Hot Potato Trader here, what is up fellow trader!

NIO is going to report earnings on November 17, 2020 After Market Close.

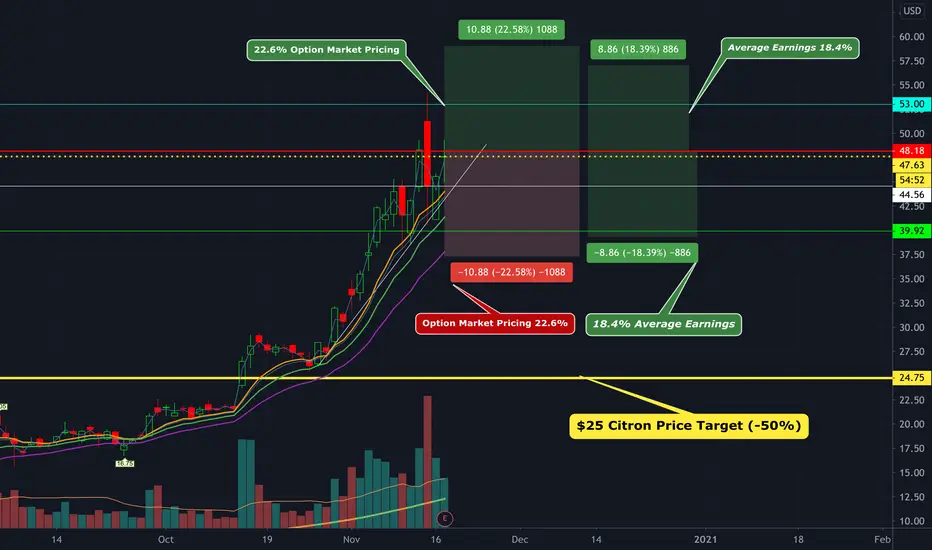

Earnings range based on historical data and option priced move.

The options market overestimated NIO stocks earnings move 75 % of the time in the last 8 quarters. The predicted move after earnings announcement was ±18.7% on average vs an average of the actual earnings moves of 17.0%

Key Points:

- Consensus estimate is for a loss of $0.17 per share on revenue of $628.00 million

- A single earnings report can bring volatility, volume , and interest to an asset

- Earnings Drift Since Previous Earnings +243.0% ~2.7 standard deviation move

- Implied Volatility Crush Earnings: 12%

- IV30 % Rank: 96%/100%

NIO is expected to stay within price range $37.3 and $59.06, giving me a confidence level of 7.5 /10

Key Levels:

- Market Close: Approx. $48.18

- $25 Citron price target

Predicted move $10.88 ( ± 22.6%)

Actual move: $8.86 ( ±18.4%)

Predicted Average: ± $10.88

downside: $37.3

upside: $ 59.06

Actual Average move: ± $8.86

downside: $39.32

upside: $57.04

Edge: luck

Note: A potential catalyst such as recent news could take NIO outside the range. In this event, the catalyst would be considered significant. And identified as an outlier will be identified as bullish or bearish .

Thanks for reviewing my idea and constructive criticism is welcome.

NIO is going to report earnings on November 17, 2020 After Market Close.

Earnings range based on historical data and option priced move.

The options market overestimated NIO stocks earnings move 75 % of the time in the last 8 quarters. The predicted move after earnings announcement was ±18.7% on average vs an average of the actual earnings moves of 17.0%

Key Points:

- Consensus estimate is for a loss of $0.17 per share on revenue of $628.00 million

- A single earnings report can bring volatility, volume , and interest to an asset

- Earnings Drift Since Previous Earnings +243.0% ~2.7 standard deviation move

- Implied Volatility Crush Earnings: 12%

- IV30 % Rank: 96%/100%

NIO is expected to stay within price range $37.3 and $59.06, giving me a confidence level of 7.5 /10

Key Levels:

- Market Close: Approx. $48.18

- $25 Citron price target

Predicted move $10.88 ( ± 22.6%)

Actual move: $8.86 ( ±18.4%)

Predicted Average: ± $10.88

downside: $37.3

upside: $ 59.06

Actual Average move: ± $8.86

downside: $39.32

upside: $57.04

Edge: luck

Note: A potential catalyst such as recent news could take NIO outside the range. In this event, the catalyst would be considered significant. And identified as an outlier will be identified as bullish or bearish .

Thanks for reviewing my idea and constructive criticism is welcome.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.