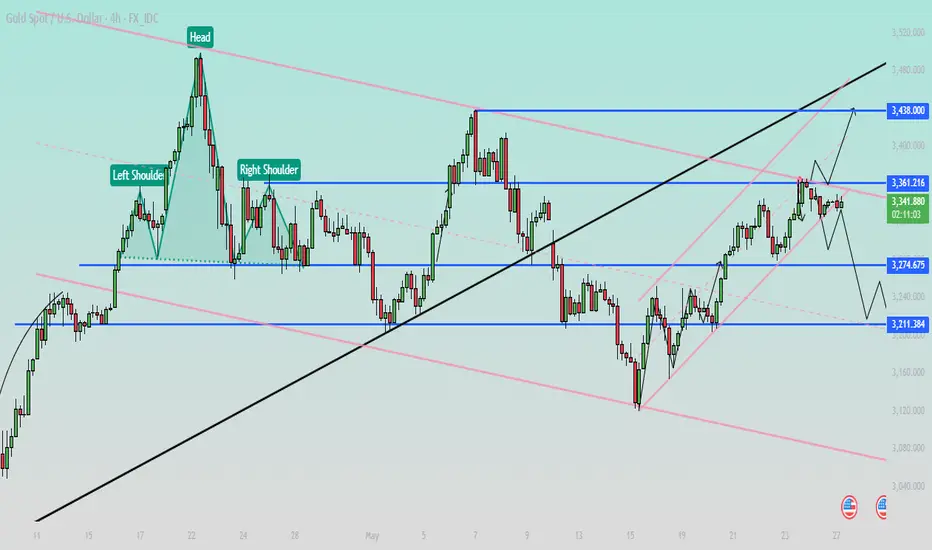

Yesterday, gold fluctuated slightly, and the daily line closed with a lower shadow hammer pattern, showing a downward recovery trend, with short-term bulls in the lead. Today, focus on the breakthrough of the upper pressure. If it breaks through the 3356-57 area, it may further test 3365 or even 3380-3415; on the contrary, if it rises and falls in the Asian session, it is necessary to pay attention to the support performance below.

Technical analysis

Daily level

K-line pattern: small hammer line, showing strong buying support below.

Indicator: MACD golden cross is initially established, STO overbought zone adhesion, indicating that bullish volatility continues.

Key support: middle rail and moving average support 3303-3289, short-term MA5 support 3329.

4-hour level

MACD dead cross opens, STO repairs downward, and there is a need for a short-term decline.

Key support: middle rail and MA30 (3329-3318), lower rail and MA60 (3288-3265).

Pressure: 3356-3365, breaking through will open upside space.

Hourly level

MACD crosses near the zero axis, STO moves downward rapidly, short-term weakness.

Support focus on 3328-29, break down to 3320; pressure focus on 3342-50.

Operation strategy

Radicals go short at 3342-44, stop loss at 3354, target at 3331-3322, break to 3310-3290.

Breakout and follow long

If it stands above 3357, go long near 3350, stop loss at 3340, target at 3365-3380.

Support level long position

3323-20 stabilizes short-term long (quick in and out), and wait and see if it falls below 3320.

Summary

Gold will maintain strong volatility in the short term. Pay attention to the possibility of a high and fall in the Asian session, and focus on the breakthrough direction in the European and American sessions. 3356-65 above is the key watershed for bulls, and 3320-30 below is the intraday strength and weakness boundary. In terms of operation, sell high and buy low at key positions, and follow up after the break.

Trade active

Short-term trend analysis:Shock range: 3320-3365, key dividing point 3320 (weakened if broken).

Support level: 3328-29 (intraday strength and weakness observation point), 3289-86 (accelerated downward if broken).

Resistance level: 3356, 3365 (upward space will be opened if broken).

Operation strategy:

High-altitude: short-term short-term pressure below 3323, stop loss above 3329, target 3289.

Aggressive attempt: try to go long with a light position near 3288 (strict stop loss at 3275).

U.S. market continuation: If it falls below 3286, short orders can be placed to expand the decline.

Key tips: 3320 is the intraday long-short watershed, and it is necessary to adjust the thinking to break through 3365.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.