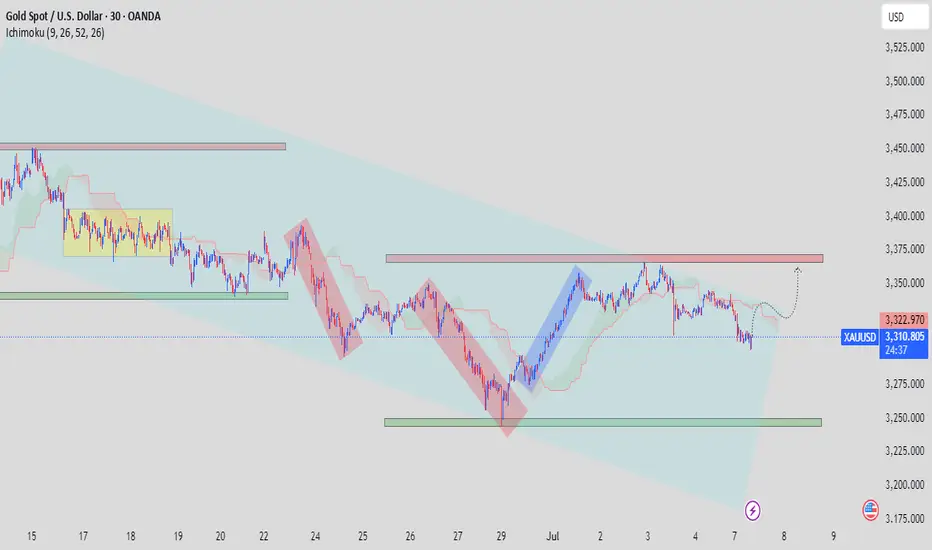

🟡 XAU/USD (Gold) 30-Min Chart Analysis — July 7, 2025

Potential Reversal Setup Toward Resistance Zone

---

✅ Technical Overview

Instrument: Gold Spot vs USD (XAU/USD)

Timeframe: 30-Minute

Indicators Used:

Ichimoku Cloud (9, 26, 52, 26)

Price Channels and Zones

Market Structure Patterns

---

📊 Key Observations

1. Descending Channel Structure

Price action has been following a well-defined descending channel (highlighted in green/blue).

Each move respects the channel's boundaries with multiple lower highs and lower lows.

2. Accumulation and Range Consolidation

Between June 17–19, we observe a range-bound consolidation (yellow box), suggesting accumulation before the breakout.

Current price action shows sideways movement near the lower boundary, potentially indicating another base formation.

3. Bullish Reversal Setup in Progress

A potential double bottom (formed around June 29 and July 5) aligns with the lower support zone (~3,245 USD).

The chart visually suggests a bullish corrective wave (dotted arrow) towards the upper supply zone (~3,360–3,380 USD).

4. Ichimoku Insights

Price is approaching the Ichimoku cloud, with possible TK cross support on lower timeframes.

A successful break and hold above the cloud would strengthen the bullish case.

---

📌 Key Zones to Watch

Zone Level (USD) Significance

Resistance 3,360 – 3,380 Key supply area from previous swing highs

Support 3,240 – 3,250 Demand zone; held twice recently

Mid-Level 3,325 (Ichimoku Kijun) Short-term resistance/trigger area

Potential Reversal Setup Toward Resistance Zone

---

✅ Technical Overview

Instrument: Gold Spot vs USD (XAU/USD)

Timeframe: 30-Minute

Indicators Used:

Ichimoku Cloud (9, 26, 52, 26)

Price Channels and Zones

Market Structure Patterns

---

📊 Key Observations

1. Descending Channel Structure

Price action has been following a well-defined descending channel (highlighted in green/blue).

Each move respects the channel's boundaries with multiple lower highs and lower lows.

2. Accumulation and Range Consolidation

Between June 17–19, we observe a range-bound consolidation (yellow box), suggesting accumulation before the breakout.

Current price action shows sideways movement near the lower boundary, potentially indicating another base formation.

3. Bullish Reversal Setup in Progress

A potential double bottom (formed around June 29 and July 5) aligns with the lower support zone (~3,245 USD).

The chart visually suggests a bullish corrective wave (dotted arrow) towards the upper supply zone (~3,360–3,380 USD).

4. Ichimoku Insights

Price is approaching the Ichimoku cloud, with possible TK cross support on lower timeframes.

A successful break and hold above the cloud would strengthen the bullish case.

---

📌 Key Zones to Watch

Zone Level (USD) Significance

Resistance 3,360 – 3,380 Key supply area from previous swing highs

Support 3,240 – 3,250 Demand zone; held twice recently

Mid-Level 3,325 (Ichimoku Kijun) Short-term resistance/trigger area

✅JOIN FREE TELEGRAM

✅t.me/+atTT3a4htZ8yZjQ0

✅DAILY 3-4 SIGNALS

✅ALL PAIRS CRYPTO & GOLD

✅t.me/+atTT3a4htZ8yZjQ0

✅DAILY 3-4 SIGNALS

✅ALL PAIRS CRYPTO & GOLD

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅JOIN FREE TELEGRAM

✅t.me/+atTT3a4htZ8yZjQ0

✅DAILY 3-4 SIGNALS

✅ALL PAIRS CRYPTO & GOLD

✅t.me/+atTT3a4htZ8yZjQ0

✅DAILY 3-4 SIGNALS

✅ALL PAIRS CRYPTO & GOLD

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.