✅ Current Market Status:

Closing Price: ₹24,972.50

Change: –95.20 points

Percentage Change: –0.38%

Day’s Range: ₹24,905.60 – ₹25,095.10

52-Week Range: ₹19,638.30 – ₹25,194.60

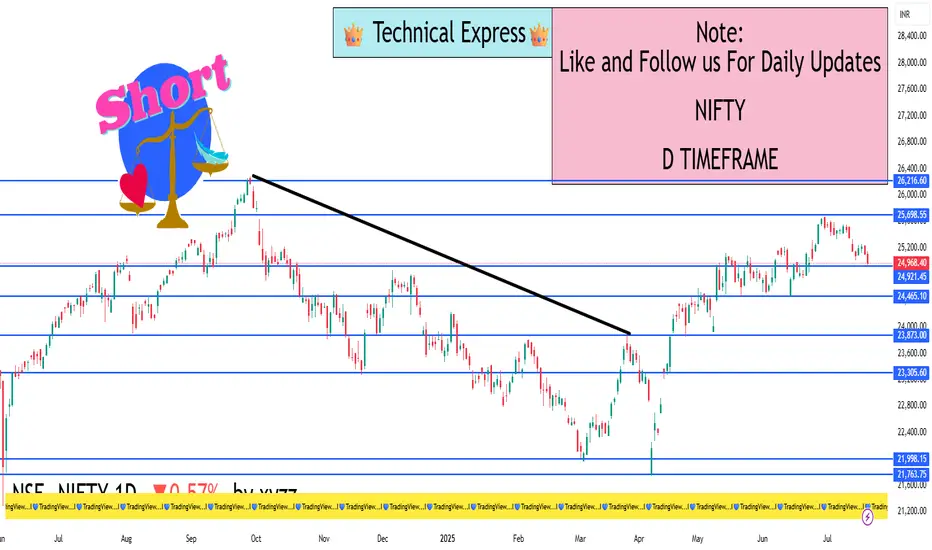

🔍 Key Technical Levels:

📌 Support Zones:

Support 1: ₹24,900 – Intraday low and key psychological level

Support 2: ₹24,750 – Previous breakout zone

Support 3: ₹24,500 – Short-term trendline base

📌 Resistance Zones:

Resistance 1: ₹25,100 – Day’s high and minor barrier

Resistance 2: ₹25,200 – All-time high

Resistance 3: ₹25,500 – Next potential rally target if breakout succeeds

🕯️ Candlestick Pattern:

Recent Candle: Bearish candle after range-bound session

Price Action: Failed to sustain above ₹25,100

Implication: Weakness around highs, possible pullback toward support

📊 Market Structure Summary:

Nifty formed a double top near ₹25,200, indicating exhaustion

Currently testing ₹24,900 – if broken, next support is ₹24,750

A breakout will only be valid above ₹25,200 with strong volume

🧠 Institutional Behavior:

Likely profit booking near highs

No major signs of heavy accumulation

May re-enter above ₹25,200 or below ₹24,500 for value buying

🔚 Summary:

🔴 Short-Term Bias: Slightly Bearish

🟡 Watch Levels: ₹24,900 (support) and ₹25,200 (resistance)

✅ Buyers: Wait for breakout above ₹25,200

⚠️ Sellers: Watch for breakdown below ₹24,900 or ₹24,750

Closing Price: ₹24,972.50

Change: –95.20 points

Percentage Change: –0.38%

Day’s Range: ₹24,905.60 – ₹25,095.10

52-Week Range: ₹19,638.30 – ₹25,194.60

🔍 Key Technical Levels:

📌 Support Zones:

Support 1: ₹24,900 – Intraday low and key psychological level

Support 2: ₹24,750 – Previous breakout zone

Support 3: ₹24,500 – Short-term trendline base

📌 Resistance Zones:

Resistance 1: ₹25,100 – Day’s high and minor barrier

Resistance 2: ₹25,200 – All-time high

Resistance 3: ₹25,500 – Next potential rally target if breakout succeeds

🕯️ Candlestick Pattern:

Recent Candle: Bearish candle after range-bound session

Price Action: Failed to sustain above ₹25,100

Implication: Weakness around highs, possible pullback toward support

📊 Market Structure Summary:

Nifty formed a double top near ₹25,200, indicating exhaustion

Currently testing ₹24,900 – if broken, next support is ₹24,750

A breakout will only be valid above ₹25,200 with strong volume

🧠 Institutional Behavior:

Likely profit booking near highs

No major signs of heavy accumulation

May re-enter above ₹25,200 or below ₹24,500 for value buying

🔚 Summary:

🔴 Short-Term Bias: Slightly Bearish

🟡 Watch Levels: ₹24,900 (support) and ₹25,200 (resistance)

✅ Buyers: Wait for breakout above ₹25,200

⚠️ Sellers: Watch for breakdown below ₹24,900 or ₹24,750

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.