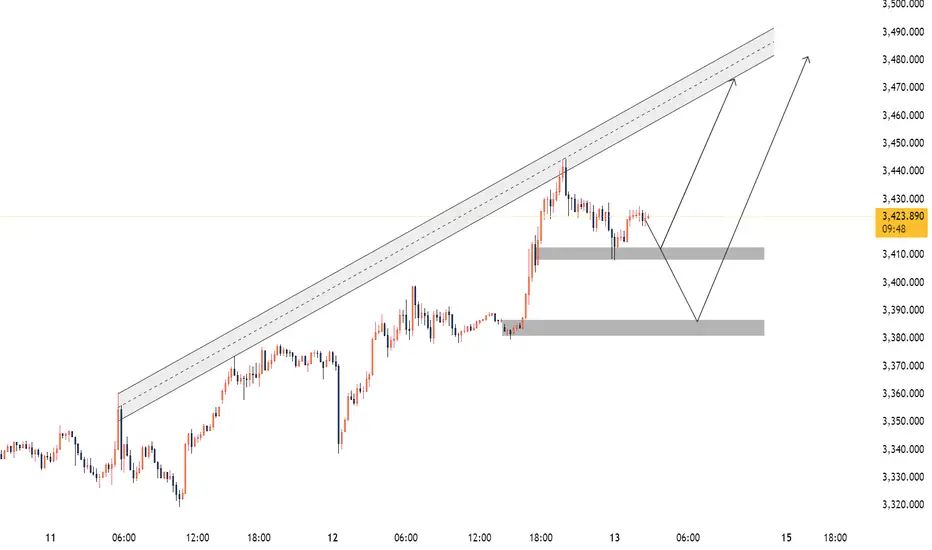

The market continues to exhibit strong bullish momentum within a well-respected ascending channel. After an impulsive breakout to the upside, price is now retracing in a healthy corrective move, offering high-probability buying opportunities at two well-defined demand zones.

🔍 Technical Structure:

Price is trending inside an ascending parallel channel, with clear respect for both the median and outer trendlines.

A significant bullish impulse pushed price above previous local highs, suggesting institutional interest and continuation potential.

Currently, price is retracing and approaching two key demand areas that align with bullish continuation setups.

🎯 Key Buy Zones:

✅ Zone 1: 3,408 – 3,412

Minor mitigating demand zone, likely to act as support if the market retraces slightly.

Ideal for aggressive long entries if price shows confirmation (e.g., bullish engulfing, LTF structure shift).

✅ Zone 2: 3,380 – 3,385

Deeper unmitigated demand zone, aligned with a potential liquidity sweep and strong institutional support.

Considered a high-probability entry area for larger impulse moves.

🌍 Fundamental Context:

Recent geopolitical tensions in the Middle East, can lead to sharp intraday moves, with 100+ pip 5-minute candles not being out of the question.

Given this backdrop, demand zones become critical areas for smart money entries as traders seek to align technical levels with macro drivers.

📈 Trade Signal:

Bias: 🔵 Bullish

Buy Zone 1: 3,408 – 3,412

SL: Below 3,395

TP: 3425, 3440, trail till 3,470

R:R: ~1:3

Buy Zone 2: 3,380 – 3,385

SL: Below 3,368

R:R: ~1:4

🧠 Final Note:

Watch for price reaction at both zones. Use LTF confirmation before entry and respect your risk management. With news-driven volatility in play, quick movements are expected, offering excellent trade opportunities for prepared traders.

🔍 Technical Structure:

Price is trending inside an ascending parallel channel, with clear respect for both the median and outer trendlines.

A significant bullish impulse pushed price above previous local highs, suggesting institutional interest and continuation potential.

Currently, price is retracing and approaching two key demand areas that align with bullish continuation setups.

🎯 Key Buy Zones:

✅ Zone 1: 3,408 – 3,412

Minor mitigating demand zone, likely to act as support if the market retraces slightly.

Ideal for aggressive long entries if price shows confirmation (e.g., bullish engulfing, LTF structure shift).

✅ Zone 2: 3,380 – 3,385

Deeper unmitigated demand zone, aligned with a potential liquidity sweep and strong institutional support.

Considered a high-probability entry area for larger impulse moves.

🌍 Fundamental Context:

Recent geopolitical tensions in the Middle East, can lead to sharp intraday moves, with 100+ pip 5-minute candles not being out of the question.

Given this backdrop, demand zones become critical areas for smart money entries as traders seek to align technical levels with macro drivers.

📈 Trade Signal:

Bias: 🔵 Bullish

Buy Zone 1: 3,408 – 3,412

SL: Below 3,395

TP: 3425, 3440, trail till 3,470

R:R: ~1:3

Buy Zone 2: 3,380 – 3,385

SL: Below 3,368

R:R: ~1:4

🧠 Final Note:

Watch for price reaction at both zones. Use LTF confirmation before entry and respect your risk management. With news-driven volatility in play, quick movements are expected, offering excellent trade opportunities for prepared traders.

✅Free Telegram

t.me/+6YQX9c4-BiQ2M2M8

Twitter 👇

twitter.com/QuinnGoldTrader

t.me/+6YQX9c4-BiQ2M2M8

Twitter 👇

twitter.com/QuinnGoldTrader

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅Free Telegram

t.me/+6YQX9c4-BiQ2M2M8

Twitter 👇

twitter.com/QuinnGoldTrader

t.me/+6YQX9c4-BiQ2M2M8

Twitter 👇

twitter.com/QuinnGoldTrader

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.