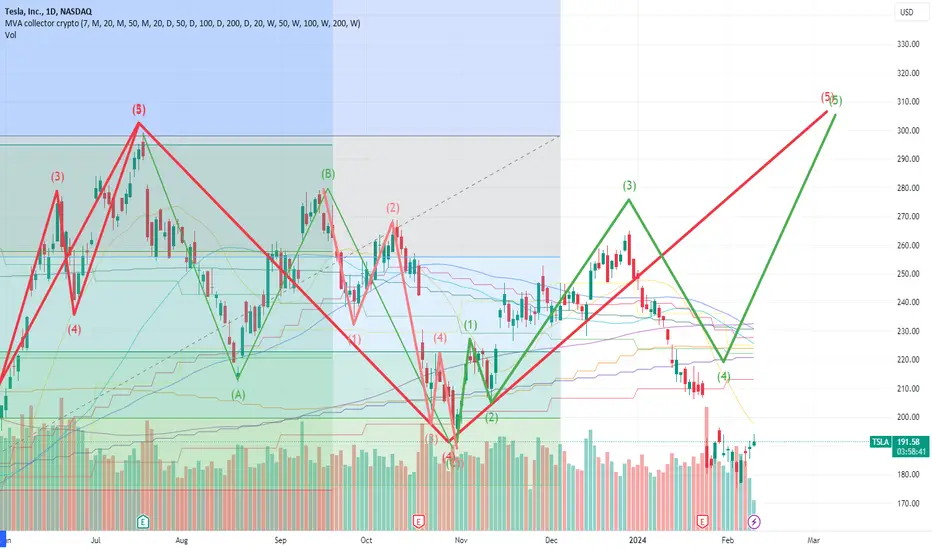

I'm seeing a lot of negative pressure here. The breakaway from the prior wave patterns isn't good for wave theorists. Still, it does tell me that there are some serious questions about longevity for this stock, as well as whether it is fat and needs shorts to bring it back to a reasonable price level for a company that doesn't offer a dividend or any buybacks to justify the high pricing here in an environment where Tresla is doing g nothing but losing market share to rivals and more nimble EV manufacturers.

I point to the following facts.

The all-time high Tesla stock closing price was 409.97 on November 04, 2021.

TSLA: 52-week high stock price is 299.29, 57.9% above the current share price; 52-week low stock price is 152.37, 19.6% below the current share price.

The average Tesla stock price for the last 52 weeks is 224.04.

All of this is happening at a time when EVs are receiving more sales incentives and buyer interest year over year and have less and less market share in Europe.

I think it's time for a hedge fund to short Tesla back below the century mark and force some systemic changes in management.

I point to the following facts.

The all-time high Tesla stock closing price was 409.97 on November 04, 2021.

TSLA: 52-week high stock price is 299.29, 57.9% above the current share price; 52-week low stock price is 152.37, 19.6% below the current share price.

The average Tesla stock price for the last 52 weeks is 224.04.

All of this is happening at a time when EVs are receiving more sales incentives and buyer interest year over year and have less and less market share in Europe.

I think it's time for a hedge fund to short Tesla back below the century mark and force some systemic changes in management.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.