Hello traders! 🌟

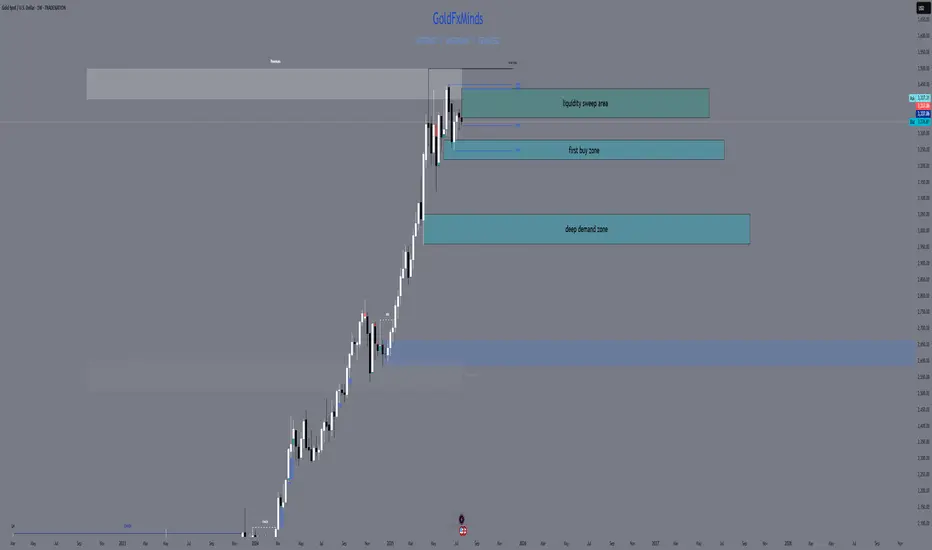

We’re stepping into a pivotal week for gold (XAUUSD), and the weekly chart tells a story of tension, liquidity hunts, and potential big moves. Let’s dive into the three truly critical zones, backed by SMC/ICT logic, Fibonacci, EMAs, RSI, and fair‑value gaps — all in one elegant map. 🎨✨

🔹 HTF Overview & Macro Pulse

Current Price: 3336

Weekly Trend: Bullish overall, but momentum is fading as price coils under premium highs.

EMAs (5/21/50/200):

EMA5 & EMA21 are flattening beneath price, hinting at stall.

EMA50 sitting near 3120 as a deep support magnet.

RSI (Weekly): Cooling from ~75 down to ~66, showing bearish divergence vs those upper wicks.

Fair‑Value Gaps:

Unfilled 3365–3405 zone above — institutional imbalance still waiting.

Partially filled 3280–3320 below — common reaction pocket.

Fibonacci Extensions (1984 → 3365 high): 127.2% at 3405, 161.8% at 3439 — the exact top of our supply wick.

Macro Catalysts This Week

Wed (Jul 30): FOMC + Fed Statement

Thu (Jul 31): Core PCE + Unemployment Claims

Fri (Aug 1): NFP + ISM Manufacturing

Prepare for violent spikes into one of our zones — then trade the reaction.

🔸 The Three TRUE Weekly Zones

W1 Supply (Ultimate Wick Zone)

🔥 3350 – 3439

This entire wick from May–July is YOUR one and only supply zone on weekly.

Pure liquidity sweep area

Confluence: unfilled fair‑value gap, 127–161.8% Fib, RSI divergence

Every touch here is a short‑trap until we see a full weekly close above 3439.

W1 Demand (Primary Buy Zone)

🌊 3220 – 3285

The last robust order block & BOS base before gold ran vertical.

Confluence: filled FVG, weekly OB body, EMA21 target, RSI back at 50

Ideal sniper entry after a news‑driven sell‑off into this range.

Deep Discount Block

🛡️ 2960 – 3050

The origin of the full 2024–2025 bull trend — true institutional accumulation.

Confluence: March 2024 CHoCH base, EMA50/200 proximity, 78.6–88.6% Fib retrace

Only for a major quarterly reset; not on the immediate radar unless USD spikes dramatically.

🧭 Strategy & Execution

Short Bias: Wait for a liquidity spike into 3350–3439 (likely around FOMC/NFP), then watch for a clean rejection candle.

Long Bias: After a thrust down into 3220–3285, look for wick‑based rejection plus EMA21 hold and a bullish engulf on weekly.

Avoid the mid‑zone between 3285–3350 — that’s noise, not structure.

Patience is everything. Let price sweep, then let us strike. The real power trades this week will be born from clear structure — not guesswork.

💬 What’s your favorite zone to watch? Drop a comment below!

👍 Smash that like🚀🚀🚀 if you found this map helpful, and hit follow for more GoldFxMinds sniper blueprints.

Disclosure: Analysis based on Trade Nation’s TradingView feed. I’m part of their Influencer Program.

GoldFxMinds 💛

We’re stepping into a pivotal week for gold (XAUUSD), and the weekly chart tells a story of tension, liquidity hunts, and potential big moves. Let’s dive into the three truly critical zones, backed by SMC/ICT logic, Fibonacci, EMAs, RSI, and fair‑value gaps — all in one elegant map. 🎨✨

🔹 HTF Overview & Macro Pulse

Current Price: 3336

Weekly Trend: Bullish overall, but momentum is fading as price coils under premium highs.

EMAs (5/21/50/200):

EMA5 & EMA21 are flattening beneath price, hinting at stall.

EMA50 sitting near 3120 as a deep support magnet.

RSI (Weekly): Cooling from ~75 down to ~66, showing bearish divergence vs those upper wicks.

Fair‑Value Gaps:

Unfilled 3365–3405 zone above — institutional imbalance still waiting.

Partially filled 3280–3320 below — common reaction pocket.

Fibonacci Extensions (1984 → 3365 high): 127.2% at 3405, 161.8% at 3439 — the exact top of our supply wick.

Macro Catalysts This Week

Wed (Jul 30): FOMC + Fed Statement

Thu (Jul 31): Core PCE + Unemployment Claims

Fri (Aug 1): NFP + ISM Manufacturing

Prepare for violent spikes into one of our zones — then trade the reaction.

🔸 The Three TRUE Weekly Zones

W1 Supply (Ultimate Wick Zone)

🔥 3350 – 3439

This entire wick from May–July is YOUR one and only supply zone on weekly.

Pure liquidity sweep area

Confluence: unfilled fair‑value gap, 127–161.8% Fib, RSI divergence

Every touch here is a short‑trap until we see a full weekly close above 3439.

W1 Demand (Primary Buy Zone)

🌊 3220 – 3285

The last robust order block & BOS base before gold ran vertical.

Confluence: filled FVG, weekly OB body, EMA21 target, RSI back at 50

Ideal sniper entry after a news‑driven sell‑off into this range.

Deep Discount Block

🛡️ 2960 – 3050

The origin of the full 2024–2025 bull trend — true institutional accumulation.

Confluence: March 2024 CHoCH base, EMA50/200 proximity, 78.6–88.6% Fib retrace

Only for a major quarterly reset; not on the immediate radar unless USD spikes dramatically.

🧭 Strategy & Execution

Short Bias: Wait for a liquidity spike into 3350–3439 (likely around FOMC/NFP), then watch for a clean rejection candle.

Long Bias: After a thrust down into 3220–3285, look for wick‑based rejection plus EMA21 hold and a bullish engulf on weekly.

Avoid the mid‑zone between 3285–3350 — that’s noise, not structure.

Patience is everything. Let price sweep, then let us strike. The real power trades this week will be born from clear structure — not guesswork.

💬 What’s your favorite zone to watch? Drop a comment below!

👍 Smash that like🚀🚀🚀 if you found this map helpful, and hit follow for more GoldFxMinds sniper blueprints.

Disclosure: Analysis based on Trade Nation’s TradingView feed. I’m part of their Influencer Program.

GoldFxMinds 💛

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.