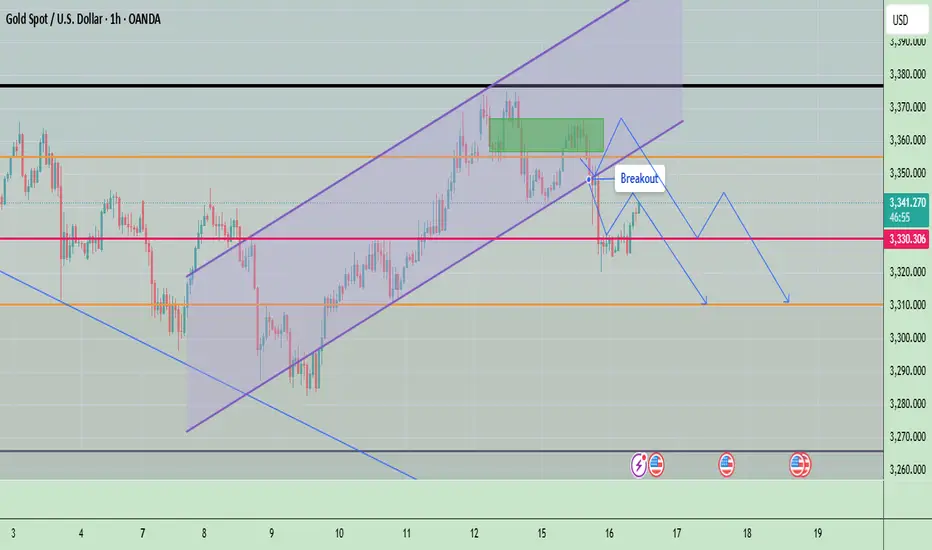

Gold is currently trading near $3,338, continuing to show signs of rejection after testing the key $3,365–$3,392 resistance zone. The market has reacted to the July 15 U.S. CPI release, and despite initial volatility, gold failed to break above its major diagonal trendline, forming a lower high, a strong technical sign of weakening bullish momentum.

If price breaks below $3,330, it could trigger a wave of selling pressure down to $3,303 and $3,248 in the coming days. Traders should monitor price behavior around these zones for short-term entry opportunities.

📌 Technical Breakdown

Resistance Zone:

- $3,365–$3,392 remains the critical ceiling where gold got rejected for the third time in recent sessions.

- This zone aligns with the top of the descending wedge, long-term black trendline.

Bearish Structure Forming:

- After multiple attempts, gold could not sustain above the resistance.

- A series of lower highs and a weakening bullish push suggest a bearish continuation is likely.

Support Levels to Watch:

- Immediate: $3,337

- Mid: $3,320

- Strong: $3,303 (0.382 Fib) and $3,293

- Final Target: $3,248 → $3,220 → $3,193

🔺 Bullish Invalidation Scenario

If gold manages a clean breakout and close above $3,392, this bearish setup will be invalidated. In that case, upside targets would include:

- $3,412

- $3,434

- $3,490 (macro trendline)

But at the moment, that seems unlikely unless driven by unexpected fundamentals.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

If price breaks below $3,330, it could trigger a wave of selling pressure down to $3,303 and $3,248 in the coming days. Traders should monitor price behavior around these zones for short-term entry opportunities.

📌 Technical Breakdown

Resistance Zone:

- $3,365–$3,392 remains the critical ceiling where gold got rejected for the third time in recent sessions.

- This zone aligns with the top of the descending wedge, long-term black trendline.

Bearish Structure Forming:

- After multiple attempts, gold could not sustain above the resistance.

- A series of lower highs and a weakening bullish push suggest a bearish continuation is likely.

Support Levels to Watch:

- Immediate: $3,337

- Mid: $3,320

- Strong: $3,303 (0.382 Fib) and $3,293

- Final Target: $3,248 → $3,220 → $3,193

🔺 Bullish Invalidation Scenario

If gold manages a clean breakout and close above $3,392, this bearish setup will be invalidated. In that case, upside targets would include:

- $3,412

- $3,434

- $3,490 (macro trendline)

But at the moment, that seems unlikely unless driven by unexpected fundamentals.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

Trade closed: target reached

First target achieved successfullyDisclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.