Gold is at a decisive point: will the market continue its bullish run, or is it setting up a deeper correction? Using Smart Money Concepts (SMC) and Elliott Wave Theory, we can map out clear scenarios without falling into FOMO traps.

🔎 Market Structure (SMC + Elliott)

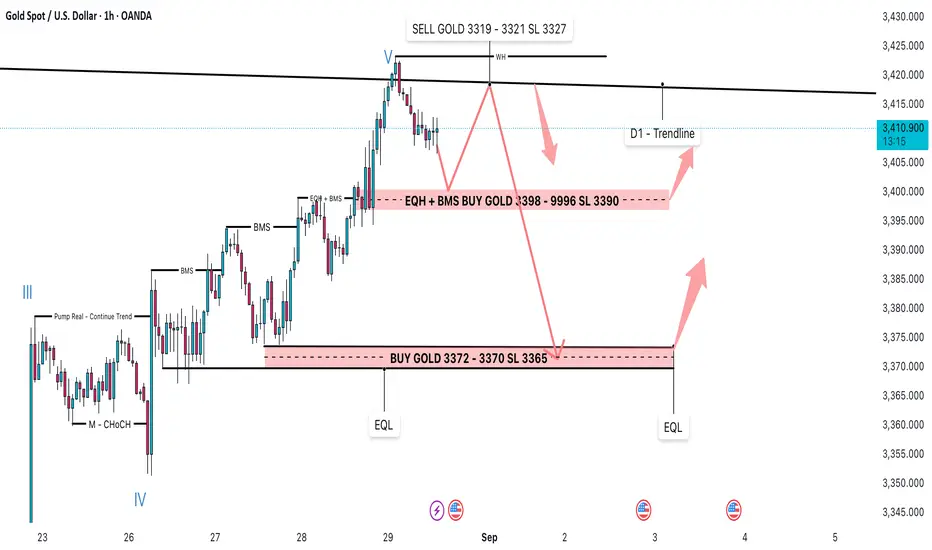

Elliott Wave: The structure has completed waves III – IV – V, with wave V tapping into the higher trendline (D1). This suggests a potential exhaustion phase.

SMC:

Multiple BMS (Break of Market Structure) signals → liquidity manipulation by institutions.

EQH (Equal Highs) and EQL (Equal Lows) → liquidity pools ready to be swept.

Key Demand Zones identified:

3398 – 3396 (EQH + BMS support)

3372 – 3370 (deep liquidity sweep / EQL)

The D1 trendline remains the main dynamic resistance.

📌 Trading Plan

Scenario 1 – Short-term Sell (Counter-trend):

Sell Zone: 3319 – 3321

Stop Loss: 3327

Target: Demand Zone 3398 – 3396

Scenario 2 – Buy at Demand Zone 1 (Main Setup):

Buy Zone: 3398 – 3396

Stop Loss: 3390

Target: 3410 – 3415 (D1 trendline retest)

Scenario 3 – Buy at Demand Zone 2 (Deeper Sweep):

Buy Zone: 3372 – 3370

Stop Loss: 3365

Target: 3400 – 3410

✅ Best Risk-Reward setup, aligned with liquidity grab + Elliott retracement.

✅ Conclusion

The bigger picture still supports a bullish bias, but liquidity sweeps may occur before continuation.

Avoid chasing the market. Wait for confirmation at demand zones for optimal entries.

Main focus: Buy from 3398–3396 or 3372–3370, instead of entering impulsively at highs.

🔎 Market Structure (SMC + Elliott)

Elliott Wave: The structure has completed waves III – IV – V, with wave V tapping into the higher trendline (D1). This suggests a potential exhaustion phase.

SMC:

Multiple BMS (Break of Market Structure) signals → liquidity manipulation by institutions.

EQH (Equal Highs) and EQL (Equal Lows) → liquidity pools ready to be swept.

Key Demand Zones identified:

3398 – 3396 (EQH + BMS support)

3372 – 3370 (deep liquidity sweep / EQL)

The D1 trendline remains the main dynamic resistance.

📌 Trading Plan

Scenario 1 – Short-term Sell (Counter-trend):

Sell Zone: 3319 – 3321

Stop Loss: 3327

Target: Demand Zone 3398 – 3396

Scenario 2 – Buy at Demand Zone 1 (Main Setup):

Buy Zone: 3398 – 3396

Stop Loss: 3390

Target: 3410 – 3415 (D1 trendline retest)

Scenario 3 – Buy at Demand Zone 2 (Deeper Sweep):

Buy Zone: 3372 – 3370

Stop Loss: 3365

Target: 3400 – 3410

✅ Best Risk-Reward setup, aligned with liquidity grab + Elliott retracement.

✅ Conclusion

The bigger picture still supports a bullish bias, but liquidity sweeps may occur before continuation.

Avoid chasing the market. Wait for confirmation at demand zones for optimal entries.

Main focus: Buy from 3398–3396 or 3372–3370, instead of entering impulsively at highs.

Real-Time Update + Signals: t.me/+EJlT6QpqU6Q3MGVl

💋 3 - 6 OneShotOneKill (Daily Trading Signals) Daily

💋 Real - Time Plan Update

💋10 - 15 Scalping Signals Daily

💋 Proceed Position and Plan

💋 3 - 6 OneShotOneKill (Daily Trading Signals) Daily

💋 Real - Time Plan Update

💋10 - 15 Scalping Signals Daily

💋 Proceed Position and Plan

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Real-Time Update + Signals: t.me/+EJlT6QpqU6Q3MGVl

💋 3 - 6 OneShotOneKill (Daily Trading Signals) Daily

💋 Real - Time Plan Update

💋10 - 15 Scalping Signals Daily

💋 Proceed Position and Plan

💋 3 - 6 OneShotOneKill (Daily Trading Signals) Daily

💋 Real - Time Plan Update

💋10 - 15 Scalping Signals Daily

💋 Proceed Position and Plan

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.