Altseason

ETH/USDT: Bullish Rise to 4770?As the previous analysis worked exactly as predicted, BINANCE:ETHUSDT is gearing up for a bullish move on the 4-hour chart , with an entry zone between 4350-4395 near a key support and trendline.

The target range of 4735-4770 aligns with the next resistance, signaling strong upside potential. Set a stop loss on a close below 4228 to manage risk effectively. Watch BTC trends! 💡

📝 Trade Plan:

✅ Entry Zone: 4350 – 4395 (support + trendline area)

❌ Stop Loss: Daily close below 4228 to manage risk

🎯 Target Zone: 4735 – 4770 (next resistance level)

Ready for this lift-off? Drop your take below! 👇

MYX/USDT Analysis. Long Setup

MYX continues to show strong daily momentum. The current high is near, and a strong support zone has formed at $15.8–$14.8.

If this zone is tested and shows a bullish reaction, we can look for a long setup targeting the current high at $18.7.

This publication is not financial advice.

ETH Awaits Fed Decision, High Volatility AheadCRYPTOCAP:ETH Update

Back on August 21, when news broke about a possible Fed rate cut on September 17, ETH instantly jumped nearly 14%. Fast forward to today, the actual announcement is scheduled for 2 PM ET, and the market is on edge.

There’s a strong probability of a rate cut, which could inject fresh momentum and push ETH higher. But if the Fed keeps rates unchanged, we could see a sharp downside correction as risk assets react.

Best approach right now? Stay patient. Wait for the full announcement from Powell, his tone will matter as much as the numbers. Extreme volatility is expected around that time, so caution is key.

DYOR, NFA

#PEACE

ADA/USDT: Bullish Rise to 0.96?BINANCE:ADAUSDT is gearing up for a bullish move on the 4-hour chart , with an entry zone between 0.87-0.85 near a key support and trendline.

The target at 0.96 aligns with the next resistance, signaling strong upside potential. Set a stop loss on a close below 0.8450 to manage risk effectively.

🌟Entry is suitable even right now with proper risk management.

📝 Trade Plan:

✅ Entry Zone: 0.85 – 0.87 (support + trendline area)

❌ Stop Loss: Daily close below 0.8450 to manage risk

🎯 Target: 0.96 (next resistance)

Ready for this lift-off? Drop your take below! 👇

XLM/USDT: Bullish Move to 0.47?BINANCE:XLMUSDT is setting up for a bullish move on the 1-hour chart , with an entry zone around 0.38 near a key support level as observed in the provided chart.

The target range of 0.46-0.47 aligns with the next resistance, offering strong upside potential. Set a stop loss on a close below 0.35 to manage risk effectively. 🌟

A break above 0.39 with solid volume could trigger this rise, driven by market momentum and XLM network activity. Watch BTC trends! 💡

📝 Trade Plan:

✅ Entry Zone: Around 0.38 (support area)

❌ Stop Loss: Daily close below 0.35 to manage risk

🎯 Target Zone: 0.46 – 0.47 (next resistance)

Ready for this push? Drop your take below! 👇

TAO – Bittensor Swing Long IdeaTAO – Bittensor Swing Long Idea

📊 Market Sentiment

Market sentiment remains strongly bullish as the FED is expected to deliver a 0.25% rate cut, with speculation building for a possible 0.5% cut in September. Monetary policy shifts are being driven by both inflation trends and weakening labor market data. The latest August and September job reports were soft, signaling that the economy is cooling rapidly. This environment continues to fuel expectations for a major bullish run in the weeks ahead.

📈 Technical Analysis

• Price rejected the 12H Demand zone and then broke the Daily Structure.

• Price also broke the bearish trendline and closed above, signaling higher targets ahead.

• Current retracement is gathering liquidity to expand higher.

📌 Game Plan

1-Price to hit Daily Demand

2-Price to run liquidity at $328

3-Possible retest of the broken trendline

🎯 Setup Trigger

Looking for a 4H Break of Structure before entering any long position.

📋 Trade Management

Stoploss: Daily close below the Daily Demand zone at $302

Targets:

• TP1: $376

• TP2: $404

• TP3: $438

💬 Like, follow, and comment if you find this setup valuable!

⚠️ Disclaimer: This content is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Always DYOR before making any financial decisions.

HIFI - BULL REVERSAL INCOMING ?? Im buying some #HIFI here, bottom could be in! 📈

I expect to see a bull reaction soon, on the weekly ichimoku support!

Multi week trend retest also around the corner...

Price manipulation was insane, but no risk, no reward!

#DYOR if you follow!

IMX/USDT – Structural Breakout Setting the Stage for a ReversalOverview

Immutable (IMX) has been trading in a prolonged downtrend since its 2024 peak near $3.76, carving out a descending channel with consistent lower highs and lower lows. Recently, however, the price action shows early signs of a potential structural shift. With momentum building and volume confirming interest, IMX could be entering the early stages of a major trend reversal.

Technical Structure

Falling Wedge Breakout: Price has been respecting a falling wedge formation for over a year. The latest breakout attempt above the upper trendline is a strong bullish technical signal.

Accumulation Base: The zone around $0.60–$0.70 acted as a significant accumulation area. Multiple retests suggest strong hands are absorbing supply here.

Key Levels in Play:

Immediate resistance: $0.88

Mid-term target: $1.20–$1.25 (structural retest zone)

Major upside objective: $1.88, which aligns with prior horizontal supply and wedge resistance flip.

Invalidation: A breakdown below $0.55 would invalidate the bullish structure and suggest continuation of the broader downtrend.

Outlook & Strategy

Institutional flows often enter during wedge breakouts, where risk/reward skews favorably. If IMX sustains momentum above $0.88, the path toward $1.20 opens quickly, with a measured move target pointing to $1.88 in the medium term.

Traders should monitor pullbacks into the $0.70–$0.75 zone as potential accumulation opportunities. Any retest of broken wedge resistance turning into support would strengthen the bullish thesis.

Conclusion

IMX is at an inflection point. After an extended corrective cycle, the technical structure suggests the potential start of a new bullish phase. With clear invalidation levels and defined upside targets, IMX/USDT presents a setup worth monitoring closely for trend reversal confirmation.

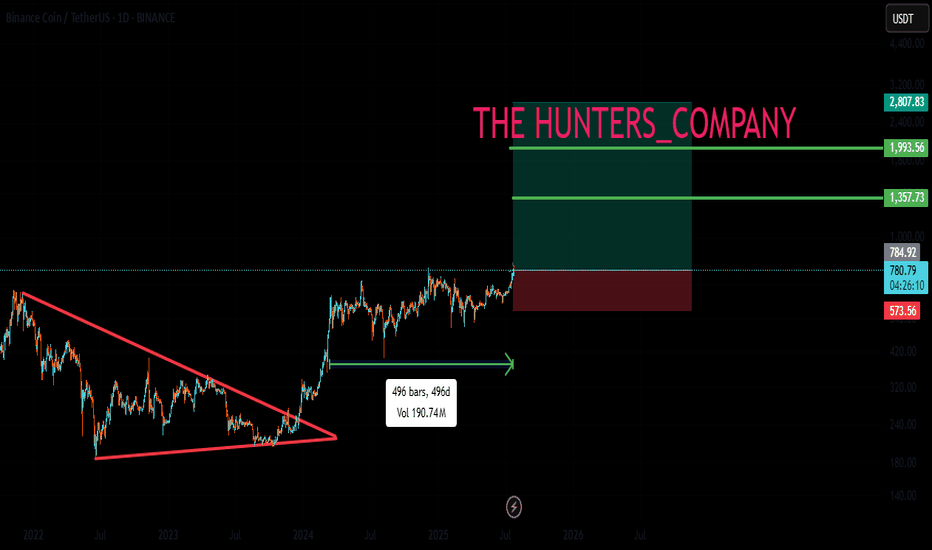

BNB WEEKLYHello friends🙌

🔊We are here with BNB analysis:

A long-term analysis that can be viewed as an investment, but in the long term, with patience and capital management...

You can see that after weeks of price suffering, a good upward move has now been formed by buyers, which has also caused a new ceiling to be set. Considering the market decline and the decline of most currencies, you can see that BNB is well supported and its price has suffered.

⚠Now, with the arrival of buyers, you can enter a long-term buy trade with capital management.

🔥Follow us for more signals🔥

*Trade safely with us*

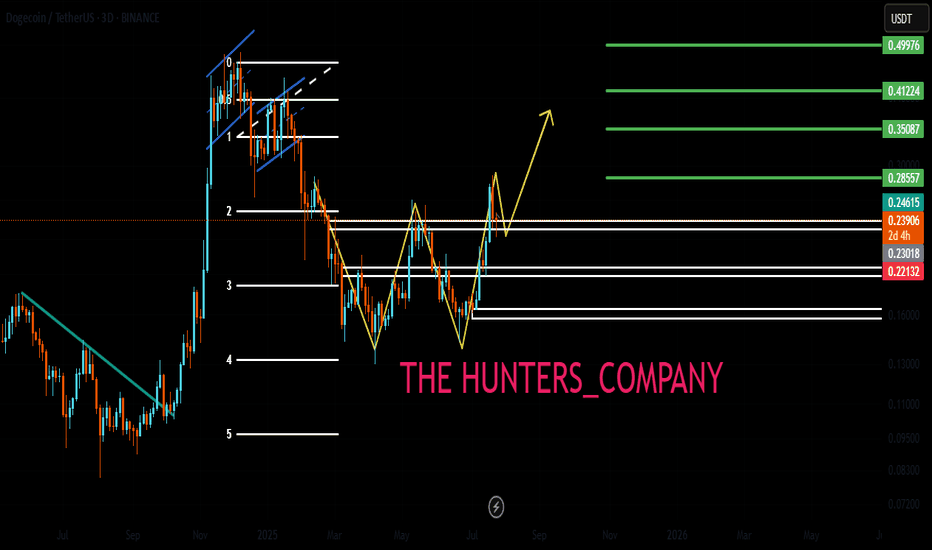

DOGECOIN : Should we expect an increase?Hello friends🙌

📈Given the decline we had, you can see that buyers entered at the specified support and formed a double bottom reversal pattern, which is a strong signal on support.

📉Considering the possible market correction, we placed two more buy levels lower so that we can buy there if the price corrects.

⚠Don't forget about capital and risk management, friends.

🔥Follow us for more signals🔥

*Trade safely with us*

VELVET : RISKY BUSINESSHello friends🙌

✅According to the movement logs that this currency has formed, it shows the high purchasing power of buyers and we can also buy in stages during price corrections with risk and capital management and move with it to the specified goals.

🔥Follow us for more signals🔥

*Trade safely with us*