Foreword of capital exchange: If a person does not have a goal and belief, even if there are many people to guide you, it is futile. Ask yourself what is the purpose of this investment? Have you achieved it? How far is it still? What conditions are needed to achieve your goal as soon as possible. I am very happy that you can come to understand. I am willing to help those who believe in me. Trust is like throwing a child into the sky. She can still smile because she believes that you can catch it. Trust is also the origin of all cooperation. If you cooperate with a skeptical attitude, then such cooperation will not last long. Profit is definitely not a win or loss in one order, and making money is definitely not a one-time game. When you are willing to let go of the past thinking. Even if you close your eyes, I will never let you get lost!

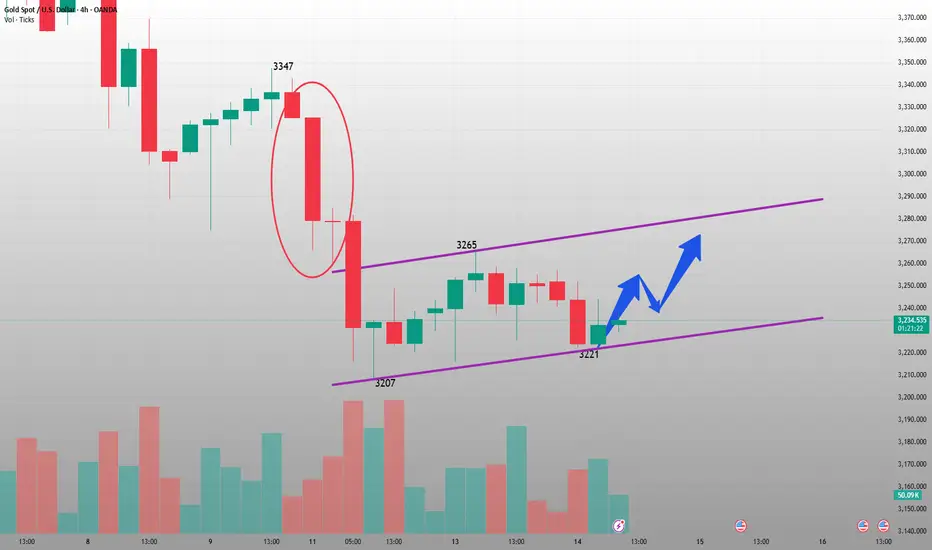

At present, the gold price is in a state of technical and fundamental game. On the one hand, the Fed's expectations of rate cuts this year and the weakness of the US dollar provide support; on the other hand, trade optimism and rising market risk appetite suppress safe-haven demand.Looking ahead, gold prices are likely to resume their corrective decline as the U.S. dollar stabilizes after the previous sell-off.Technical analysis of gold: In recent trading days, gold has experienced a rapid decline in the early trading, and then stabilized and rebounded. The European trading session fluctuated, and the US trading session rebounded after a high rise. Today's early trading was under pressure, and the high point of yesterday's US trading in the 3258-60 area has already experienced a rapid decline. It depends on whether it can stabilize and rebound next. Overall, continue to pay attention to the medium-term support of the 3202-07 mark. Before breaking down, once the bulls stabilize, they will fill the gap of Monday's gap in the 3320-25 area; if it breaks down, it will open up the downward space, further 3160-3120, and then gradually fall to 3060 and the 3000 mark, the starting point of this round of bullish rise. The M top or W bottom we emphasized is still waiting for the market to choose!

Today's short-term gold operation ideas suggest that callbacks should be the main focus, and rebound shorts should be supplemented. The top short-term focus is on the first-line resistance of 3257-3265, and the bottom short-term focus is on the first-line support of 3215-3220. All friends must keep up with the rhythm.

Short position strategy:

Strategy 1: Short 20% of the gold position in batches near 3255-3260, stop loss 10 points, target near 3240-3230, break to see 3220 line;

Long position strategy:

Strategy 2: Buy 20% of the gold position in batches near 3220-3222, stop loss 10 points, target near 3240-3250, break to see 3270 line;

At present, the gold price is in a state of technical and fundamental game. On the one hand, the Fed's expectations of rate cuts this year and the weakness of the US dollar provide support; on the other hand, trade optimism and rising market risk appetite suppress safe-haven demand.Looking ahead, gold prices are likely to resume their corrective decline as the U.S. dollar stabilizes after the previous sell-off.Technical analysis of gold: In recent trading days, gold has experienced a rapid decline in the early trading, and then stabilized and rebounded. The European trading session fluctuated, and the US trading session rebounded after a high rise. Today's early trading was under pressure, and the high point of yesterday's US trading in the 3258-60 area has already experienced a rapid decline. It depends on whether it can stabilize and rebound next. Overall, continue to pay attention to the medium-term support of the 3202-07 mark. Before breaking down, once the bulls stabilize, they will fill the gap of Monday's gap in the 3320-25 area; if it breaks down, it will open up the downward space, further 3160-3120, and then gradually fall to 3060 and the 3000 mark, the starting point of this round of bullish rise. The M top or W bottom we emphasized is still waiting for the market to choose!

Today's short-term gold operation ideas suggest that callbacks should be the main focus, and rebound shorts should be supplemented. The top short-term focus is on the first-line resistance of 3257-3265, and the bottom short-term focus is on the first-line support of 3215-3220. All friends must keep up with the rhythm.

Short position strategy:

Strategy 1: Short 20% of the gold position in batches near 3255-3260, stop loss 10 points, target near 3240-3230, break to see 3220 line;

Long position strategy:

Strategy 2: Buy 20% of the gold position in batches near 3220-3222, stop loss 10 points, target near 3240-3250, break to see 3270 line;

Trade active

Gold can continue to be sold at present. The decline in gold prices will continue. Continue to sell gold at the current price, with the target at 3130.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.