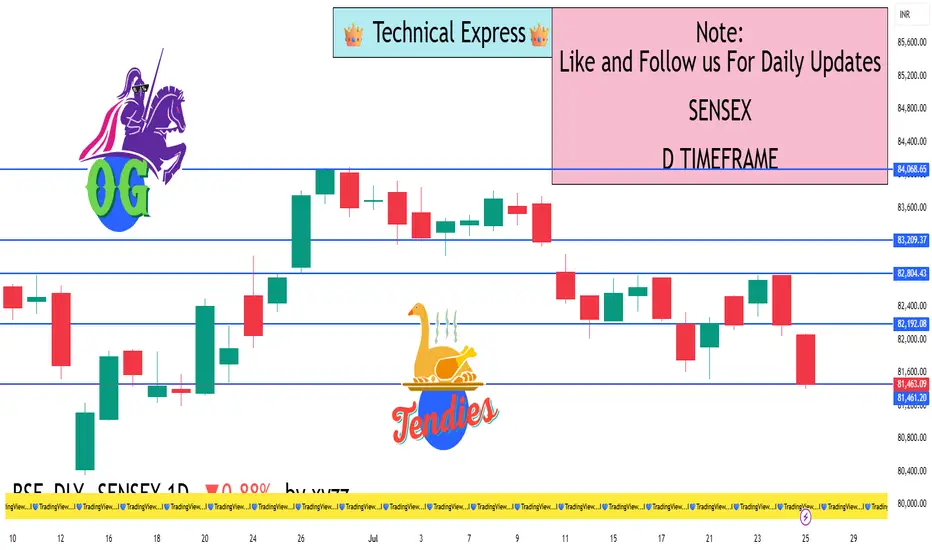

Closing Value: 81,463.09

Net Change: −721.08 points (−0.88%)

Opening Level: 82,065.76

Day’s High: 82,069.51

Day’s Low: 81,397.69

Trend: Bearish

📊 Technical Analysis:

✅ Candle Type:

Large bearish candle with a close near the day’s low.

Indicates strong selling pressure throughout the session.

🔻 Support Levels:

81,400 – Immediate support (Friday’s low)

81,000 – Critical psychological and technical level

80,700 – Medium-term support zone

🔺 Resistance Levels:

82,070 – Intraday high and near-term resistance

82,300 – Minor resistance

82,500 – Strong resistance zone

📈 Indicator Summary:

RSI (Relative Strength Index): Likely below 50 – shows weakening buying strength

MACD: Bearish crossover – confirms ongoing downtrend

Volume: Higher than average – selling was broad-based and strong

🧠 Market Sentiment:

Bearish sentiment due to pressure in Auto, Banking, Energy, and IT sectors

Major stocks pulling down the index: Reliance, HDFC Bank, Infosys, Tech Mahindra, and Bajaj Finance

Investors showed caution amid FII selling, weak global signals, and earnings season pressure

✅ Conclusion:

Sensex is in a short-term downtrend

A breakdown below 81,000 could trigger a move toward 80,700 or lower

Bulls must reclaim 82,000–82,300 levels to regain positive momentum

Net Change: −721.08 points (−0.88%)

Opening Level: 82,065.76

Day’s High: 82,069.51

Day’s Low: 81,397.69

Trend: Bearish

📊 Technical Analysis:

✅ Candle Type:

Large bearish candle with a close near the day’s low.

Indicates strong selling pressure throughout the session.

🔻 Support Levels:

81,400 – Immediate support (Friday’s low)

81,000 – Critical psychological and technical level

80,700 – Medium-term support zone

🔺 Resistance Levels:

82,070 – Intraday high and near-term resistance

82,300 – Minor resistance

82,500 – Strong resistance zone

📈 Indicator Summary:

RSI (Relative Strength Index): Likely below 50 – shows weakening buying strength

MACD: Bearish crossover – confirms ongoing downtrend

Volume: Higher than average – selling was broad-based and strong

🧠 Market Sentiment:

Bearish sentiment due to pressure in Auto, Banking, Energy, and IT sectors

Major stocks pulling down the index: Reliance, HDFC Bank, Infosys, Tech Mahindra, and Bajaj Finance

Investors showed caution amid FII selling, weak global signals, and earnings season pressure

✅ Conclusion:

Sensex is in a short-term downtrend

A breakdown below 81,000 could trigger a move toward 80,700 or lower

Bulls must reclaim 82,000–82,300 levels to regain positive momentum

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.