

Support (Buy-on-Dip) Levels

Here are the levels where the stock is likely to bounce if it pulls back:

₹2,192–₹2,180 – Decent cushion; everyday bounce zone

₹2,162 – Stronger support that previously held price from falling lower

₹2,142–₹2,160 – Broader base zone; still reputable buying area

Resistance (Profit-Zone) Levels

These are key barriers where profit-booking may occur:

₹2,221–₹2,222 – Daily pivot resistance; short-term ceiling

₹2,239–₹2,251 – Next upside target zones; tougher hurdles

₹2,302 (52-wk high) – Major breakout level; a decisive daily close above could spark a fresh rally

What You Can Do

If You’re Holding

Continue to hold—trend is intact.

Consider taking partial profits near ₹2,239–₹2,251 if short-term gains are attractive.

If You Want to Buy

Best buy ranges:

₹2,192–₹2,180 (safe pivot area)

₹2,162 (good buffer zone)

Accumulate in small lots; add on deeper dips.

If You’re Playing Breakouts

Watch for a daily close above ₹2,251—that could open the path to the old high of ₹2,302+ with momentum.

Risk/Stop-Loss

If you buy near ₹2,192, use a stop-loss just below ₹2,180.

If entry is near ₹2,162, a stop under ₹2,142 is prudent.

Current Trading Range: Roughly ₹2,216–₹2,227 (today’s range: ₹2,204–₹2,233)

The stock is in a positive trend, but not yet extended drastically—making now a reasonable entry moment .

Support (Buy-on-Dip) Levels

Here are the levels where the stock is likely to bounce if it pulls back:

₹2,192–₹2,180 – Decent cushion; everyday bounce zone

₹2,162 – Stronger support that previously held price from falling lower

₹2,142–₹2,160 – Broader base zone; still reputable buying area

Resistance (Profit-Zone) Levels

These are key barriers where profit-booking may occur:

₹2,221–₹2,222 – Daily pivot resistance; short-term ceiling

₹2,239–₹2,251 – Next upside target zones; tougher hurdles

₹2,302 (52-wk high) – Major breakout level; a decisive daily close above could spark a fresh rally

What You Can Do

If You’re Holding

Continue to hold—trend is intact.

Consider taking partial profits near ₹2,239–₹2,251 if short-term gains are attractive.

If You Want to Buy

Best buy ranges:

₹2,192–₹2,180 (safe pivot area)

₹2,162 (good buffer zone)

Accumulate in small lots; add on deeper dips.

If You’re Playing Breakouts

Watch for a daily close above ₹2,251—that could open the path to the old high of ₹2,302+ with momentum.

Risk/Stop-Loss

If you buy near ₹2,192, use a stop-loss just below ₹2,180.

If entry is near ₹2,162, a stop under ₹2,142 is prudent.

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.