Hi there, over the past 30 days, these five unexpected crypto sectors have been the top performers by weighted average, Let’s dive in boyz :

1. NFT Applications 🖼️

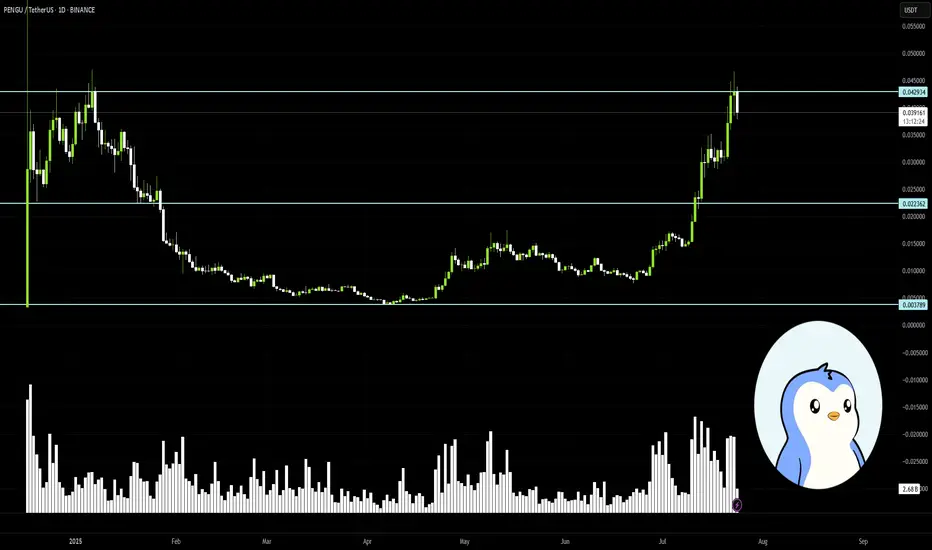

Not again! Surprised eh? You’re not alone. NFT related tokens are surging and the main driver is Pudgy Penguins’ token, PENGU, which has been posting eye popping returns and dragging the entire sector up with it. how they pumped this much? well just look at early days of listing , rug the fan , wait for couple of month then ride the btc pump hype (story of most NFTs) lemme show you top performer in each sections now

PUDGY PENGU , BLUR , APENFT

2. Gen 1 Smart Contracts 🧠

This sector includes the original smart contract chains that haven’t undergone major upgrades (so Ethereum, post Merge, doesn’t count). These older protocols are seeing a resurgence, and a few standout tokens are carrying the load.

TEZOS , HEDRA , XDC NETWORK

3. Oracles 🔮

Oracles are blockchains that bring real-world data onto the blockchain. Think weather data for onchain farming bets, yeah, that specific. These infrastructure plays are quietly gaining traction, powering up the backend of some niche platforms.

CHAINLINK , PYTH NETWORK , BAND PROTOCL

4. Memecoins 🪙

Wait… NFT tokens are outpacing memecoins? Is it 2021 again? Surprisingly,

BONKUSDT a heavyweight in the meme world is leading thanks to its new launchpad BonkFun, which has even been outperforming PumpFun in daily revenue (though a lot of that is likely driven by incentives for now).

BONKUSDT a heavyweight in the meme world is leading thanks to its new launchpad BonkFun, which has even been outperforming PumpFun in daily revenue (though a lot of that is likely driven by incentives for now).

BONK , FLOKI , PEPE

5. DePIN (Decentralized Physical Infrastructure Networks) 📌

Think crowdsourced infrastructure. For example, Helium Mobile pays users to share their WiFi or 5G signals. The real kicker? This data is sometimes passed on to major telecom networks — everyday users are interacting with Web3, often without realizing it.

HELIUM , JASMY , loTeX

now you look at the crypto chart and thinking whats going on !

Crypto bull markets has 4 major phase :

1. BTC pumps

2. Big alts pumps (Eth,Sol,BNB..)

3. low cap atls pumps (gems listing)

4. correction and REPEAT

recent data shows retails taking profit while WallStreet loading the dips

1. NFT Applications 🖼️

Not again! Surprised eh? You’re not alone. NFT related tokens are surging and the main driver is Pudgy Penguins’ token, PENGU, which has been posting eye popping returns and dragging the entire sector up with it. how they pumped this much? well just look at early days of listing , rug the fan , wait for couple of month then ride the btc pump hype (story of most NFTs) lemme show you top performer in each sections now

PUDGY PENGU , BLUR , APENFT

2. Gen 1 Smart Contracts 🧠

This sector includes the original smart contract chains that haven’t undergone major upgrades (so Ethereum, post Merge, doesn’t count). These older protocols are seeing a resurgence, and a few standout tokens are carrying the load.

TEZOS , HEDRA , XDC NETWORK

3. Oracles 🔮

Oracles are blockchains that bring real-world data onto the blockchain. Think weather data for onchain farming bets, yeah, that specific. These infrastructure plays are quietly gaining traction, powering up the backend of some niche platforms.

CHAINLINK , PYTH NETWORK , BAND PROTOCL

4. Memecoins 🪙

Wait… NFT tokens are outpacing memecoins? Is it 2021 again? Surprisingly,

BONK , FLOKI , PEPE

5. DePIN (Decentralized Physical Infrastructure Networks) 📌

Think crowdsourced infrastructure. For example, Helium Mobile pays users to share their WiFi or 5G signals. The real kicker? This data is sometimes passed on to major telecom networks — everyday users are interacting with Web3, often without realizing it.

HELIUM , JASMY , loTeX

now you look at the crypto chart and thinking whats going on !

Crypto bull markets has 4 major phase :

1. BTC pumps

2. Big alts pumps (Eth,Sol,BNB..)

3. low cap atls pumps (gems listing)

4. correction and REPEAT

recent data shows retails taking profit while WallStreet loading the dips

Trade active

ETH is experiencing strong upward momentum, approaching the $4,000 level for the first time since last December. Interest continues to grow, with inflows into spot ETH ETFs surpassing those of BTC for seven straight days. Given that ETH’s market cap is still only about 20% of BTC’s, even modest inflows from institutions or corporate treasuries can have a significant price impact.Although ETH has taken center stage recently, BTC has shown steady strength in the background. Even with a slowdown in spot BTC ETF inflows, the price has remained stable. The market absorbed a large 80,000 BTC sell-off on Friday surprisingly well, with traders quickly stepping in to buy the dip and dampen volatility.

BTC’s dominance in the market is holding steady at around 60%, showing investors still see it as a reliable store of value, not necessarily rotating into altcoins. This stability leaves room for ETH and other major assets to gain share. To compare, during ETH’s peak in November 2021, BTC dominance was under 45%, while ETH hovered near 20%.

However, current market positioning appears stretched. Open interest in perpetual futures has climbed to near yearly highs—$45 billion for BTC and $28 billion for ETH. Funding rates for these contracts are also elevated above 15% on major platforms. Though we haven’t reached panic levels yet, it wouldn't take much to trigger a rapid correction like the one seen last Friday. Some major players have already taken profits such as exiting a large ETH 26SEP25 call spread and sizable BTC 8AUG25 puts have been purchased as protection against short-term downside risk

Options activity and flattened risk reversals suggest traders expect some selling pressure as ETH nears $4,000 and BTC approaches $120,000. Still, with strong momentum, positive sentiment, and supportive macro conditions, both long-term holders and institutions appear ready to step in on any dips, as evidenced by Friday’s quick rebound.

Trade closed: target reached

Bitcoin remains locked in a tight range, unable to decisively break above $120k, though steady buying around $116k continues to offer support. Meanwhile, Ether’s rally is losing momentum as it nears the key $4k psychological level, with momentum indicators turning more neutral.Structurally, ongoing institutional inflows and improving regulatory conditions suggest the potential for new all-time highs over the medium term. Continued accumulation by institutional investors like MicroStrategy (MSTR) and SharpLink Gaming (SBET) — both actively raising capital for Bitcoin purchases — reflects sustained long-term confidence.

However, some concerns remain. Despite a stream of bullish news — such as pro-crypto regulatory moves in the U.S. and progress on spot and derivatives ETFs — prices haven’t reacted significantly. This kind of muted response often signals short-term fatigue, a pattern typical of late-cycle market behaviour.

On the macro front, risks are emerging from overcrowded short positions against the U.S. Dollar. So far in 2025, markets have been betting on a weaker Dollar amid the ongoing Tariff War, but with the Dollar already down 10% year-to-date, further downside seems limited.

CFTC data shows a heavy build-up of USDJPY shorts, a widely shared and costly position to maintain. This leaves the market vulnerable to a Dollar short squeeze, which could trigger risk-off moves across equities, emerging markets, and crypto.

At the same time, the Tariff War continues. Though the U.S. and EU have reached a tentative truce, global tensions remain. Former President Trump has advocated for an end to the Russia–Ukraine conflict, but global policymakers appear skeptical, expecting him to soften his stance.

Looking ahead, upcoming U.S. macro data — especially inflation and employment figures — will be critical for shaping the outlook for Q3. With tariffs expected to impact both corporate margins and consumer prices, Q3 could represent a major turning point. All eyes now turn to the Fed: a rate hold is expected in July, with policymakers likely to stress a data-driven approach ahead of the high-stakes September meeting, where a rate cut remains on the table.

🟣MasterClass moonypto.com/masterclass

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🟣MasterClass moonypto.com/masterclass

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.