🟢 Nifty Analysis EOD – August 4, 2025 – Monday 🔴

A Monday full of mind games.

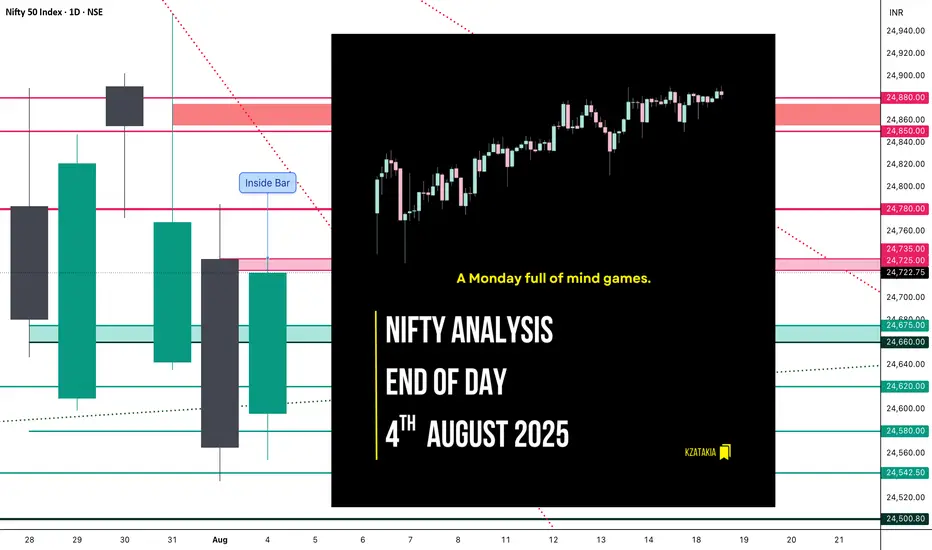

Nifty opened with a slight positive gap and immediately tested the TC of CPR, but that optimism didn’t last long — sharp rejection took it to day’s low (24,554). What followed was a rollercoaster: a 100-point recovery, a 50-point pullback — all within 10 minutes. This wild price action defined the rest of the day.

Throughout the session, Nifty remained trapped within the CPR zone. Both sides experienced multiple fakeouts, especially around initial balance (IB) zones. Even when prices nudged toward R1, repeated failed attempts to break above reflected the market’s indecisiveness. The day finally closed near the high, but conviction was still lacking.

Many option buyers likely struggled due to deceptive shadows and unexpected fractal breakouts. The entire price action stayed within Friday’s range — forming an Inside Bar structure on the daily chart. This suggests a potential range breakout trade tomorrow.

The market faced resistance near the Fibonacci 0.618–0.786 retracement of the prior fall — aligning with 24,740–24,780 zones. A close above 24,780 tomorrow could shift momentum back in the bulls’ favour. If not, bears still hold the upper ground.

📈 5 Min Time Frame Chart with Intraday Levels

📉 Daily Time Frame Chart with Intraday Levels

📊 Daily Candle Breakdown

Candle Type:

🟢 Bullish Marubozu-like — reflects a strong control by buyers after early weakness.

Structure Breakdown:

Real Body: 126.70 pts (Bullish)

Upper Wick: 13.50 pts (Minor resistance near close)

Lower Wick: 42.05 pts (Early dip got bought aggressively)

Key Insight:

Closed near the high of the day — positive bias for tomorrow

Inside Bar formed – Expect a breakout trade

24,780+ closing will turn sentiment bullish

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 209.36

IB Range: 115.95 → Medium

Market Structure: Balanced

Trade Summary:

🕚 11:30 AM – Long Entry → SL Hit

🕛 12:30 PM – Long Entry → SL Hit

🕐 13:10 PM – Short Entry → SL Hit

Tough day — strategy got chopped in noise-heavy moves.

🔍 Support & Resistance Levels

Resistance Zones:

Support Zones:

💭 Final Thoughts

"Markets love to test your patience before they reward your conviction."

Today was a lesson in restraint — avoid overtrading when structure lacks clarity. Inside bar gives us a clean slate for tomorrow. Let price lead.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

A Monday full of mind games.

Nifty opened with a slight positive gap and immediately tested the TC of CPR, but that optimism didn’t last long — sharp rejection took it to day’s low (24,554). What followed was a rollercoaster: a 100-point recovery, a 50-point pullback — all within 10 minutes. This wild price action defined the rest of the day.

Throughout the session, Nifty remained trapped within the CPR zone. Both sides experienced multiple fakeouts, especially around initial balance (IB) zones. Even when prices nudged toward R1, repeated failed attempts to break above reflected the market’s indecisiveness. The day finally closed near the high, but conviction was still lacking.

Many option buyers likely struggled due to deceptive shadows and unexpected fractal breakouts. The entire price action stayed within Friday’s range — forming an Inside Bar structure on the daily chart. This suggests a potential range breakout trade tomorrow.

The market faced resistance near the Fibonacci 0.618–0.786 retracement of the prior fall — aligning with 24,740–24,780 zones. A close above 24,780 tomorrow could shift momentum back in the bulls’ favour. If not, bears still hold the upper ground.

📈 5 Min Time Frame Chart with Intraday Levels

📉 Daily Time Frame Chart with Intraday Levels

📊 Daily Candle Breakdown

- Open: 24,596.05

- High: 24,736.25

- Low: 24,554.00

- Close: 24,722.75

- Change: +157.40 (+0.64%)

Candle Type:

🟢 Bullish Marubozu-like — reflects a strong control by buyers after early weakness.

Structure Breakdown:

Real Body: 126.70 pts (Bullish)

Upper Wick: 13.50 pts (Minor resistance near close)

Lower Wick: 42.05 pts (Early dip got bought aggressively)

Key Insight:

Closed near the high of the day — positive bias for tomorrow

Inside Bar formed – Expect a breakout trade

24,780+ closing will turn sentiment bullish

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 209.36

IB Range: 115.95 → Medium

Market Structure: Balanced

Trade Summary:

🕚 11:30 AM – Long Entry → SL Hit

🕛 12:30 PM – Long Entry → SL Hit

🕐 13:10 PM – Short Entry → SL Hit

Tough day — strategy got chopped in noise-heavy moves.

🔍 Support & Resistance Levels

Resistance Zones:

- 24,725 ~ 24,735

- 24,780 ~ 24,795

- 24,860 ~ 24,880

Support Zones:

- 24,675 ~ 24,660

- 24,620

- 24,542 ~ 24,535

- 24,500

- 24,470 ~ 24,460

💭 Final Thoughts

"Markets love to test your patience before they reward your conviction."

Today was a lesson in restraint — avoid overtrading when structure lacks clarity. Inside bar gives us a clean slate for tomorrow. Let price lead.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.