📈 Nifty 50 – Market Overview

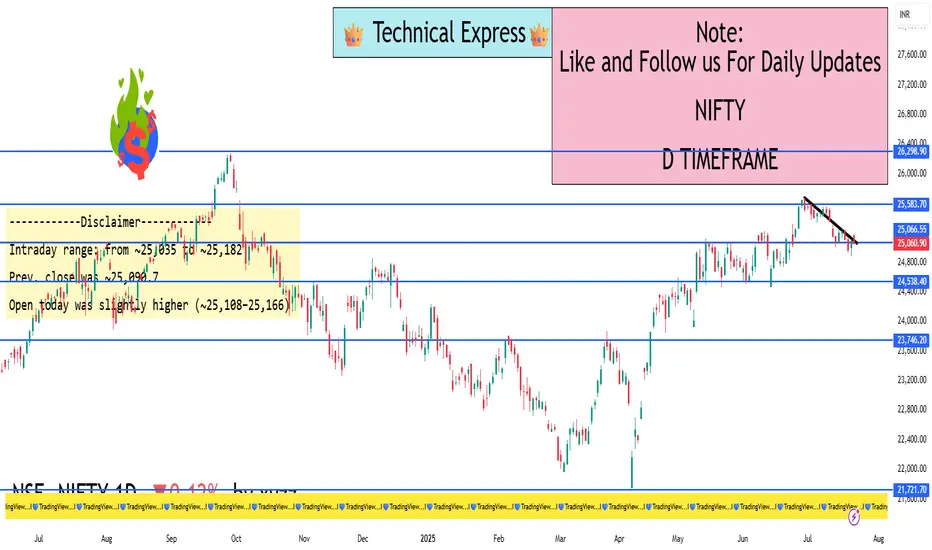

Opening Level: Nifty 50 opened positive above 25,100, continuing momentum from the previous session.

Intraday High: Touched around 25,166 during the early session.

Intraday Low: Hovered around 25,111 in the later session.

Current Range: Mostly trading between 25,110 to 25,160, with a slight upward bias.

Previous Close: Around 25,090.

Current Gains: Around +0.1% to +0.3% for the day.

🔍 What’s Driving Nifty Today

Banking Sector Strength: Strong performance from HDFC Bank, ICICI Bank, and other financial stocks lifted the index.

Quick Commerce Rally: Companies like Eternal (Zomato parent) showed double-digit gains, adding upward pressure.

Volatility Decline: The India VIX dropped nearly 3%, suggesting reduced market fear and more stable price action.

Mid-Session Profit Booking: Sectors like Realty, Pharma, and Media witnessed some selling, causing small dips during the day.

📊 Technical Snapshot

Support Level: Immediate support seen around 25,100, below which the next strong zone is around 24,950.

Resistance Level: Strong resistance around 25,160–25,200, with breakout potential toward 25,300–25,400 if breached.

Trend Outlook: The market is holding a bullish tone, with minor intraday corrections typical in a trending market.

💡 Traders’ Perspective

Direction Trigger Level Expected Move

Bullish Scenario Above 25,166–25,200 Target next zone between 25,300–25,400

Neutral/Range-bound Between 25,100–25,160 Choppy movement, watch sector rotation

Bearish Scenario Below 25,100 Possible quick slide toward 24,950–25,000

✅ Summary

Today’s session on Nifty 50 shows mild positivity driven by financial stocks and quick-commerce momentum. The market remains range-bound near recent highs, with sectors like realty and pharma underperforming. The index is showing strength above 25,100, and a breakout above 25,200 could lead to further upside in the coming days

Opening Level: Nifty 50 opened positive above 25,100, continuing momentum from the previous session.

Intraday High: Touched around 25,166 during the early session.

Intraday Low: Hovered around 25,111 in the later session.

Current Range: Mostly trading between 25,110 to 25,160, with a slight upward bias.

Previous Close: Around 25,090.

Current Gains: Around +0.1% to +0.3% for the day.

🔍 What’s Driving Nifty Today

Banking Sector Strength: Strong performance from HDFC Bank, ICICI Bank, and other financial stocks lifted the index.

Quick Commerce Rally: Companies like Eternal (Zomato parent) showed double-digit gains, adding upward pressure.

Volatility Decline: The India VIX dropped nearly 3%, suggesting reduced market fear and more stable price action.

Mid-Session Profit Booking: Sectors like Realty, Pharma, and Media witnessed some selling, causing small dips during the day.

📊 Technical Snapshot

Support Level: Immediate support seen around 25,100, below which the next strong zone is around 24,950.

Resistance Level: Strong resistance around 25,160–25,200, with breakout potential toward 25,300–25,400 if breached.

Trend Outlook: The market is holding a bullish tone, with minor intraday corrections typical in a trending market.

💡 Traders’ Perspective

Direction Trigger Level Expected Move

Bullish Scenario Above 25,166–25,200 Target next zone between 25,300–25,400

Neutral/Range-bound Between 25,100–25,160 Choppy movement, watch sector rotation

Bearish Scenario Below 25,100 Possible quick slide toward 24,950–25,000

✅ Summary

Today’s session on Nifty 50 shows mild positivity driven by financial stocks and quick-commerce momentum. The market remains range-bound near recent highs, with sectors like realty and pharma underperforming. The index is showing strength above 25,100, and a breakout above 25,200 could lead to further upside in the coming days

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.