I. Current Gold Market Overview

Fundamental Factors

Safe-haven demand: Global trade tensions (such as Trump's tariff policy) and expectations of a September Fed rate cut continue to support gold prices.

Impact of the US dollar's trend: If the US dollar weakens due to weak economic data (such as the job market), gold prices may rise further; conversely, if the US dollar rebounds, gold prices may come under pressure.

Central Bank Gold Purchases: China continues to increase its gold reserves, which is positive for gold prices in the long term.

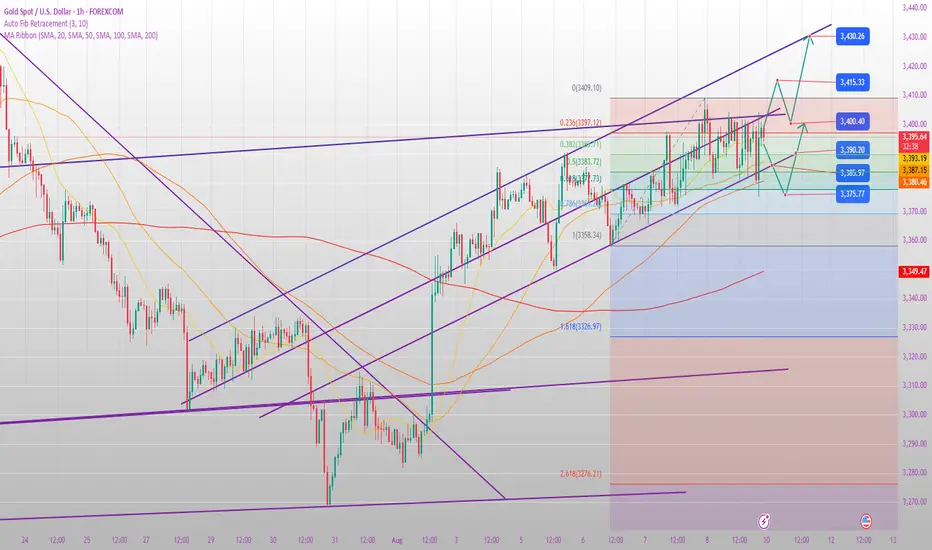

Key Technical Levels

Support: 3380 (4-hour Bollinger Band middle), 3364 (daily key support), 3350 (20-day moving average).

Resistance: 3409 (this week's high), 3415 (previous high), 3430-3450 (historical resistance zone).

II. Technical Analysis of Gold Trends

Daily Chart

Trend: The overall trend remains bullish, with the price stabilizing above the 20-day moving average (above 3350). The MACD forms a golden cross with high volume, but the RSI is approaching overbought territory, prompting caution against a pullback.

Key Observation: If the price closes above 3400, it could test 3430-3450. If it falls below 3380, it could retest the support levels of 3360-3350.

4-Hour Chart

Short-Term Momentum: The Bollinger Bands are opening upward, the price is moving along the upper band, and the MACD forms a second golden cross. However, the KDJ indicator is overbought and blunt, prompting concern about the effectiveness of the 3380 support level.

Key Breakout Directions:

Break above 3410 → target 3430-3450.

Break below 3380 → target 3360-3350.

1-Hour Chart

Swing Range: 3380-3410. If the US market breaks in this direction, trade accordingly.

III. Trading Strategy for August 11th

1. Main Trading Strategy: Buy on Pullbacks (Primarily Buy on Dips)

Entry Point: 3380-3370 (Buy after support stabilizes).

Stop Loss: Below 3360.

Target: 3400-3410 (Target 3430 after a breakout).

2. Short on Rebound Highs: Auxiliary Trading Strategy: Short on Rebound Highs

Entry Point: 3410-3415 (If a breakout fails).

Stop Loss: Above 3420.

Target: 3380-3360.

3. Breakout Strategy

Break above 3415 → Follow up with long orders on a pullback to 3400, target 3430-3450.

Break below 3360 → Short on a rebound to 3370, target 3350-3330.

IV. Risk Warning

Economic Data: This week's US inflation data and speeches by Federal Reserve officials may impact gold prices.

Geopolitical Risks: The US-Russia meeting and escalating trade wars could trigger market volatility.

Adhere to a strict stop-loss order: The current market is volatile and strong, but overbought signals exist, so be wary of a sudden pullback.

Conclusion: Gold remains bullish in the short term, but caution is advised against pullbacks from high levels. We recommend trading primarily in the 3380-3410 range, with a follow-up move after a breakout.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.