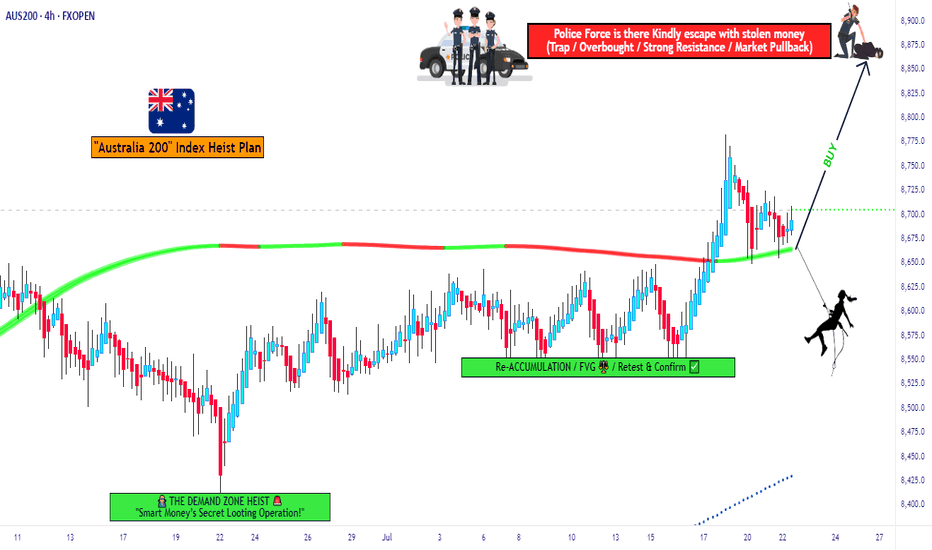

ASX200 Heist Blueprint – Entry, Exit, Escape Mapped Out!💼💣 The ASX200 Heist Blueprint: Bullish Loot Incoming! 🔥💰

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 👋

Welcome back, Money Makers & Market Robbers! 🤑💸✈️

It's time for another high-stakes heist, this time targeting the ASX200 / AUS200 “Australia 200” Index. Get your trading toolkit ready – we're planning a strategic, stealthy bullish operation based on Thief Trader’s signature blend of technical setups + macro fundamental analysis.

💹 ENTRY STRATEGY – "The Vault Is Open!"

The bullish loot is ripe for the taking. Watch for pullbacks on the 15M to 30M charts – layer in limit buy orders near recent swing lows or key levels.

🧠 Use DCA-style (Dollar Cost Averaging) layering to maximize your position like a smart thief scaling walls.

Every entry counts – but precision matters. Time your move, rob the dip, and don’t get caught by the bears. 🐂💥

🛡 STOP LOSS – "Don’t Trip the Alarm!"

Protect your capital like it’s the last stack of bills in the vault.

📉 Suggested SL: Near 4H swing low/high (e.g., 8620.0)

Always adjust based on:

Your risk tolerance

Position size

Number of open entries

Risk smart. The getaway must be clean. 🚁💨

🎯 TARGET – "8880.0 & Beyond!"

That’s the main exit point for our current job.

Expect tough resistance ahead – the police barricade zone where supply, exhaustion, and reversal pressure builds.

Book profits and treat yourself like a boss – your hustle deserves celebration! 💪🎉🍾

📊 Market Condition Overview

The ASX200 is currently in a bullish trend, supported by:

Risk-on sentiment globally 🌐

Aussie economic data strength 📈

Global indices correlation 🧩

Technical confirmations from Thief Trader tools 🔧

📌 Important Note – Stay Informed!

📢 Fundamentals Matter!

Tap into macro analysis, COT reports, geopolitical news, sentiment indicators, and intermarket flows. These are the real gears behind the charts.

📡 Always stay sharp and analyze what’s behind the candles.

⚠️ NEWS TRAP WARNING

🚨 Big news = big volatility. Don’t get caught during releases.

✔️ Avoid opening new positions around high-impact events

✔️ Use trailing SLs to protect open profits

✔️ Manage leverage like a pro thief manages their escape route

💖 Support the Thief Gang!

If this heist plan helped you, hit that Boost 💥 & Follow – it fuels our mission to help more traders rob the market cleanly and smartly.

Together we earn. Together we learn.

🧠💼 Stay tuned for more heist blueprints and tactical break-ins into global markets with the Thief Trading Style™.

🔥 Until next time, rob responsibly. 🕶💸🎯

Asx200signal

AUS200 Breakout or Fakeout? I Say Breakout – Here's Why🔍 Technical Overview:

After monitoring the recent movement in AUS200, I believe we are in the early phase of a bullish breakout continuation rather than a fakeout.

Uptrend Structure: Price has been consistently respecting higher lows and trending above the green trendline.

Break of Descending Resistance: The downtrend line has now been pierced with momentum candles — a bullish sign.

Buy Condition Set:

Next 1-hour/s candle should close above the intersection (highlighted zone).

Candle should be green, and preferably no wick on the top (indicating strength).

Volume analysis to be considered on confirmation.

✅ Trade Plan:

Buy Zone marked.

Stop Loss Zone clearly defined – I plan to exit the trade if price closes back below the shaded red/gray zone.

Upside Potential: Initial target around 8,820–8,840, with extension toward 8,900+ if momentum sustains.

Risk/Reward ratio looks favorable based on current structure.

📰 Fundamentals:

I have not yet identified any bearish macro or news catalyst that contradicts the current technical picture. If you know of any relevant developments (e.g., RBA policy, earnings, CPI releases), feel free to comment.

🔄 Validation Request:

Would love the community’s take:

Do you see this as a valid breakout?

Any hidden divergence or bearish signals I might have missed?

Let me know if you're tracking the same structure or see something different.

SHORT AUS200/ASX200 - TIME TO SHORT THE AUSSIETeam, over the last few days, we have been successfully SHORT BOTH UK100/AUS200, but I did not post the chart

Today is a good time to post.

Ensure you understand your RISK - can always discuss with us in the room

Let's SHORT UK100/FTSE100, I still expect the market to be volatile even though the US expect a rate cut. on the 9th JULY, there will be a tariff announcement, and it could also extend towards September

We are SHORTING AUS200 at 8586 toward 8616 - SLOWLY

with target at 8562-47

DOUBLE THE SHORT AT 8632-56

Target at 8608-8592

AUS200/ASX200 - TIME FOR A KILLTeam, another successful trading at ActiveTraderCommunity - we have hit 4/4 trades again today with target hit.

AUS200/ASX200 has been one of my favorite, but it moves like a snail. However I have all the time in the world to be patience and that what I am good at when it comes in term of trading. Be patience until the PRICE IS RIGHT

Please carefully look at two TARGET price ranges

Target 1 at 8478-8473 - please take 70% profit once it hit here and bring stop loss to BE

Target 2 at 8467-8458 - close our chapter

PLEASE NOTE: These two prices are also taking into consideration base on my statistic and probability of highly chance the target will hit.

Make sure you follow my channel for further trade. As we have not losing a trade for a very long long time. Also click on video above and you will see all my trade are accurate.

ASX200/AUS200 "Australia 200" Indices Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the ASX200/AUS200 "Australia 200" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (8360) swing Trade Basis Using the 3H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 8000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Sentimental Outlook:

ASX200/AUS200 "Australia 200" Indices Market is currently experiencing a Bearish trend in short term, driven by several key factors.

⭐Fundamental Analysis

Earnings: Q4 2024 EPS growth strong for ASX 200 firms (e.g., banks, miners); Q1 2025 prelims suggest resilience—bullish.

Rates: RBA at 4.35% (stable, Feb 2025)—high yields vs. ECB (2.5%) pressure equities—bearish.

Inflation: Australia at 2.8% (Jan 2025)—above RBA’s 2-3% target, mixed impact.

Growth: GDP ~1.5% (Q4 2024 est.)—steady, mildly bullish.

Geopolitics: U.S.-China tariffs shift trade to Australia—bullish for miners.

⭐Macroeconomic Factors

U.S.: Fed at 3-3.5%, PCE 2.6%—USD softness aids AUD—bullish (Eurostat/U.S. data).

Eurozone: PMI 46.2—stagnation pressures global equities—bearish

Global: China 4.5%, Japan 1%—slow growth, commodity demand soft—bearish (ECB forecasts).

Commodities: Iron ore ~$100/ton, oil $70.44—stable, neutral for ASX miners/energy (global data).

Trump Policies: Tariffs (25% Mexico/Canada, 10% China)—benefits Australian exports—bullish.

⭐Global Market Analysis

Equity Markets: S&P 500 at 5,990, DAX ~19,000—range-bound, neutral correlation with ASX.

Commodities Influence: Stable mining/energy sectors (BHP, Rio Tinto) support ASX—bullish.

Liquidity: High trading volume reflects global interest—bullish stability.

⭐Commitments of Traders (COT) Data

Speculators: Net long ~60,000 contracts (down from 70,000)—cautious bullishness (global futures).

Hedgers: Net short ~65,000—stable, locking in highs.

Open Interest: ~130,000 contracts—steady global interest, neutral.

⭐Market Sentiment Analysis

Retail: 55% short contrarian upside—bullish potential.

Institutional: Mixed—optimism for miners, caution on rates—neutral.

Corporate: Firms hedge at 8,600-8,650—neutral.

Social media Trends: Bearish bias to 8,200-8,160—bearish short-term (

⭐Positioning Analysis

Speculative: Longs target 8,675-8,700, shorts aim for 8,080-8,000.

Retail: Shorts at 8,568-8,600—squeeze risk if price rises.

Institutional: Balanced, commodity-focused optimism.

⭐Next Trend Move

Technical:

Support: 8080-8000

Resistance: 8,675-8,700

Below 8,080 targets 8,000; above 8,675 aims for 8,750.

Short-Term (1-2 Weeks): Dip to 8,000 if risk-off persists; rebound to 8,700 if support holds.

Medium-Term (1-3 Months): Range 8,080-8,800, tariff-driven.

⭐Overall Summary Outlook

ASX 200 at 8,080.00 balances bullish fundamentals (earnings, tariffs, commodity stability) with bearish pressures (global slowdown, RBA rates, sentiment). COT shows cautious longs, positioning suggests short-term caution, and global trends support a dip before recovery. Short-term downside to 8,000 likely, with medium-term upside to 8,800 if macro stabilizes.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

ASX200 "Australia 200 Index" Money Heist Plan on BearishHello My Dear Robbers / Money Makers & Losers, 🤑💰

This is our master plan to Heist ASX200 "Australia 200 Index" Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich 💰.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Entry : Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe Recent / Nearest Swing High

Stop Loss 🛑: Recent Swing High using 1h timeframe

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂b

ASX looks set to retrace from resistanceThe ASX 200 cash market enjoyed its most bullish day in seven on Thursday. But like the SPI 200 futures contract, it met resistance before pausing.

The daily chart shows that a double top formed around the June 26 high and trend resistance. And as it's not unusual to see a market retrace against a strong move, and we have an NFP report looming which could suppress volatility, we're looking for prices to retrace lower against yesterday's rally.

Bears could target the 20-day EMA between the weekly and monthly pivot point, with a stop above yesterday's high.

SPI 200 hints at bullish breakoutPrices have been coiling on the daily chart to form a potential bullish pennant / symmetrical triangle, which hints at further gains. RSI (14) remains over 50 on the daily chart, and volumes were lower during the consolidation to show lack of conviction from bears, sellers stepping in at the cycle highs.

The 1-hour chart shows prices retracing lower after RSI (2) reached overbought, alongside a bearish pinbar at the cycle high. We're now looking for price to either hold above the triangle breakout level, or for RSI (2) to reach oversold whilst prices hold above the high-volume node.

From here, the bias is for a rise to 7850m or the weekly pivot point just above the high-volume node at 7866.

SPI 200 looks set for lift-off ahead of US PCE dataWe have a huge risk event in the coming hours; US PCE inflation. Should it come in softer than expected, risk is likely to pick up as this is how it has behaved pretty much every time inflation has come in soft. Conversely, a hot inflation report could dent risk - but we suspect not to such a large degree.

Fed members have been very vocal about maintaining higher rates, and markets seem more likely to jump on any chance of re-pricing in multiple cuts which could send indices higher.

SPI 200 futures (of the ASX 200 cash market) just tapped a record high ahead of the European Open. Given the US dollar is also retracing, it suggests traders are placing last minute bets of a softer inflation report.

But the bullish trend structure of the SPI 200 futures chart is hard to ignore. Prices have remained above the bullish trendline despite two intraday spikes below it. And an inverted head and shoulders pattern (bullish continuation during an uptrend) appears to have formed at the record high, which projects an upside target around 7900. The 100% projection of the prior rally lands around 7800.