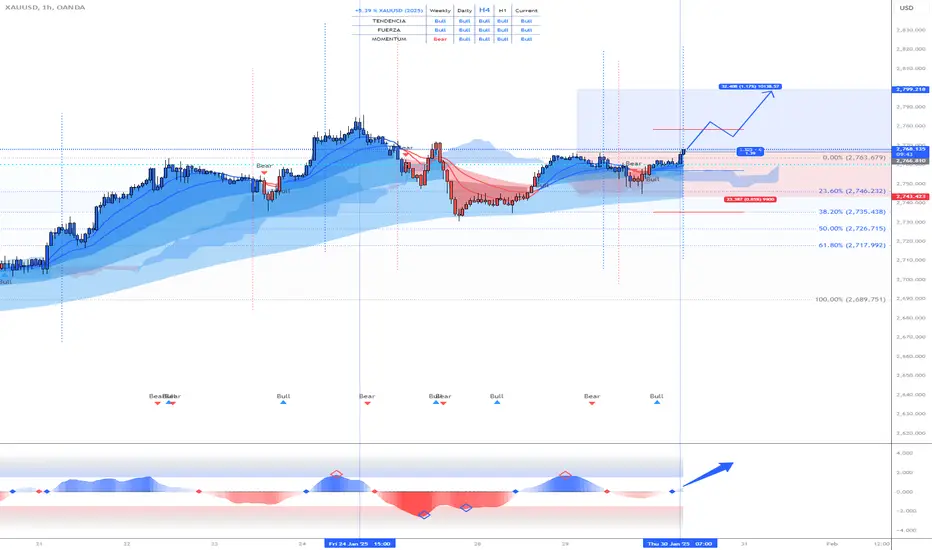

As can be seen in the chart, GOLD is clearly bullish (Bull), therefore, we will only look for long trades.

On January 24th, a retracement phase began, taking gold to the 50% Fibonacci zone (2,730) and from that zone it gained bullish strength again (Bull). TODAY, the first serious sign of bullish strength (Bull) has appeared, therefore, there is a HIGH probability that the price will attack highs.

-------------------------------------

Strategy to follow:

ENTRY: We will open 2 long positions if H1 candle closes above 2,766

POSITION 1 (TP1): We close the first position in the 2,799 zone (+1.17%)

--> Stop Loss at 2,743 (-0.85%).

--> RATIO 1:4

POSITION 2 (TP2): We open a Trailing Stop type position.

--> Initial dynamic Stop Loss at (-0.85%) (coinciding with the 2,743 of position 1).

--> We modify the dynamic Stop Loss to (-0.3%) when the price reaches TP1 (2,799).

-------------------------------------------

SET UP EXPLANATIONS

*** How do you know which 2 long positions to open? Let's take an example: If we want to invest 2,000 euros in the stock, what we do is divide that amount by 2, and instead of opening 1 position of 2,000, we will open 2 positions of 1,000 each.

*** What is Trailing Stop? A Trailing Stop allows a trade to continue gaining value when the market price moves in a favorable direction, but automatically closes the trade if the market price suddenly moves in an unfavorable direction by a certain distance. That certain distance is the Trailing Stop Loss.

-->Example: If the Trailing Stop Loss is at -1%, it means that if the price drops by -1%, the position will be closed. If the price rises, the Stop Loss also rises to maintain that -1% on rises, therefore, the risk is increasingly lower until the position becomes profitable. In this way, very strong and stable price trends can be taken advantage of, maximizing profits.

On January 24th, a retracement phase began, taking gold to the 50% Fibonacci zone (2,730) and from that zone it gained bullish strength again (Bull). TODAY, the first serious sign of bullish strength (Bull) has appeared, therefore, there is a HIGH probability that the price will attack highs.

-------------------------------------

Strategy to follow:

ENTRY: We will open 2 long positions if H1 candle closes above 2,766

POSITION 1 (TP1): We close the first position in the 2,799 zone (+1.17%)

--> Stop Loss at 2,743 (-0.85%).

--> RATIO 1:4

POSITION 2 (TP2): We open a Trailing Stop type position.

--> Initial dynamic Stop Loss at (-0.85%) (coinciding with the 2,743 of position 1).

--> We modify the dynamic Stop Loss to (-0.3%) when the price reaches TP1 (2,799).

-------------------------------------------

SET UP EXPLANATIONS

*** How do you know which 2 long positions to open? Let's take an example: If we want to invest 2,000 euros in the stock, what we do is divide that amount by 2, and instead of opening 1 position of 2,000, we will open 2 positions of 1,000 each.

*** What is Trailing Stop? A Trailing Stop allows a trade to continue gaining value when the market price moves in a favorable direction, but automatically closes the trade if the market price suddenly moves in an unfavorable direction by a certain distance. That certain distance is the Trailing Stop Loss.

-->Example: If the Trailing Stop Loss is at -1%, it means that if the price drops by -1%, the position will be closed. If the price rises, the Stop Loss also rises to maintain that -1% on rises, therefore, the risk is increasingly lower until the position becomes profitable. In this way, very strong and stable price trends can be taken advantage of, maximizing profits.

JMESADO

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

JMESADO

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.