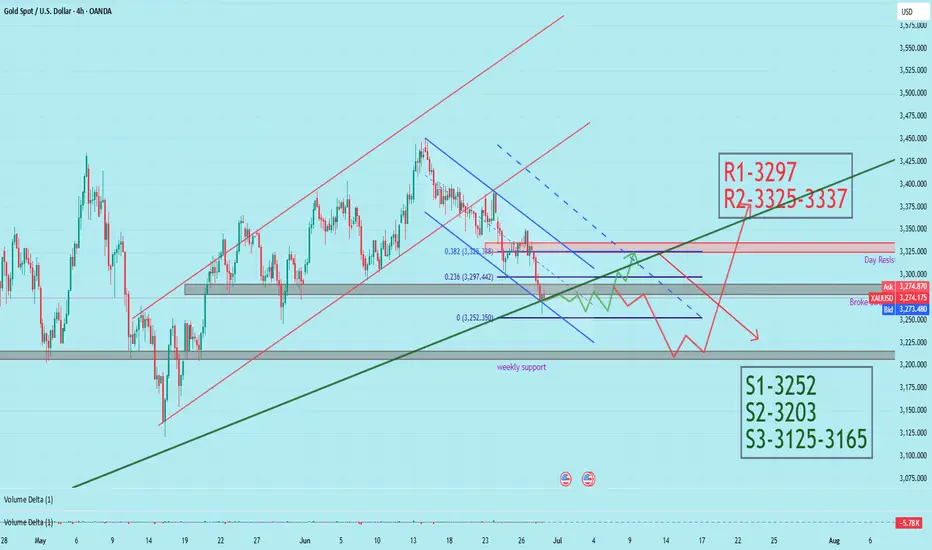

Gold is will consolidating below broken trendline resistance and trading inside a short-term bearish channel. A critical support zone lies ahead, while bulls may try to reclaim lost ground. Here's the structured outlook:

Key Levels:

🔺 Resistance:

R1: 3297 – 23.6% Fib level + Trendline confluence zone

R2: 3325 – 3337 – Strong structural zone + previous highs

🔻 Support:

S1: 3252 – Recent swing low (Fib 0%)

S2: 3203 – Psychological and structural level

S3: 3125 – 3165 – Weekly support area

🧠 Bias Scenarios:

✅ Bullish Scenario:

If bulls reclaim above 3297 (R1) and sustain:

Potential push toward R2: 3325–3337.

Watch for bullish breakout from the falling channel.

Targets will expand if price holds above the green long-term trendline.

❌ Bearish Scenario:

If gold fails to break and hold above the green trendline and 3297, expect:

Continuation inside the falling channel.

Bearish push toward S1: 3252, and if broken, slide toward S2: 3203 and even S3: 3125–3165.

Technical Signals:

Price respecting Fibonacci retracement zones.

Bearish channel still intact, awaiting breakout confirmation.

Volume shows bearish pressure near resistance zones.

Weekly support could act as a demand base if market sentiment shifts.

Summary for Next Week:

⚠️ Watch how price reacts around 3297 and the trendline.

Rejection will likely open the path to lower supports.

A breakout above resistance with volume can switch momentum bullish again.

Note: Stay cautious with macroeconomic events or USD strength-related catalysts.

Key Levels:

🔺 Resistance:

R1: 3297 – 23.6% Fib level + Trendline confluence zone

R2: 3325 – 3337 – Strong structural zone + previous highs

🔻 Support:

S1: 3252 – Recent swing low (Fib 0%)

S2: 3203 – Psychological and structural level

S3: 3125 – 3165 – Weekly support area

🧠 Bias Scenarios:

✅ Bullish Scenario:

If bulls reclaim above 3297 (R1) and sustain:

Potential push toward R2: 3325–3337.

Watch for bullish breakout from the falling channel.

Targets will expand if price holds above the green long-term trendline.

❌ Bearish Scenario:

If gold fails to break and hold above the green trendline and 3297, expect:

Continuation inside the falling channel.

Bearish push toward S1: 3252, and if broken, slide toward S2: 3203 and even S3: 3125–3165.

Technical Signals:

Price respecting Fibonacci retracement zones.

Bearish channel still intact, awaiting breakout confirmation.

Volume shows bearish pressure near resistance zones.

Weekly support could act as a demand base if market sentiment shifts.

Summary for Next Week:

⚠️ Watch how price reacts around 3297 and the trendline.

Rejection will likely open the path to lower supports.

A breakout above resistance with volume can switch momentum bullish again.

Note: Stay cautious with macroeconomic events or USD strength-related catalysts.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.