Core logic sorting

Influence of news:

The conclusion of the trade agreement between Europe and the United States weakens the demand for safe-haven, but the support for buying on dips is obvious.

Multiple risk events this week (Fed resolution, non-agricultural data, PCE inflation, etc.) may trigger fluctuations.

Key technical positions:

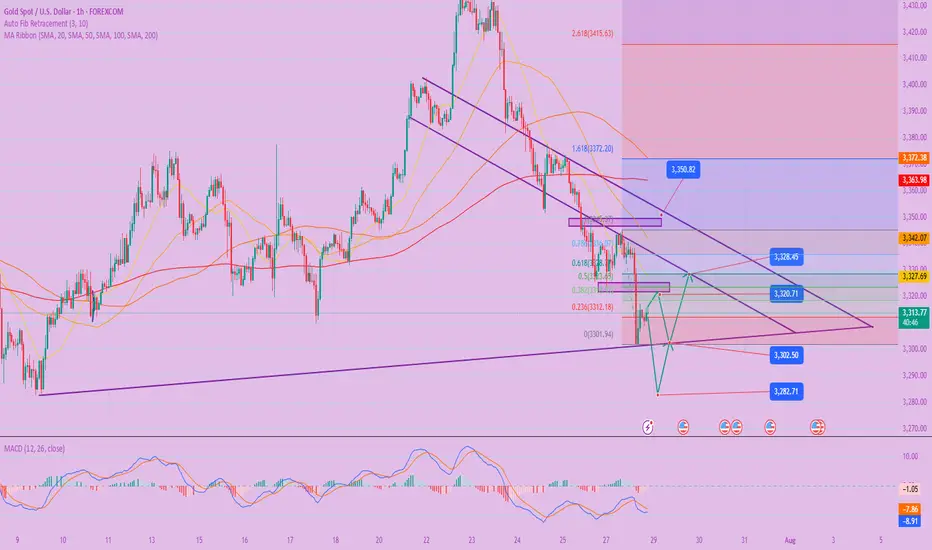

Weekly level: 3355 is the watershed between strength and weakness, and the breakthrough will look at 3380-3430; 3285 below is the key support.

Daily line: Bollinger bands have not opened, and the range oscillates (3285-3400) waiting for data to guide the direction.

4 hours: The Asian morning session on Monday bottomed out and rebounded, waiting for confirmation of the short-term bottom, breaking the 3300 low or going down to 3285.

Specific operation strategy

Intraday short-term

Bull opportunity

Entry: 3300-3302 light long order (defense below 3294).

Target: 3320-3330 (first pressure), break through 3345 and hold to see 3355.

Logic: 4-hour potential double bottom pattern, 3285 is a strong support for the daily line.

Short opportunity

Entry: 3334-3336 short (stop loss above 3342).

Target: 3320-3315 (quick profit stop).

Logic: The market came under pressure after the gap was filled in the early trading session, and it will still be weak and volatile before 3355 is broken.

Medium cycle focus

Break above 3355: chase long and look to 3380-3400, stop loss 3330.

Break below 3294: Watch the support of 3285, and turn long if it stabilizes. If it breaks, turn short and look at 3250.

Risk warning

Be cautious in holding positions before data: After Wednesday, the Fed’s decision and non-agricultural data may subvert the technical pattern. It is recommended to reduce positions or exit before the data.

False breakthrough risk: If the Asian and European sessions rise and fall quickly, be alert to the signal of inducing longs near 3355.

Liquidity gap: After the gap (3320-3335) opened low on Monday is filled, we need to observe the sustained momentum.

Key time nodes

Monday to Tuesday: Technical aspects dominate, pay attention to the breakthrough of the 3300-3350 range.

After Wednesday: Data drives the market, be wary of unilateral volatility amplification, and follow the trend.

Trade active

Latest Gold Trend Analysis and Trading Strategies:

Analysis of Core Influencing Factors

Negative Factors

A stronger US dollar: A rebound in the US dollar index is suppressing gold, as gold and the US dollar are typically negatively correlated.

Recovering risk appetite: The US-EU trade agreement and a rebound in global stock markets are weakening safe-haven demand for gold.

Rising real interest rates: If the Federal Reserve fails to send dovish signals, rising real interest rates will increase the cost of holding gold.

Potential Bullish Support

Geopolitical Risks: Uncertainty surrounding US-China trade negotiations, the Middle East, and US-Russia relations could trigger safe-haven buying.

Federal Reserve Policy Expectations: If Wednesday's FOMC statement is dovish (e.g., hinting at a rate cut or economic concerns), gold could receive a boost.

Key Technical Levels

Support:

Short-term: 3310-3300 (psychological barrier, near yesterday's low of 3301).

Strong Support: 3285 (If it falls below 3300, watch for signs of a breakout at this level).

Resistance:

Short-term: 3340-3345 (yesterday's rebound high, capped by the 4-hour moving average). Breakout Target: 3350-3360 (possible test after stabilizing at 3340).

Today's Trading Strategy

Short-Term Bullish Opportunity

Entry Conditions: Stabilization in the 3310-3300 area during the Asian and European sessions, or a breakout above 3330 followed by a pullback for confirmation.

Target: 3340-3345 (partial reduction of positions may be recommended upon first reaching this level); if it breaks through, target 3350-3360.

Stop Loss: Below 3295 (to prevent a rapid decline after a false break below 3300).

High-Side Support Strategy

Entry Conditions: A rebound to 3345-3350, where pressure builds, and signs of stagflation (such as a long upper shadow) appear.

Target: 3320-3310.

Stop Loss: Above 3355.

Key Risk Warnings

Data Impact: Stronger-than-expected US consumer confidence and JOLTs job openings data could strengthen the US dollar and weigh on gold. Fed Expectations: Avoid heavy bets ahead of the FOMC meeting and be wary of sharp fluctuations triggered by policy announcements.

Medium- to Long-Term Perspective

The overall trend remains bullish: If the market pulls back to around 3285 or the Fed sends dovish signals, consider establishing medium- to long-term long positions, targeting above 3400.

Breakdown Warning: If 3285 falls and the dollar continues to strengthen, be wary of a deeper pullback to 3250.

Summary: The market is expected to fluctuate between 3310 and 3345 during the day. Investors should maintain strict stop-loss orders when buying on dips, and enter and exit the market quickly when selling on highs. Focus on US market data and Fed policy expectations. Market volatility may increase in the second half of the week, so a light position is recommended.

Trade closed: target reached

Key Gold Positioning Strategies Before the Fed Decision:

Core Logic Triple Verified

Federal Divergence

Dovish Camp Expands: Bowman and Waller Clearly Support Rate Cuts; New Board Members Strengthen Expectations of a September Rate Cut

Powell Walks a Tightrope: Balancing "Stabilizing Employment" and "Inflation Risks"; Be Wary of His Use of "Learning Periods" Vague terms such as "Period" are used.

Key USD threshold: 104.5 is the dividing line between strength and weakness. A break above 105.2 or below 103.8 after the decision will determine gold's direction.

Technical bull/bear critical points.

Descending wedge breakout: 4-hour chart breaks through the 3325 resistance level, with moderate volume growth but no significant increase (validity needs to be confirmed).

Golden Ratio: 3301-3345 range, with 3338 (61.8%) as the bullish watershed.

CME open interest fluctuations: Open interest below 3300 surges by 20%, indicating strong institutional interest in bottoming out.

Market Sentiment Pendulum.

VIX-gold correlation: Recent divergence is significant, suggesting that safe-haven demand is not fully priced in.

Retail long-short ratio: 1:1.7 indicates excessive pessimism, while contrarian indicators suggest rebound potential.

▶ Pre-Federal Reserve Strategy

Bull Assault Route

Go long with a light position on a pullback to 3318-3315, stop loss at 3308, target 3338-3345

Buy on a breakout above 3345, add to your position on a pullback to 3338, stop loss at 3325, target 3370

Bear Defensive Position

Place short orders at 3338-3340, stop loss at 3347, target 3320 (quick in and out)

Unexpected break below 3308: Go short on a pullback to 3312, stop loss at 3320, target 3285

Nuclear Button Response

Dovish Surprise (direct hint of a September rate cut): Buy on a pullback to 3335 after a break below 3350, stop loss at 3320

Hawkish Impact (negating a rate cut this year): Go short on a pullback to 3310 after a break below 3300, stop loss at 3325

Key Technical Level Update

15-Minute Support Level: 3315 Resistance Level: 3330 Key Features: Lower Rising Channel

Hourly Chart Support level: 3300; Resistance level: 3345. Key characteristic: Head-and-shoulders bottom neckline.

Daily chart: Support level: 3285; Resistance level: 3370. Key characteristic: 200-day moving average pressure.

Professional Advice:

Conservatives: Close all long positions at 3315 at 3330, and follow up if the price breaks through 3345.

Algorithmic Trading: Set up grid trading between 3315 and 3345, with a 0.5% risk per trade.

Institutional Thinking: Strategize medium-term long positions between 3300 and 3285, with a stop loss at 3250 and a target at 3420.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.