The decision by President Trump to give Putin an additional two weeks to agree to meet and negotiate with Zelensky is seen as a positive signal, aimed at pressuring Putin to advance peace talks and end the Russia-Ukraine war. However, some investors argue that, despite the constructive nature of this deadline, it also carries the risk of escalating the conflict, as Putin might use the two-week period to intensify attacks and seize more Ukrainian territory before being forced to the negotiating table. Additionally, the unexpectedly dovish remarks by Federal Reserve Chairman Jerome Powell at the Jackson Hole Symposium have significantly increased the odds of an interest rate cut in September, while raising the projected number of rate cuts this year from 2 to 3.

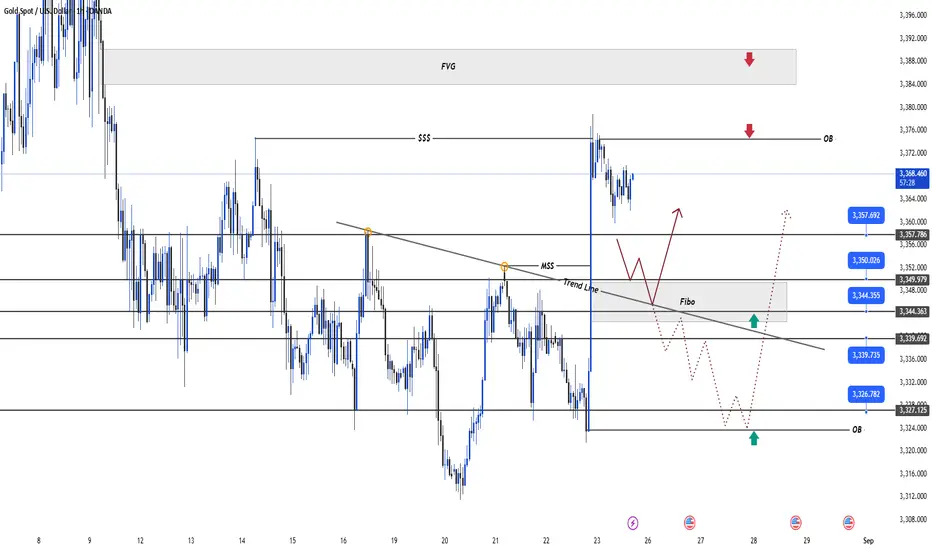

The strong upward movement in gold following the Jackson Hole Symposium reflects a positive reaction to Powell's dovish stance, boosting expectations of an interest rate cut. However, this rally concluded with a candle closing below the 337x price level, indicating a liquidity sweep designed to eliminate weak buy orders before a market correction. The current trading strategy should focus on a SELL scalp targeting a drop to the 335x support levels, where excess liquidity might absorb selling pressure. Simultaneously, monitor Fibonacci (FIBO) levels and Fair Value Gap (FVG) zones for BUY opportunities when the price reacts at these areas, especially if reversal signals like Order Block (OB) or favorable market structure emerge. Notably, the OB 333x level, a critical support zone, should not be overlooked, as it could serve as a profit-taking point or a long-term buying opportunity if the price continues to decline further. Exercise caution by tracking price structures and economic news to confirm entry signals.

Key Price Levels to Watch

Resistance: - 3374 - 3386 - 3398

Support- 3357- 3350 - 3344 - 3339 - 3326

Trading Strategies

SELL Scalp : 3373 - 3375

- Stop Loss (SL): 3380

- Take Profit (TP): 3367 - 3359 - 3349

SELL Zone : 3385 - 3387

- Stop Loss (SL) : 3392

- Take Profit (TP) : 3380 - 3369 - 3358 - 3349 - 3339

BUY Scalp

- Entry Zone : 3347 - 3345

- Stop Loss (SL) : 3342

- Take Profit (TP) : 3350 - 3357 - 3362

BUY Zone

- Entry Zone : 3328 - 3326

- Stop Loss (SL): 3320

- Take Profit (TP): 3339 - 3349 - 3357 - 3373

The strong upward movement in gold following the Jackson Hole Symposium reflects a positive reaction to Powell's dovish stance, boosting expectations of an interest rate cut. However, this rally concluded with a candle closing below the 337x price level, indicating a liquidity sweep designed to eliminate weak buy orders before a market correction. The current trading strategy should focus on a SELL scalp targeting a drop to the 335x support levels, where excess liquidity might absorb selling pressure. Simultaneously, monitor Fibonacci (FIBO) levels and Fair Value Gap (FVG) zones for BUY opportunities when the price reacts at these areas, especially if reversal signals like Order Block (OB) or favorable market structure emerge. Notably, the OB 333x level, a critical support zone, should not be overlooked, as it could serve as a profit-taking point or a long-term buying opportunity if the price continues to decline further. Exercise caution by tracking price structures and economic news to confirm entry signals.

Key Price Levels to Watch

Resistance: - 3374 - 3386 - 3398

Support- 3357- 3350 - 3344 - 3339 - 3326

Trading Strategies

SELL Scalp : 3373 - 3375

- Stop Loss (SL): 3380

- Take Profit (TP): 3367 - 3359 - 3349

SELL Zone : 3385 - 3387

- Stop Loss (SL) : 3392

- Take Profit (TP) : 3380 - 3369 - 3358 - 3349 - 3339

BUY Scalp

- Entry Zone : 3347 - 3345

- Stop Loss (SL) : 3342

- Take Profit (TP) : 3350 - 3357 - 3362

BUY Zone

- Entry Zone : 3328 - 3326

- Stop Loss (SL): 3320

- Take Profit (TP): 3339 - 3349 - 3357 - 3373

🔥 Ready to Elevate Your Trading Game?

t.me/+1aSqbdspbEdkYjU9

✅ Dive into in-depth technical & fundamental analysis

✅ Master risk management tips to safeguard your capital

📩 Join our TradingView community now!

t.me/+1aSqbdspbEdkYjU9

t.me/+1aSqbdspbEdkYjU9

✅ Dive into in-depth technical & fundamental analysis

✅ Master risk management tips to safeguard your capital

📩 Join our TradingView community now!

t.me/+1aSqbdspbEdkYjU9

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔥 Ready to Elevate Your Trading Game?

t.me/+1aSqbdspbEdkYjU9

✅ Dive into in-depth technical & fundamental analysis

✅ Master risk management tips to safeguard your capital

📩 Join our TradingView community now!

t.me/+1aSqbdspbEdkYjU9

t.me/+1aSqbdspbEdkYjU9

✅ Dive into in-depth technical & fundamental analysis

✅ Master risk management tips to safeguard your capital

📩 Join our TradingView community now!

t.me/+1aSqbdspbEdkYjU9

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.