ADA/USDT — Major Reversal or Deep Breakdown?ADA/USDT on the weekly timeframe has returned to one of the most decisive zones since 2022.

The 0.275–0.22 region is not just another support — it is a historical demand and accumulation block where major reversals have repeatedly formed.

This week, ADA once again tapped this zone with a long downside wick, signaling a massive liquidity sweep. This is a clear indication that larger players are active here, collecting liquidity before choosing the next major direction.

This chart doesn’t reflect a simple pullback — it reflects the early stages of a major battle between long-term buyers and the dominant sellers who have controlled the trend since 2021.

---

🔥 Key Pattern & Market Dynamics

1. Long-term downtrend structure

Since the macro top, ADA has continued forming lower highs, maintaining bearish pressure in the weekly structure.

2. Strong accumulation demand (0.275–0.22)

This area has produced three major reversals in the past.

The latest reaction suggests either:

A liquidity hunt before a potential rebound, or

The beginning of a deeper breakdown if buyers fail to defend it.

3. Increased volatility

A wick of this size is rarely random.

It often precedes large directional moves, especially on the weekly chart.

---

📈 Bullish Scenario (If the Zone Holds)

A bullish continuation requires clear conditions:

✔ Strong rejection from 0.275–0.22

✔ Weekly close above the pivot zone at 0.40–0.45

✔ Formation of a higher-low structure

If confirmed, ADA may begin a structural trend reversal with:

Target 1: 0.65

Target 2: 1.00 – 1.20 (if volume expansion supports the breakout)

This would mark a shift from long-term weakness to medium-term recovery.

---

📉 Bearish Scenario (If the Zone Breaks)

A weekly close below 0.22 would be a significant bearish signal:

Historical demand fails

Market structure breaks down

A deeper markdown phase begins

Downside targets:

0.16 — next major psychological support

0.09 — historical accumulation zone

A loss of 0.22 would be one of ADA’s strongest bearish confirmations in years.

---

🧠 Core Message for Traders

This is not an ordinary support level —

this is a macro decision point that will define ADA’s direction for months ahead.

ADA now stands exactly where it stood in 2022–2023, and from this zone the market has only two paths:

➡ Hold the historical accumulation zone and reverse upward

or

➡ Break below it and enter a deeper long-term downtrend

Professional traders do not guess —

they wait for the weekly close, analyze volume, and watch how the market reacts to this key zone.

---

#ADA #ADAUSDT #Cardano #CryptoAnalysis #PriceAction #MarketStructure #WeeklyChart #SupportZone #CryptoTrading #CryptoOutlook

Adausdtsignal

#ADAUSDT: Two Targets Both Possible, Let's See How Price MoveADAUSDT collapsed following the announcement of new tariffs on China, which caused fear in the cryptocurrency market and affected minor currency pairs. This led to a significant drop in the price of ADAUSDT. A minor decline may occur before the price reverses. There are two potential targets for the price to reach.

Entry area:

- We have identified the key area where a price reversal is likely to occur.

We wish you the best of luck and trade safely.

Team Setupsfx

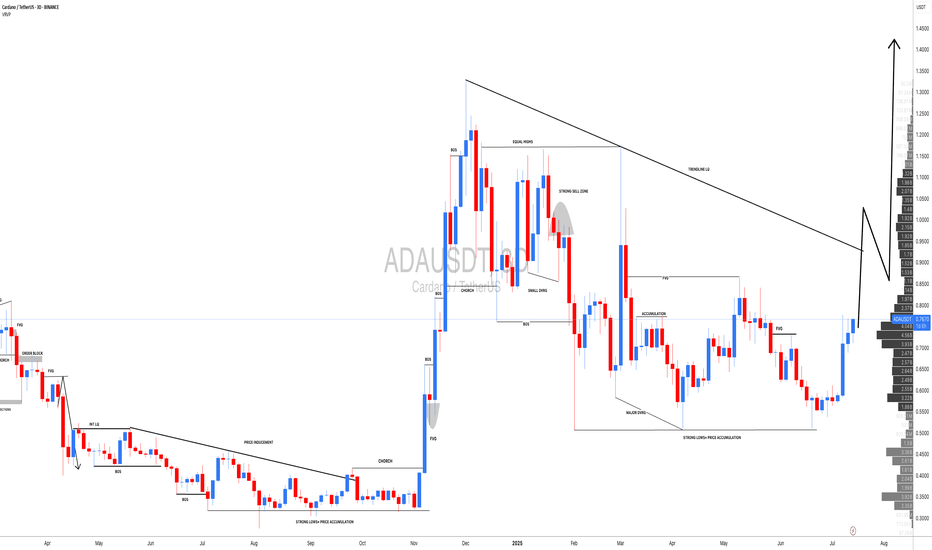

ADAUSDTIn this week’s BINANCE:ADAUSDT analysis, after a bearish reaction from the 0.85 USD zone, the price remains consolidating below previous highs, showing weakness in bullish momentum on the daily timeframe. If the current support fails, a move toward lower zones is likely before a potential bullish correction begins from support levels.

Supports:

* 0.59 USD

* 0.51 USD

Resistances:

* 0.69 USD

* 0.85 USD

ADA/USDT — at a Make-or-Break Zone: Will Bulls Defend?Cardano (ADA) is now sitting at a critical decision point, testing the major demand zone between 0.55–0.625 USDT — a key level that has acted as the foundation for multiple rallies since early 2024. This zone represents the battlefield between long-term buyers and sellers, where price reactions have historically triggered large directional moves.

Recently, ADA experienced a deep liquidity sweep, leaving a long wick below the zone — a common sign of stop-loss hunting or institutional accumulation. Such moves often occur before a trend reversal, making this area one of the most strategic zones to watch in the coming weeks.

---

Pattern and Market Structure Analysis

The yellow block (0.55–0.625) is a macro demand/support zone, repeatedly tested and defended by buyers.

Main resistances are located at 0.9239, 1.2075, and 1.3264, forming the upper bounds of ADA’s broader trading range.

The overall structure shows a wide consolidation phase, potentially signaling re-accumulation if the current zone holds.

The long wick beneath support reflects a liquidity grab, often used by smart money to fill large buy orders before an upward move.

---

Bullish Scenario — Potential Start of a Major Rebound

1. Price holds and rebounds from 0.55–0.625 with a strong bullish reversal candle (bullish engulfing, hammer, or pin bar).

2. Increasing buying volume confirms accumulation interest at this level.

3. A clean breakout and daily close above 0.9239 would confirm bullish continuation toward 1.20 and 1.32.

4. Formation of a higher low above 0.625 will further validate a new uptrend structure.

🎯 Bullish Targets:

TP1: 0.92

TP2: 1.20

TP3: 1.32

📉 Suggested Stop Loss: Below 0.53 (outside the demand zone).

Narrative:

If this pattern confirms, ADA could begin a new major recovery wave, potentially marking the start of a strong uptrend cycle heading into 2026.

---

Bearish Scenario — Breakdown and Failed Retest

1. Price fails to hold above 0.55 and closes decisively below the yellow zone.

2. High selling volume confirms continuation pressure.

3. A failed retest of 0.55–0.625 as new resistance strengthens bearish momentum.

4. The next key downside targets are 0.40 and 0.27, both major liquidity levels.

🎯 Bearish Targets:

TP1: 0.40

TP2: 0.27

📈 Confirmation: Daily candle close below 0.55 with strong volume.

Narrative:

If this support collapses, ADA could enter a mid-term redistribution phase, potentially setting a new bottom before the next macro bull run.

---

Conclusion and Strategic Outlook

The 0.55–0.625 zone is ADA’s make-or-break region — a critical level that will likely define its direction for the months ahead.

Holding the zone could trigger a strong reversal rally toward 0.92–1.32.

Losing it would confirm a bearish continuation toward 0.27.

Traders should wait for confirmation through daily candle closes and volume surges before committing to major positions.

This zone offers both a high-risk accumulation opportunity for patient investors and a decisive pivot area for short-term traders.

---

#ADA #Cardano #ADAUSDT #CryptoAnalysis #TechnicalAnalysis #PriceAction #SupportZone #ReversalZone #Altcoin #CryptoMarket #DemandZone

#ADAUSDT: Is the crypto hype finally over? ADAUSDT is likely to drop first then it can reverse and continue the bullish move upwards of previous all time high. Before we can confirm any entry on this pair we need strong confirmation which will allow us to predict a correct and accurate swing move.

If you like the work then do consider liking and commenting on the idea.

Team Setupsfx_❤️

ADA/USDT | Low-Risk Swing Setup with 215%+ Upside Potential🚀 Trade Setup Details:

🕯 #ADA/USDT 🔼 Buy | Long 🔼

⌛️ TimeFrame: 1D

--------------------

🛡 Risk Management (Example):

🛡 Based on $10,000 Balance

🛡 Loss-Limit: 1% (Conservative)

🛡 The Signal Margin: $463.61

--------------------

☄️ En1: 0.721 (Amount: $46.36)

☄️ En2: 0.6644 (Amount: $162.26)

☄️ En3: 0.6269 (Amount: $208.62)

☄️ En4: 0.5915 (Amount: $46.36)

--------------------

☄️ If All Entries Are Activated, Then:

☄️ Average.En: 0.6458 ($463.61)

--------------------

☑️ TP1: 0.8789 (+36.09%) (RR:1.67)

☑️ TP2: 1.0193 (+57.84%) (RR:2.68)

☑️ TP3: 1.2306 (+90.55%) (RR:4.2)

☑️ TP4: 1.5637 (+142.13%) (RR:6.59)

☑️ TP5: 2.0372 (+215.45%) (RR:9.99)

☑️ TP6: Open 🔝

--------------------

❌ SL: 0.5065 (-21.57%) (-$100)

--------------------

💯 Maximum.Lev: 3X

⌛️ Trading Type: Swing Trading

‼️ Signal Risk: 🙂 Low-Risk! 🙂

--------------------

🔗 www.tradingview.com

❤️ Your Like & Comments are valuable to us ❤️

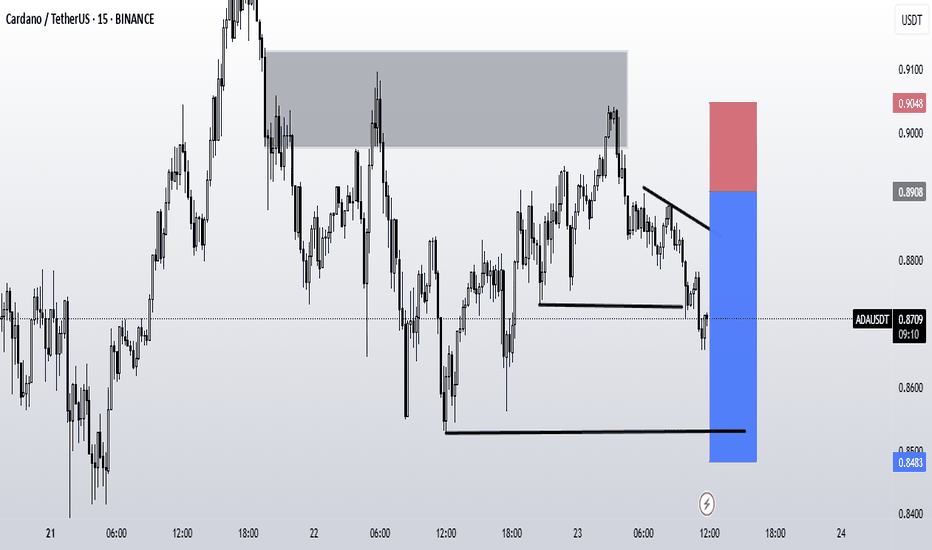

ADA Battles $0.82 – Can Bulls Break $0.87 Resistance?Cardano (ADA) is trading around $0.82–$0.83 on the 4H chart, holding above its key support but still capped under resistance. In today’s video, I focus only on the short-term price structure: support at $0.8157–$0.8014, deeper levels at $0.7724 and $0.7620, and resistance at $0.8484, $0.8710, and $0.9347. A breakout above $0.8710 would be a key step for ADA to confirm recovery momentum.

The mid-term bias remains for more upside, but ADA must prove strength step by step. With Bitcoin showing bullish signals this morning and today’s NFP release increasing volatility, ADA’s reaction at these levels will define whether bulls can take control or if we see another retest of support.

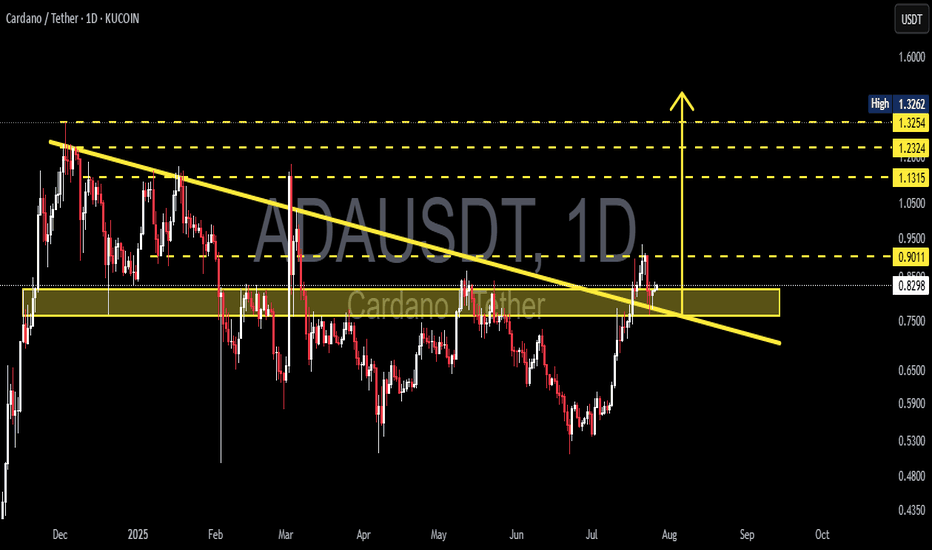

ADA/USDT — Breakout & Retest at a Critical Fibonacci Zone!

Currently, Cardano (ADA/USDT) is at a decisive point on the 3D timeframe, where price has just broken out of a mid-term downtrend line and is now retesting a very strong support area.

---

🔎 Technical Structure & Pattern

Downtrend line has been broken to the upside → sign of trend reversal.

Price is retesting a confluence support zone (0.78 – 0.83) consisting of:

Historical support/resistance (yellow box).

Fibonacci retracement 0.5 (0.8217) and 0.618 (0.7955).

This setup forms a classic “breakout & retest” pattern — where old resistance potentially flips into new support. If it holds, ADA could confirm a mid-term bullish continuation.

---

🟢 Bullish Scenario

If the price holds and closes above 0.795–0.821, bullish momentum remains valid.

Potential upside targets:

R1 = 0.9364 (short-term swing target).

R2 = 1.1213 (strong confirmation of trend shift).

R3 = 1.2152 (key resistance before major highs).

R4 = 1.3262 (major high & psychological zone).

In this scenario, ADA could stage a significant rally if market sentiment supports it.

---

🔴 Bearish Scenario

If the price breaks down below 0.7955 (Fib 0.618), the bullish setup may turn into a false breakout.

Downside targets to watch:

Previous consolidation range around 0.60–0.70.

Deeper support near 0.44.

Worst-case scenario: retesting the major low at 0.27.

---

📌 Conclusion

ADA is currently at a make-or-break level.

As long as price holds above 0.795–0.821, the bias remains bullish with targets at 0.94 – 1.12 in the mid-term.

A failure to hold this zone would shift bias to bearish, opening the way for deeper corrections.

Traders should closely monitor price action & volume around this retest, as it will determine ADA’s next big move.

---

📝 Notes

Always apply risk management (stop-loss & position sizing).

Wait for 3D/weekly candle close confirmation.

This is technical analysis, not financial advice.

#Cardano #ADA #ADAUSDT #CryptoBreakout #CryptoTrading #TechnicalAnalysis #PriceAction #Altcoins #CryptoSetup

ADA Cardano Equilibrium Pullback and Possible Trade Opportunity🔵 ADA (Cardano) on the weekly timeframe is holding a strong bullish trend 📈. We can see price has retraced into the Fibonacci 50–61.8% zone 🔢, which is typically a pullback into equilibrium ⚖️—an area often considered an ideal continuation entry in line with the trend.

👀 My bias remains long, but let’s break it down further:

📊 On the 4H chart, price action suggests a potential base forming—possibly big money accumulation 💼💰. That said, we don’t yet have a decisive break above to confirm.

🔎 Zooming into the 30M chart, the recent downtrend has been compromised with a shift in structure to the upside 🔄📈. What I’m waiting for now is:

1️⃣ An expansion above the previous high

2️⃣ A retracement and retest

3️⃣ A potential buy opportunity in alignment with trend ✅

This setup also aligns with a possible Wyckoff accumulation 📚—we’ve got relative equal lows, and a liquidity spike below could create a springboard for more bullish activity 🌱🚀.

⚠️ This is purely educational and not financial advice 🔒

ADAUSDT Breaks Long-Term Downtrend – Critical Support Retest!The ADAUSDT pair is showing a compelling technical setup. The price has successfully broken out of a long-term descending trendline (yellow line) that had been acting as dynamic resistance since late 2024. This breakout came with strong momentum, signaling a potential shift from a bearish trend to a bullish reversal.

After the breakout, price managed to rally up to minor resistance around $0.90, but is now pulling back and retesting the key support zone (highlighted yellow box) — a previous strong resistance area now potentially flipping into support.

---

🟢 Bullish Scenario:

If the price holds above the $0.80 - $0.83 support zone, the break-and-retest structure will be validated.

A successful bounce from this area could push ADA back toward:

$0.90 (current minor resistance)

$1.13 (psychological and horizontal resistance)

$1.23 (previous supply zone)

$1.32 (recent local high)

A confirmed bullish continuation will be more convincing if the price forms a higher low and breaks above $0.90 with strong volume.

---

🔴 Bearish Scenario:

If ADA fails to hold the $0.8281 support and falls back below the descending trendline, then:

It may re-enter the previous range and test lower support around $0.75 or even $0.65.

This would suggest a potential false breakout and return to bearish territory.

Watch for bearish candlestick confirmations below $0.80 as an early warning.

---

📌 Pattern Insights:

Descending Trendline Breakout: Suggests a possible long-term trend reversal.

Break & Retest Structure: Price is currently testing the previous resistance zone as new support.

Layered Resistance Zones: Several clear resistance levels above provide logical targets for a bullish rally.

---

📊 Conclusion:

ADAUSDT has printed an early signal of a bullish reversal by breaking out of a long-standing downtrend. However, the sustainability of this trend depends heavily on the ability of price to hold the $0.80 - $0.83 support zone. Look for bullish confirmation candles in this area for a safer long entry.

#ADAUSDT #Cardano #CryptoBreakout #TechnicalAnalysis #Altcoins #BreakoutSetup #BullishRetest #CryptoChart #SupportAndResistance #PriceAction #TrendReversal

ADA/USDT | Multi-Month Breakout Brewing — a 10x play ?Cardano is quietly mirroring its previous macro cycle — but this time, the structure looks tighter, cleaner, and potentially more explosive.

The multi-month chart reveals a consistent uptrend forming off the 2022 lows, contained within a well-respected ascending channel. The price action shows strong similarities to the 2018–2020 accumulation phase, followed by the breakout that led ADA to its all-time high in 2021.

The current price structure is forming higher highs and higher lows within a channel — a strong bullish continuation pattern.

Volume has been increasing steadily during the up-moves, signaling real demand building underneath.

Fibonacci Extensions from the previous cycle highs and lows show key long-term resistance zones:

1.618 – $4.91

2.618 – $7.79

4.236 – $12.47

These levels could act as major psychological targets if the trend continues to evolve similarly to the last cycle.

⏳ Current Price (~$0.64) is still significantly below previous all-time highs and long-term extension zones — offering a potentially favorable risk/reward setup for patient investors.

⚠️ As always, nothing moves in a straight line — but if you're a macro-mind investor, you’ll start to notice more straight lines than most. Zooming out often reveals the patterns that noise hides.

ADAUSDT.P m15 : a Short Position fot TP3The price, on its weekly upward path, reacted bearishly to the daily zone and seems likely to take out key lows to collect liquidity (whether for a future decline or rise).

Our trade will be activated after the liquidity Grab, based on trend and horizontal levels

ADAUSDT: $1.50 Year End Target, Is It Possible? The price has remained steadily bullish, but we haven’t seen a strong bullish impulse in the daily timeframe yet. This suggests that we’ll likely reach the $1.50 price range. Please wait for the price to break out and then enter a trade when it shows confirmation. You can use smaller timeframes while taking any entry. Good luck and trade safely!

Like and comment for more!

Team Setupsfx_

ADA/USD Thief Trading Plan – Bullish Snatch & Run!🚨 ADA/USD HEIST ALERT! 🚨 – Bullish Loot Grab Before the Escape! (Thief Trading Strategy)

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

🔥 THIEF TRADING STRIKES AGAIN! 🔥

💎 The Setup:

Based on our stealthy technical & fundamental heist tactics, ADA/USD is primed for a bullish loot grab! The plan? Long entry with an escape near key resistance. High-risk? Yes. Overbought? Maybe. But the heist must go on!

🎯 Key Levels:

📈 Entry (Vault Cracked!) → Swipe bullish positions on pullbacks (15m-30m precision).

🛑 Stop Loss (Escape Route) → Recent swing low (4H basis) at 0.5290 (adjust per risk!).

🏴☠️ Target (Profit Snatch!) → 0.6500 (or bail early if bears ambush!).

⚡ Scalpers’ Quick Heist:

Only scalp LONG!

Big wallets? Charge in! Small stacks? Ride the swing!

🔐 Lock profits with Trailing SL!

📢 Breaking News (Heist Intel!):

Fundamentals, COT, On-Chain, Sentiment— All hint at bullish momentum!.

🚨 ALERT! News volatility ahead—Avoid new trades during releases! Secure running positions with Trailing SL!

💥 BOOST THIS HEIST! 💥

👉 Hit LIKE & FOLLOW to fuel our next market robbery! 🚀💰

🎯 Profit taken? Treat yourself—you earned it!

🔜 Next heist incoming… Stay tuned, pirates! 🏴☠️💎

$ADA/USDT — Potential Long-Term BreakoutCardano is showing a major breakout from a long-standing descending channel on the daily timeframe.

Structure:

Downtrend channel respected for ~7 months

Breakout confirmed with a strong bullish daily candle

Price hovering around $0.7192, above previous resistance

Support Levels:

$0.60

$0.5299

Resistance / Long-Term Targets:

$0.8158

$1.0876

$1.3159

$1.8958

Ultimate target (Fib extension): $2.76+

Outlook:

The 285% potential move mirrors ADA’s past rally from similar conditions. If market sentiment continues improving and BTC holds above key levels, ADA might repeat history.

A pullback to $0.60–$0.66 could offer re-entry opportunities.

Bias: Bullish (long-term)

Caution: Not a trade setup—strictly an outlook. Watch BTC/ETH correlation.

DYOR | Not financial advice

Cardano Forming Potential Reversal Structure Inside TriangleHello guys!

Cardano’s been stuck inside this big descending triangle for months. We had a fake breakout a while back that totally failed.

Now, price is back at support and showing bullish divergence. That’s usually a sign sellers are getting tired.

If buyers step in here, I’m expecting a move back up toward 0.67–0.70 (top of the triangle). But if it loses the 0.53 support, that setup’s off the table.

Bias: Leaning bullish

🎯 Target: 0.67–0.70

Invalidation: Clean break below 0.53

Let’s see how this plays out.

ADA/USDT Ready to Explode? Watch This Symmetrical Triangle

🧠 Detailed Technical Analysis:

Cardano (ADA) is currently consolidating within a well-defined Symmetrical Triangle pattern on the 3-day chart. This pattern is formed by a series of lower highs and higher lows, indicating compression and indecision in the market — a classic setup for a strong breakout in either direction.

Price has recently bounced off the lower boundary of the triangle and is now heading toward the resistance trendline. A breakout from this structure could trigger a powerful bullish move if confirmed with volume.

🔼 Bullish Scenario (Upside Breakout):

A confirmed breakout above the descending trendline (~$0.65) with strong volume would indicate buyers regaining control.

Key upside targets based on historical resistance zones and the triangle's height:

🟡 $0.8144 – First major horizontal resistance

🟡 $0.9386 – Mid-range resistance from March 2025

🟡 $1.0920 – Former distribution zone

🟡 $1.2118 – Medium-term bullish target

🔵 $1.3264 – Key structural high from previous cycle

🔔 A breakout from a symmetrical triangle often leads to significant price action due to the long period of coiled pressure release.

🔽 Bearish Scenario (Breakdown):

If ADA fails to break above $0.62–$0.65 and gets rejected from the upper boundary of the triangle, the price could:

Revisit the lower trendline support around $0.55

A breakdown below this zone could lead to:

🔻 $0.48

🔻 $0.39

🔻 $0.2756 – A major psychological and historical support level

⚠️ This scenario would invalidate the bullish structure and potentially resume the mid-term downtrend.

📐 Pattern Breakdown – Symmetrical Triangle:

Pattern Duration: ~6 months of consolidation (Feb – July 2025)

Support Zone: $0.55 – $0.60

Resistance Zone: $0.65 – $0.75

Breakout Confirmation: Requires strong bullish candle close with increased volume

Volume Profile: Decreasing, typical of symmetrical triangle before explosive move

💡 Final Thoughts:

Cardano is at a make-or-break point. It has bounced from support and is attempting a breakout from this symmetrical triangle. If successful, this could mark the beginning of a major trend reversal with over +100% upside potential from current levels.

On the flip side, failure to break resistance could lead to a deeper retracement. That’s why confirmation is critical before entering a position!

#ADAUSDT #CardanoAnalysis #CryptoBreakout #SymmetricalTriangle #AltcoinSeason #BullishBreakout #BearishScenario #TechnicalAnalysis #CryptoChart #CryptoTrading #Altcoins

ADAUSDT Intraday SetupAda Showing some good movement. Trade Rules

must gave 30m candle closing above marked area, if wick above marked area then trade will become risky. Must use the sl. Target is given.

If retraces back before the marked area then it also good, in this case 30m marked area will first tp book 30% here, rest hold till final tp or SL.