ASX intraday dips continue to attract buyers.ASX200 - 24h expiry

Price action resulted in a new all-time high at 8974.

Offers ample risk/reward to buy at the market.

Intraday dips continue to attract buyers and there is no clear indication that this sequence for trading is coming to an end.

Price action continues to trade around the all-time highs.

20 4hour EMA is at 8925.

We look to Buy at 8926 (stop at 8876)

Our profit targets will be 9076 and 9096

Resistance: 8974 / 9000 / 9050

Support: 8898 / 8820 / 8788

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Asx200

ARIASWAVE MARKET UPDATE - NASDAQ 400K - DOW 200K...In this major market update, I’m sharing fresh analysis that signals the beginning of a powerful new uptrend.

Years of excessive money printing have fueled what appears to be a massive incoming bull market—one that could surpass all previous trends in strength, thanks to the extraordinary liquidity injected into global markets.

We may be entering a modern-day “Roaring 20s 2.0,” but eventually, this cycle will run its course.

For now, the key is to capitalize on the opportunities ahead by making well-informed decisions.

Bearish potential detected for SDFEntry conditions:

(i) lower share price for ASX:SDF along with swing of DMI indicator towards bearishness and RSI downwards, and

(ii) observing market reaction around the share price of $5.89 (open of 20th June).

Stop loss for the trade would be:

(i) above the potential prior resistance of $6.08 from the open of 4th December 2024, or

(i) above the potential prior resistance of $6.19 from the open of 3rd July 2024, depending on risk tolerance.

Bullish potential detected for QUBEntry conditions:

(i) higher share price for ASX:QUB along with swing up of indicators such as DMI/RSI.

Depending on risk tolerance, the stop loss for the trade would be:

(i) a close below the bottom of the formed channel (i.e.: below $4.20), or

(ii) below previous support of $4.11 from the open of 9th May, or

(iii) below the rising 150 day moving average (currently $4.07).

Potential outside week and bullish potential for ALQEntry conditions:

(i) higher share price for ASX:ALQ above the level of the potential outside week noted on 8th August (i.e.: above the level of $18.63).

Stop loss for the trade would be:

(i) below the low of the outside week on 4th August (i.e.: below $17.67), should the trade activate.

ASX200 continues to trade around the all time highs.ASX200 - 24h expiry

Price action resulted in a new all-time high at 8910.

There is no clear indication that the upward move is coming to an end.

The lack of interest is a concern for bears.

Price action continues to trade around the all-time highs.

20 4hour EMA is at 8848.

We look to Buy at 8851 (stop at 8807)

Our profit targets will be 8981 and 9001

Resistance: 8910 / 8950 / 9000

Support: 8865 / 8830 / 8788

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

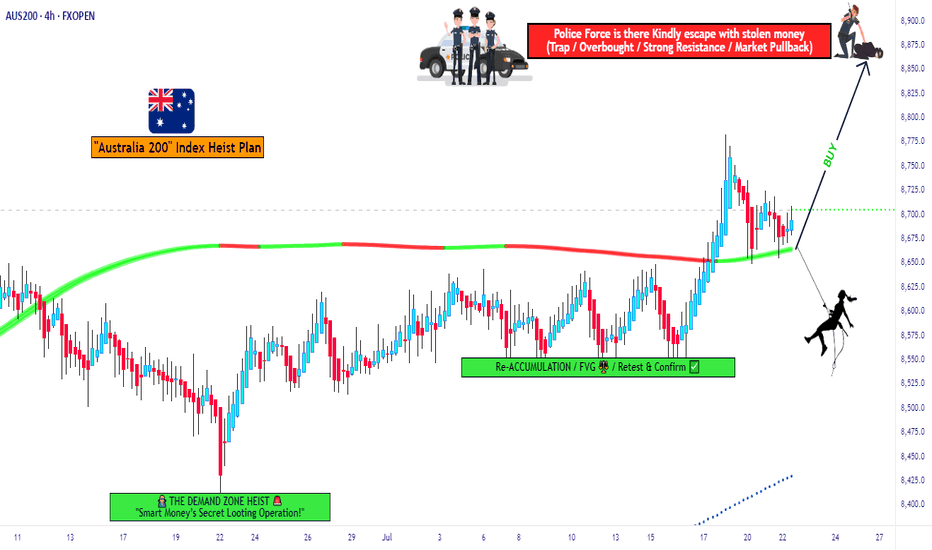

ASX200 Heist Blueprint – Entry, Exit, Escape Mapped Out!💼💣 The ASX200 Heist Blueprint: Bullish Loot Incoming! 🔥💰

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 👋

Welcome back, Money Makers & Market Robbers! 🤑💸✈️

It's time for another high-stakes heist, this time targeting the ASX200 / AUS200 “Australia 200” Index. Get your trading toolkit ready – we're planning a strategic, stealthy bullish operation based on Thief Trader’s signature blend of technical setups + macro fundamental analysis.

💹 ENTRY STRATEGY – "The Vault Is Open!"

The bullish loot is ripe for the taking. Watch for pullbacks on the 15M to 30M charts – layer in limit buy orders near recent swing lows or key levels.

🧠 Use DCA-style (Dollar Cost Averaging) layering to maximize your position like a smart thief scaling walls.

Every entry counts – but precision matters. Time your move, rob the dip, and don’t get caught by the bears. 🐂💥

🛡 STOP LOSS – "Don’t Trip the Alarm!"

Protect your capital like it’s the last stack of bills in the vault.

📉 Suggested SL: Near 4H swing low/high (e.g., 8620.0)

Always adjust based on:

Your risk tolerance

Position size

Number of open entries

Risk smart. The getaway must be clean. 🚁💨

🎯 TARGET – "8880.0 & Beyond!"

That’s the main exit point for our current job.

Expect tough resistance ahead – the police barricade zone where supply, exhaustion, and reversal pressure builds.

Book profits and treat yourself like a boss – your hustle deserves celebration! 💪🎉🍾

📊 Market Condition Overview

The ASX200 is currently in a bullish trend, supported by:

Risk-on sentiment globally 🌐

Aussie economic data strength 📈

Global indices correlation 🧩

Technical confirmations from Thief Trader tools 🔧

📌 Important Note – Stay Informed!

📢 Fundamentals Matter!

Tap into macro analysis, COT reports, geopolitical news, sentiment indicators, and intermarket flows. These are the real gears behind the charts.

📡 Always stay sharp and analyze what’s behind the candles.

⚠️ NEWS TRAP WARNING

🚨 Big news = big volatility. Don’t get caught during releases.

✔️ Avoid opening new positions around high-impact events

✔️ Use trailing SLs to protect open profits

✔️ Manage leverage like a pro thief manages their escape route

💖 Support the Thief Gang!

If this heist plan helped you, hit that Boost 💥 & Follow – it fuels our mission to help more traders rob the market cleanly and smartly.

Together we earn. Together we learn.

🧠💼 Stay tuned for more heist blueprints and tactical break-ins into global markets with the Thief Trading Style™.

🔥 Until next time, rob responsibly. 🕶💸🎯

Bearish potential detected for SUNEntry conditions:

(i) lower share price for ASX:SUN along with swing of DMI indicator towards bearishness and RSI downwards, and

(ii) observing market reaction around the share price of $20.46 (open of 19th May).

Stop loss for the trade would be:

(i) above the potential prior resistance of $21.36 from the open of 5th June, or

(i) above the high of the recent swing high once the trade is activated (currently $22.14 from the high of 1st July), depending on risk tolerance.

Bearish potential detected for AGLEntry conditions:

(i) breach of the lower confines of the Darvas box formation for ASX:AGL

- i.e.: below low of $9.84 of 7th April, and

(ii) swing increased bearishness of indicators such as DMI/RSI along with a test of prior level of support of $10.02 from 11th March.

Stop loss for the trade (based upon the Darvas box formation) would be:

(i) above the high of 10th April (i.e.: above $10.89), or

(ii) above the prior support level from the open of 10th January (i.e.: above $11.15), depending on risk tolerance.

Bullish potential detected for ORGEntry conditions:

(i) breach of the upper confines of the Darvas box formation for ASX:ORG

- i.e.: above high of $11.69 of 16th June (most conservative entry), and

(ii) swing up of indicators such as DMI/RSI.

Stop loss for the trade (based upon the Darvas box formation) would be:

(i) below the support level from the low of 26th June (i.e.: below $10.62).

#ASX: The 9,000 countdown has begun.On August 7, 2025, the #ASX index surged to an all-time high of 8,856.9 points , driven by a rare mix of catalysts: soaring gold prices lifting major miners, expectations of simultaneous easing by the RBA and the Fed boosting bank and media-tech stocks, and steady demand for iron ore and base metals pushing BHP, Rio Tinto, and Fortescue higher. A global “risk-on” sentiment amid falling U.S. yields and short-covering added extra fuel.

Five key drivers that could push the #ASX to new heights:

1. China’s 2025 infrastructure push: Beijing is preparing an expanded lending package for transport and energy projects. This fuels iron ore and copper imports — directly boosting revenues for BHP, Rio Tinto, and Fortescue, which make up ~25% of the index.

2. Gold rally continues: The expected Fed rate cut in September pressures U.S. yields and supports gold prices. Even a move toward $3,500/oz could revive Northern Star, Evolution, and Newmont, adding dozens of points to the index.

3. Dovish RBA + weak AUD: Further rate cuts by the Reserve Bank of Australia (with AUDUSD staying below 0.64) make domestic loans cheaper while increasing export margins for resource and agri stocks.

4. Green metals boom: Rising global demand for lithium, nickel, and rare earths for batteries and renewables is driving up valuations of Pilbara Minerals, IGO, Lynas, and others — boosting the materials sector’s contribution to index growth.

5. Housing sector reversal: Lower mortgage rates and tax breaks for first-home buyers are lifting transaction volumes and online demand via REA Group. Rising home prices traditionally ignite banking and construction stocks, creating a multiplier effect on the index.

#ASX has already climbed near the top — and it has at least five major “boosters” for another rally. According to FreshForex , the index could break above 9,000 even faster if three extra catalysts come into play:

1. Superannuation fund inflows shift toward equities, adding long-term capital.

2. Buybacks and M&A by giants like BHP and Commonwealth Bank reduce float and boost EPS.

3. A fresh IPO wave of lithium and AI startups injects new tech momentum.

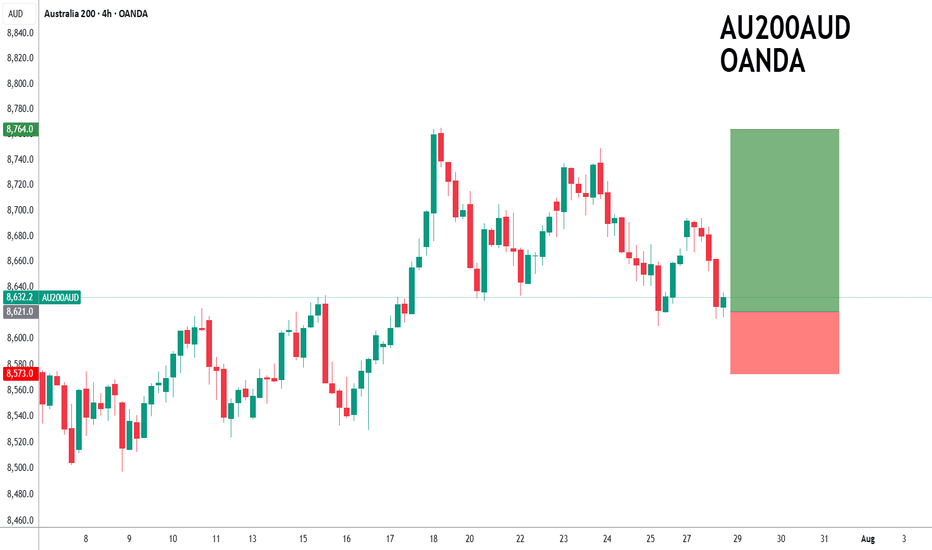

ASX200 to find support at current market price?ASX200 - 24h expiry

The primary trend remains bullish.

Price action continues to trade around the all-time highs.

20 1day EMA is at 8619.

Offers ample risk/reward to buy at the market.

Our outlook is bullish.

We look to Buy at 8621 (stop at 8573)

Our profit targets will be 8764 and 8794

Resistance: 8670 / 8694 / 8749

Support: 8610 / 8570 / 8524

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Bullish potential detected for WDSEntry conditions:

(i) higher share price for ASX:WDS along with swing up of the DMI indicators and swing up of the RSI indicator, and

(ii) observation of market reaction at the support/resistance level at $24.87 (from the open of 14th February).

Stop loss for the trade would be, dependent of risk tolerance (once the trade is activated):

(i) below the support level from the open of 15th July (i.e.: below $23.95), or

(ii) below the recent swing low of 30th June (i.e.: below $23.24).

NOTE: Positive momentum move on 23rd July already in play (suggested not to chase this initial move and await a retracement back towards the support/resistance level of $24.87 and observe the market reaction - potentially overbought with resistance above current price area of $26.20 as at 25th July). If the move keeps going, let it go.

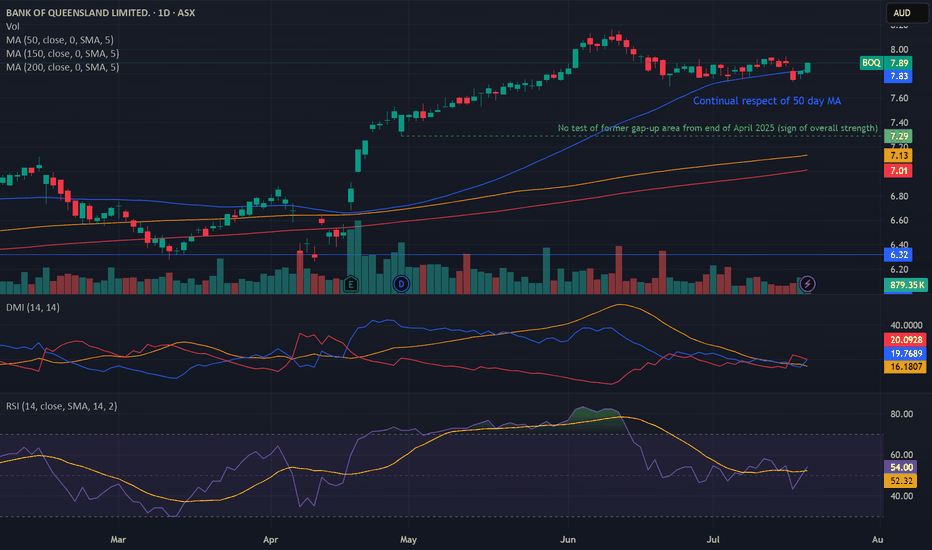

Bullish potential detected for BOQEntry conditions:

(i) higher share price for ASX:BOQ along with swing up of indicators such as DMI/RSI.

Depending on risk tolerance, the stop loss for the trade would be:

(i) a close below the 50 day moving average (currently $7.83), or

(ii) below previous swing low of $7.69 from the low of 23rd June, or

(iii) below previous support of $7.60 from the open of 12th May.

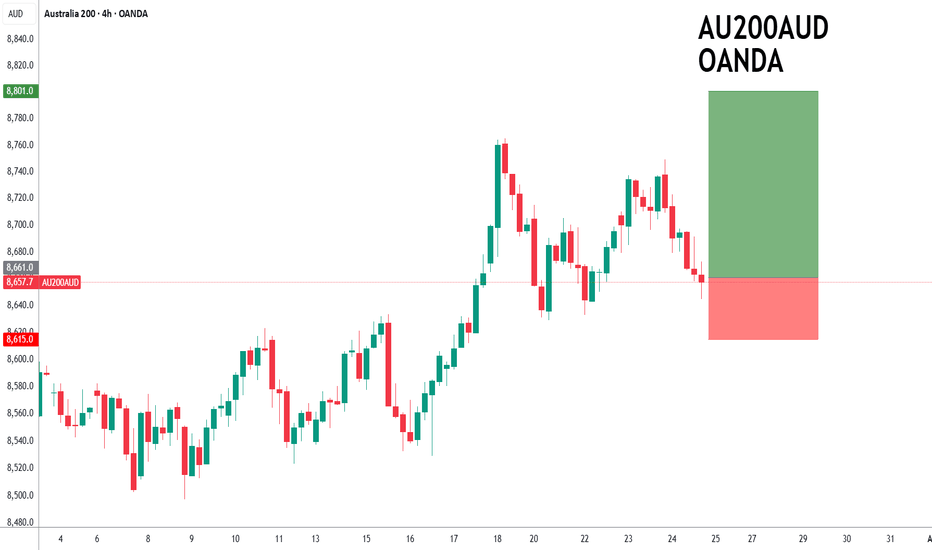

ASX200 to find buyers at current market price?ASX200 - 24h expiry

Price action resulted in a new all-time high at 8765.

Price action continues to trade around the all-time highs.

The bullish engulfing candle on the 4 hour chart the positive for sentiment.

50 4hour EMA is at 8658.

We look for a temporary move lower.

We look to Buy at 8661 (stop at 8615)

Our profit targets will be 8801 and 8831

Resistance: 8700 / 8749 / 8765

Support: 8658 / 8629 / 8600

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

AUS200 Breakout or Fakeout? I Say Breakout – Here's Why🔍 Technical Overview:

After monitoring the recent movement in AUS200, I believe we are in the early phase of a bullish breakout continuation rather than a fakeout.

Uptrend Structure: Price has been consistently respecting higher lows and trending above the green trendline.

Break of Descending Resistance: The downtrend line has now been pierced with momentum candles — a bullish sign.

Buy Condition Set:

Next 1-hour/s candle should close above the intersection (highlighted zone).

Candle should be green, and preferably no wick on the top (indicating strength).

Volume analysis to be considered on confirmation.

✅ Trade Plan:

Buy Zone marked.

Stop Loss Zone clearly defined – I plan to exit the trade if price closes back below the shaded red/gray zone.

Upside Potential: Initial target around 8,820–8,840, with extension toward 8,900+ if momentum sustains.

Risk/Reward ratio looks favorable based on current structure.

📰 Fundamentals:

I have not yet identified any bearish macro or news catalyst that contradicts the current technical picture. If you know of any relevant developments (e.g., RBA policy, earnings, CPI releases), feel free to comment.

🔄 Validation Request:

Would love the community’s take:

Do you see this as a valid breakout?

Any hidden divergence or bearish signals I might have missed?

Let me know if you're tracking the same structure or see something different.

SHORT AUS200/ASX200 - TIME TO SHORT THE AUSSIETeam, over the last few days, we have been successfully SHORT BOTH UK100/AUS200, but I did not post the chart

Today is a good time to post.

Ensure you understand your RISK - can always discuss with us in the room

Let's SHORT UK100/FTSE100, I still expect the market to be volatile even though the US expect a rate cut. on the 9th JULY, there will be a tariff announcement, and it could also extend towards September

We are SHORTING AUS200 at 8586 toward 8616 - SLOWLY

with target at 8562-47

DOUBLE THE SHORT AT 8632-56

Target at 8608-8592

ASX200 short term bias has turned negative.ASX200 - 24h expiry

Short term bias has turned negative.

A shooting star has been posted on the weekly charts.

Bearish divergence is expected to cap gains.

Previous resistance located at 8550.

50 4hour EMA is at 8528.

We look to Sell at 8529 (stop at 8581)

Our profit targets will be 8375 and 8355

Resistance: 8543 / 8574 / 8594

Support: 8476 / 8400 / 8335

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

ASX 200 Looks Set to BounceThe ASX 200 has drifted lower since its latest record high was set six days ago. 8500 held as support before doji formed on Tuesday to mark a false break of this key level. ASX 200 futures also tried but failed to break beneath it overnight.

Given the bullish divergence on the 1-hour RSI (14) and RSI (2), the bias is to seek dips towards 8500 for a cheeky long towards the December high.

Matt Simpson, Market Analyst at City Index and Forexc.com

ASX200 forming a top?ASX200 - 24h expiry

Price action looks to be forming a top. A shooting star has been posted on the weekly charts.

Bearish divergence is expected to cap gains.

Previous resistance located at 8550.

Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible.

We look to Sell at 8549 (stop at 8601)

Our profit targets will be 8395 and 8365

Resistance: 8552 / 8594 / 8629

Support: 8504 / 8450 / 8400

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Bearish potential detected for NHCEntry conditions:

(i) lower share price for ASX:NHC along with swing of DMI indicator towards bearishness and RSI downwards, and

(ii) observing market reaction around the share price of $3.57 (open of 11th April).

Stop loss for the trade would be:

(i) above the high of the recent swing high once the trade is activated (currently $3.75 from the high of 19th May).