The Fed and Interest Rates

The Federal Reserve kept interest rates unchanged for a fifth straight meeting on Wednesday, defying persistent pressure from President Donald Trump and White House officials.

However, two members of the central bank's board dissented, a rare move in three decades that underscored growing divisions within the central bank over the impact of Trump's tariff policies.

At the meeting, the Fed kept its benchmark federal funds rate in a range of 4.25% to 4.5%, in line with policy through 2025. Last fall, the Fed cut rates by a total of 100 basis points.

However, Federal Reserve Board Governors Christopher Waller and Michelle Bowman opposed cutting interest rates by another 25 basis points, marking the first time since Alan Greenspan in 1993 that two board members have opposed a majority resolution at a meeting.

At the press conference, Chairman Jerome Powell did not signal a rate cut at the next interest rate meeting on September 16-17, saying only that “no decision has been made about September” and that “more data will be evaluated in the coming months.” Powell also noted that despite Trump’s call for a sharp 3% rate cut to reduce interest costs on US debt and stimulate the housing market, the Fed will continue to monitor the longer-term impact of tariffs on the path of inflation and economic recovery.

Market expectations for a Fed rate cut in September fell to 47% in Powell's speech.

Economic data

ADP jobs data beats expectations and is bearish

US ADP payrolls jumped 104,000 in July, beating market expectations of 75,000 and marking the biggest gain since March. The data showed continued strength in the labor market, reinforcing the Federal Reserve’s stance on keeping interest rates high. Meanwhile, the preliminary estimate of annual GDP growth in the second quarter came in at 3% (2.4% expected), and the core personal consumption expenditures price index rose 2.5% year-on-year (2.3% expected), indicating both economic resilience and inflation stability, further weakening expectations for a rate cut.

Keep an eye on the ISM manufacturing PMI and non-farm payrolls data on August 1. If the jobs numbers continue to be strong, this could reinforce the Fed’s dovish stance.

Geopolitical and Policy Plays

News of a 90-day extension of the US-China tariff deal has eased some safe-haven demand, but Trump’s August 8 deadline for a new Russia-Ukraine deal, coupled with tensions in the Middle East, continue to provide potential support for gold.

Continued purchases by central banks (such as China and India) are a positive signal in the medium to long term, but are unlikely to offset short-term pressure from the Federal Reserve’s policies.

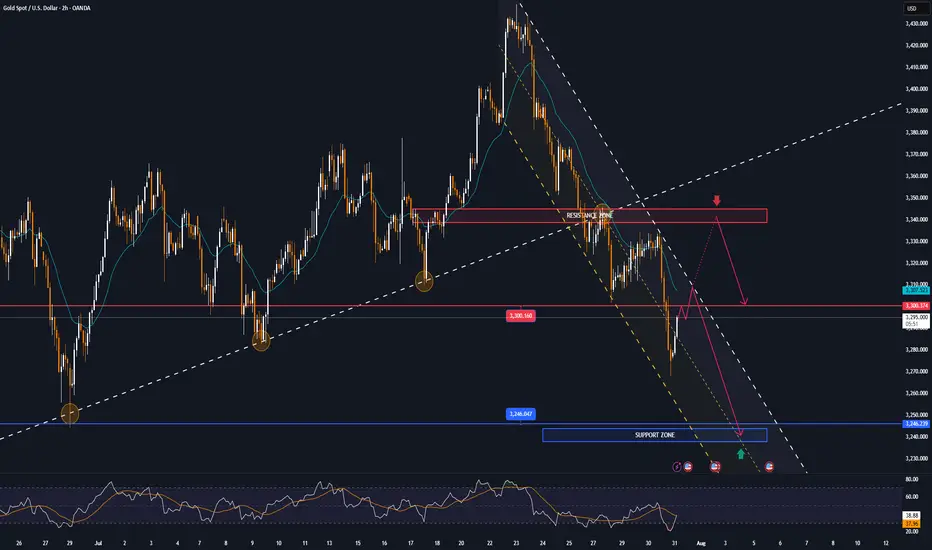

Technical outlook for

On the daily chart, gold has been sold below the $3,300 level and now the $3,300 level has become the nearest resistance at present. For now, gold will be limited by the area of the 0.382% Fibonacci retracement with the original price point of $3,300, along with that it has formed a short-term downtrend with the price channel, the next target will be around $3,246 in the short term followed by the Fibonacci retracement level noted with readers in previous publications.

On the momentum front, the Relative Strength Index is operating below 50 and is far from the oversold zone (20-0), indicating that there is still plenty of room for downside ahead.

In addition, the gold trend will also be pressured by the EMA21, as long as gold remains below the EMA21, the current technical conditions continue to favor the downside.

For the day, the technical outlook for gold is bearish with notable positions listed as follows.

Support: 3,246 – 3,228 USD

Resistance: 3,300 USD

SELL XAUUSD PRICE 3345 - 3343⚡️

↠↠ Stop Loss 3349

→Take Profit 1 3337

↨

→Take Profit 2 3331

BUY XAUUSD PRICE 3240 - 3242⚡️

↠↠ Stop Loss 3236

→Take Profit 1 3248

↨

→Take Profit 2 3254

Note

▫️Spot gold price reached 3310 USD/ounce, up 1.07% on the day.Note

Gold prices rose to a record high of $3,314.71 an ounce amid growing global concerns over US-international trade tensions, rising US inflation and escalating geopolitical tensions in the Middle East. President Trump’s executive order to increase import tariffs on many countries has caused investors to flock to gold as a safe haven asset.Note

Today's price is not much different from yesterday. Mainly because of Non-Farm today, the price was stable yesterday.

Before Non-Farm news today, these Resistance/Support zones are still used.

I will update the strategy for everyone when Non-Farm news is about to be announced🥰

Trade closed: target reached

Plan SELL HIT TP1 +80pips. Heading to TP2 😵😵😵Note

Spot gold prices rose sharply, surpassing the threshold of 3,360 USD/ounce, showing investor interest in safe-haven assets.Note

Last Friday (August 1), spot gold prices rose 2.23% to a one-week high of $3,363.37/ounce as a weaker-than-expected US non-farm payrolls report for July, coupled with concerns over new tax policies from the Trump administration, boosted demand for safe havens.Note

Spot gold today, after consolidating at high levels, has now rebounded ahead of the US session and reached $3,370. In terms of actual buy/sell orders, 50.7% of orders were buy and 49.3% were sell, indicating that the sentiment is still slightly bullish.Note

▫️Spot gold hit $3,380 an ounce, up 0.19% on the day.Note

🔴Spot gold surpassed the threshold of 3,390 USD/ounce, up 0.48% on the day.Note

Gold prices continue to increase strongly, recording 4 consecutive increasing sessions and approaching the 3400 USD/oz mark.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

![GOLD MARKET ANALYSIS AND COMMENTARY - [Aug 04 - Aug 08]](https://s3.tradingview.com/v/vsak8bLZ_mid.png)