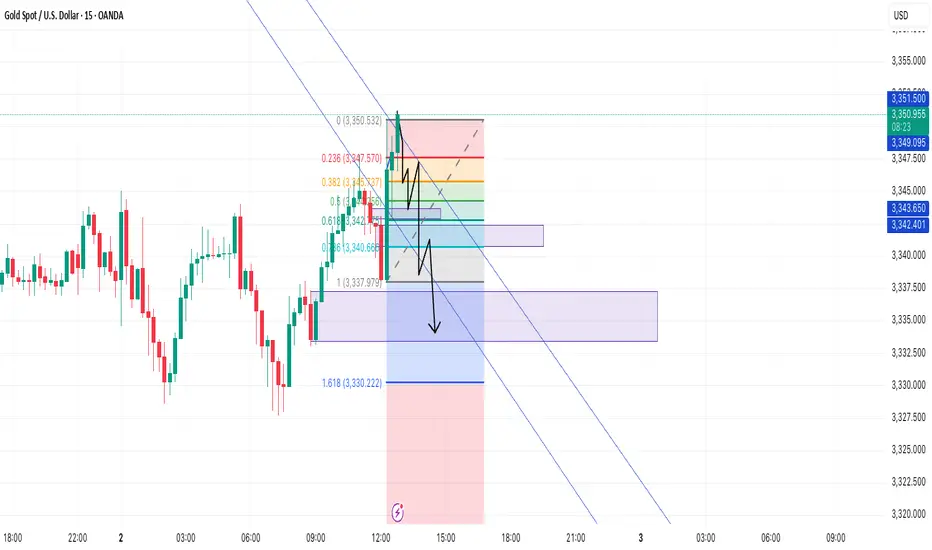

XAU/USD M5 – Bearish Fib Retracement & Downtrend Continuation Setup

Gold is currently testing the Fibonacci 0.236–0.382 retracement zone after a clean bearish leg, aligning with the descending channel structure. Price is now forming a possible lower high, hinting at a potential continuation of the intraday downtrend.

🔍 Key Technical Highlights:

Bearish Market Structure: Price remains inside a well-respected descending channel, respecting both lower highs and lower lows.

Fibonacci Confluence: Retracement into the 0.236–0.382 zone (around $3,345 – $3,347) may act as a resistance.

Rejection Expected: Small distribution forming near $3,347 inside the channel resistance.

Downside Targets:

1.0 extension: ~$3,338

1.618 extension: ~$3,330

Extended target: Lower channel boundary

📊 Trade Setup:

Bias: Short (scalp/intraday)

Sell Area: $3,345 – $3,347 (Fibonacci + structure confluence)

Stop Loss: Above $3,350

Target: $3,330

Risk:Reward: ~1:3 (depending on entry)

🧠 Tactical Note:

Watch for a break and retest below $3,343–3,342 demand zone (purple box) to confirm continuation. A breakout from the descending channel would invalidate this scenario.

Gold is currently testing the Fibonacci 0.236–0.382 retracement zone after a clean bearish leg, aligning with the descending channel structure. Price is now forming a possible lower high, hinting at a potential continuation of the intraday downtrend.

🔍 Key Technical Highlights:

Bearish Market Structure: Price remains inside a well-respected descending channel, respecting both lower highs and lower lows.

Fibonacci Confluence: Retracement into the 0.236–0.382 zone (around $3,345 – $3,347) may act as a resistance.

Rejection Expected: Small distribution forming near $3,347 inside the channel resistance.

Downside Targets:

1.0 extension: ~$3,338

1.618 extension: ~$3,330

Extended target: Lower channel boundary

📊 Trade Setup:

Bias: Short (scalp/intraday)

Sell Area: $3,345 – $3,347 (Fibonacci + structure confluence)

Stop Loss: Above $3,350

Target: $3,330

Risk:Reward: ~1:3 (depending on entry)

🧠 Tactical Note:

Watch for a break and retest below $3,343–3,342 demand zone (purple box) to confirm continuation. A breakout from the descending channel would invalidate this scenario.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.