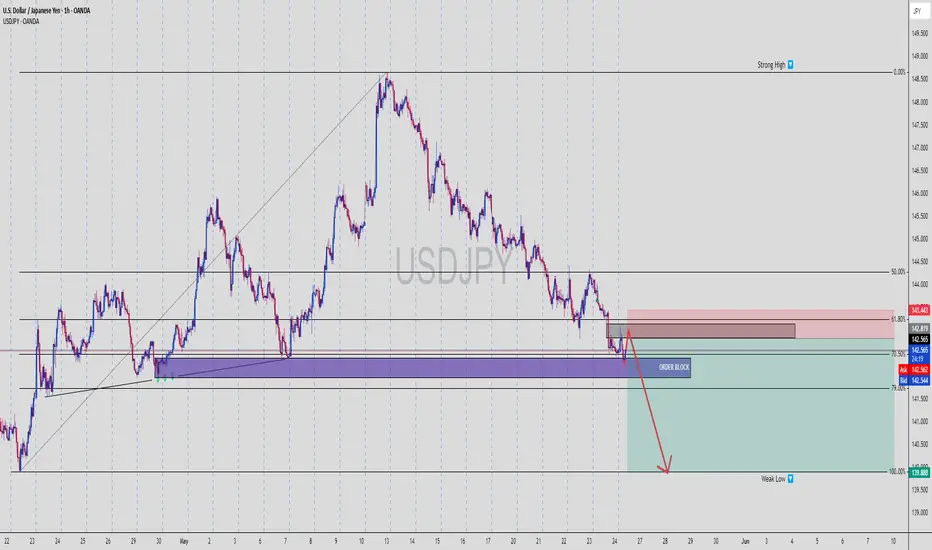

📊 USDJPY | 1H Bearish Play – Smart Money In Control

We’re seeing a classic setup where price retraces into a bearish zone of confluence and prepares for a selloff toward internal liquidity. Check the breakdown:

🔻 1. Structure Shift Confirmed

Price broke structure on the downside after forming a lower high

Current move is a retracement into discount OB zone

Clear rejection is forming, signaling short momentum incoming

🟪 2. Zone Confluence

📌 Order Block (OB): Sitting just under the 61.8% Fib

📌 Fair Value Gap (FVG): Mitigated perfectly

📌 Fib Retracement: Price reacts between 61.8% and 70.5% — classic Smart Money play

📌 Previous Demand Turned Supply: This level is now acting as a rejection zone

This is stacked confluence — just how Smart Money likes to move.

💣 3. Entry Strategy

Entry Zone: 142.55 (midpoint of the OB reaction area)

Stop Loss: Above 143.443 (above OB + liquidity wick)

Take Profit: 139.888 (weak low, previous liquidity resting point)

⚖️ 4. Risk-to-Reward Ratio (RRR)

🎯 TP = 139.888

📍 Entry = 142.550

🔐 SL = 143.443

✅ RRR ≈ 1:3.5

A great example of high-probability short setup using pure Smart Money logic.

📉 5. Why This Works

Retail traders will try to long at this zone hoping for a breakout

Smart Money uses this zone to engineer liquidity

They tap into the FVG/OB, then target internal liquidity and weak lows

Clean, controlled sell-off expected down to 139.888

🧠 SMC Insights

This chart is all about liquidity engineering:

Push up into OB

Reject at premium pricing

Drive down to weak low to collect stops

Possibly reverse or continue trend from there

💬 Comment “FVG TAP + OB = 🔥” if you spotted this setup early

💾 Save it before the drop happens

📤 Share with a fellow SMC trader who needs this breakdown

We’re seeing a classic setup where price retraces into a bearish zone of confluence and prepares for a selloff toward internal liquidity. Check the breakdown:

🔻 1. Structure Shift Confirmed

Price broke structure on the downside after forming a lower high

Current move is a retracement into discount OB zone

Clear rejection is forming, signaling short momentum incoming

🟪 2. Zone Confluence

📌 Order Block (OB): Sitting just under the 61.8% Fib

📌 Fair Value Gap (FVG): Mitigated perfectly

📌 Fib Retracement: Price reacts between 61.8% and 70.5% — classic Smart Money play

📌 Previous Demand Turned Supply: This level is now acting as a rejection zone

This is stacked confluence — just how Smart Money likes to move.

💣 3. Entry Strategy

Entry Zone: 142.55 (midpoint of the OB reaction area)

Stop Loss: Above 143.443 (above OB + liquidity wick)

Take Profit: 139.888 (weak low, previous liquidity resting point)

⚖️ 4. Risk-to-Reward Ratio (RRR)

🎯 TP = 139.888

📍 Entry = 142.550

🔐 SL = 143.443

✅ RRR ≈ 1:3.5

A great example of high-probability short setup using pure Smart Money logic.

📉 5. Why This Works

Retail traders will try to long at this zone hoping for a breakout

Smart Money uses this zone to engineer liquidity

They tap into the FVG/OB, then target internal liquidity and weak lows

Clean, controlled sell-off expected down to 139.888

🧠 SMC Insights

This chart is all about liquidity engineering:

Push up into OB

Reject at premium pricing

Drive down to weak low to collect stops

Possibly reverse or continue trend from there

💬 Comment “FVG TAP + OB = 🔥” if you spotted this setup early

💾 Save it before the drop happens

📤 Share with a fellow SMC trader who needs this breakdown

Trade closed: stop reached

📍 Trade Update:✅ Setup played out but momentum faded halfway.

✅ SL moved to entry = Breakeven secured! 🔐

🔥 Capital preserved, sniper mode reloaded for the next strike!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.