Breakout

NEIROCTO: Coiling Up for a Breakout?NEIROCTO might be preparing for a strong upside move after weeks of selling pressure.

🔹 Break of Structure on 4H (BOS) — market structure has shifted bullish after printing a higher high. This is often the first sign of trend reversal.

🔹 Major Downtrend Line Test — price is consolidating just below a multi-week trendline. A clean break could trigger aggressive buying.

🔹 Risk/Reward in Bulls’ Favor — current setup offers a potential 80% move with 3.55 R/R — very attractive conditions.

If NEIROCTO breaks and closes above the trendline, we could see acceleration toward the 0.0003189 level.

Entry: 0.0001770

Stop-loss: 0.0001370

Target: 0.0003189

Risk/Reward: 3.55

More thoughts in my profile @93balaclava

Personally I trade on a platform that offers low fees and strong execution. DM me if you're interested.

Triple Tap, Then Boom: ETH Breakout Brewing?We're looking at a classic ascending triangle setup on ETH. Price has tapped the resistance zone around $1676 three times already — the next attempt could lead to a breakout. Market structure is clean: higher lows with strong bullish momentum squeezing price toward the horizontal resistance.

This pattern usually ends with a strong impulse up, and considering the overall sentiment, this could be the beginning of a new local rally.

Entry: $1630-1650

SL: $1582

TP: $1820

Risk/Reward: 4.0

More thoughts in my profile @93balaclava

Personally I trade on a platform that offers low fees and strong execution. DM me if you're interested.

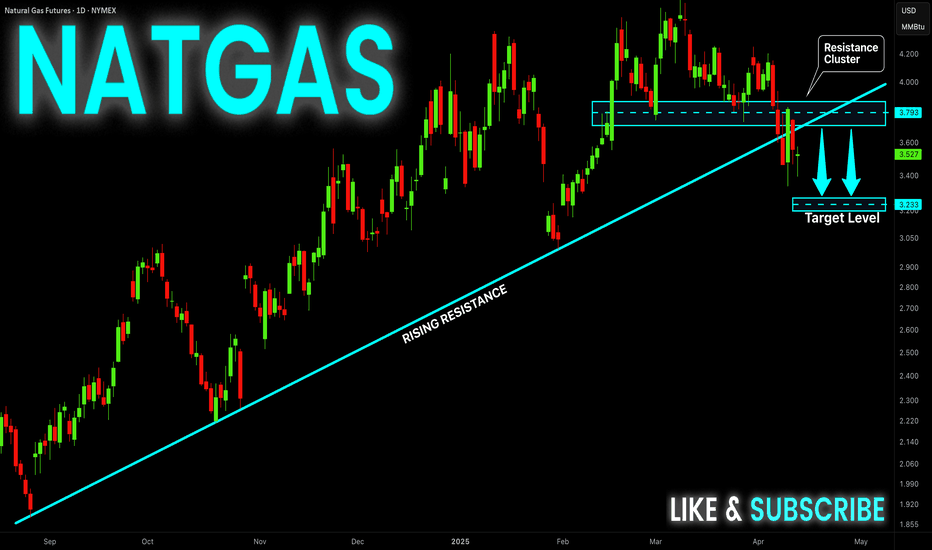

Gold can make correction to mirorr line, after upward movementHello traders, I want share with you my opinion about Gold. After a strong breakout from the support area between 2975 - 3000 points, the price continued moving upward, forming an impulsive rally. This movement brought the asset directly into the upper support area, now acting as resistance, between 3195 - 3170 points. Once inside this zone, the bullish momentum began to slow down. This area also aligns with previous local highs and is showing clear signs of selling pressure. The recent reaction from the top of the zone suggests that the market could be preparing for a pullback. If this reaction develops further, I expect the price to head toward the mirror line, which currently acts as a dynamic support level, located around TP1 - 3120 points. This line has historically served as a key structure level - first as resistance, then flipped into support - and now may once again act as a magnet for price. A retest of this level would not break the overall bullish structure but could provide a healthy correction before the next leg. Considering the sharp push into resistance, the potential loss of bullish momentum, and the nearby structural support at 3120 points, I remain bearish in the short term, expecting a local decline. Please share this idea with your friends and click Boost 🚀

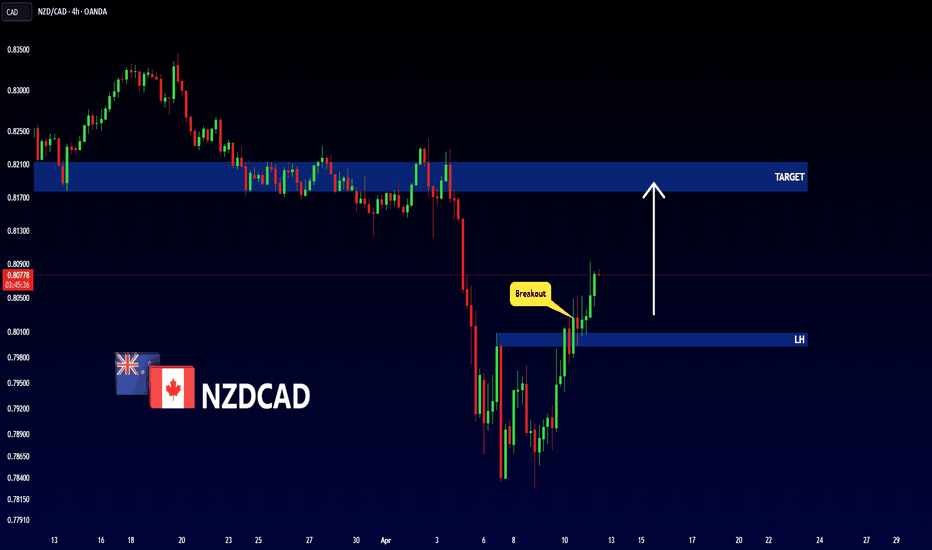

NATGAS Resistance Cluster Above! Sell!

Hello,Traders!

NATGAS made a bearish

Breakout of the support

Cluster of the rising and

Horizontal support levels

Which is now a resistance

Cluster round 3.717$ then

Went down and made a local

Pullback on Thursday and

Friday but we are bearish

Biased mid-term so we

Will be expecting a further

Bearish move down this week

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_USD SWING LONG|

✅EUR_USD made a strong

Breakout of the massive wide

Key horizontal level of 1.1235

Which is now a support and

As the breakout is confirmed

And the pair is in a strong

Uptrend our bullish bias is

Confirmed and we will be

Expecting further growth

On Monday

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

1INCH Rectangle Downside BreakoutLast week, BINANCE:1INCHUSDT fully confirmed a downside breakout from a multi-year rectangle.

If $0.20 isn't reclaimed soon, there is a good chance that the token will head to the $0.06 rectangle target.

Worth watching it, as a failed retest of $0.20 could offer a very good short opportunity, while a sustained daily close above it would invalidate the setup and possibly lead to a retest of $0.45 or even $0.70.

EUR-GBP Bullish Bias! Buy!

Hello,Traders!

EUR-GBP is trading in a

Strong uptrend and the pair

Made a bullish breakout of

The key horizontal level

Of 0.8623 then surged

Further up and is now

Making a local bearish

Correction so we are

Bullish biased and after

The retest of the new

Support level we will be

Expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DXY Breakdown: Bearish Momentum Builds Amid Weak U.S. DataThe U.S. Dollar Index (DXY) is maintaining a clear bearish trajectory, with price action on the H4 chart showing a consistent pattern of lower highs and lower lows inside a descending channel. The technical structure points to continued selling pressure, and recent fundamental developments only reinforce this view.

📰 Key drivers behind the decline:

The latest U.S. CPI data came in weaker than expected, signaling easing inflationary pressure and fueling expectations that the Federal Reserve may cut interest rates sooner than anticipated.

A slight uptick in jobless claims has raised concerns that the U.S. labor market may be losing momentum.

Simultaneously, global players like China and Japan are shifting toward more stable monetary policy, prompting capital flows away from the dollar.

📉 From a technical perspective, DXY has broken below the key 100.817 support zone and is now trading around 99.7. Each attempt at a bullish pullback has been short-lived, with sellers regaining control quickly. The green arrows on the chart indicate potential reaction zones, but the descending channel structure remains firmly intact.

Outlook: If the index fails to reclaim the 100.8 – 101.3 resistance area, there’s a high probability of further downside toward the 98.5 – 98.0 support region.

In short, DXY is under pressure both technically and fundamentally, which explains the current bullish momentum in EUR/USD, GBP/USD, and especially gold (XAU/USD).

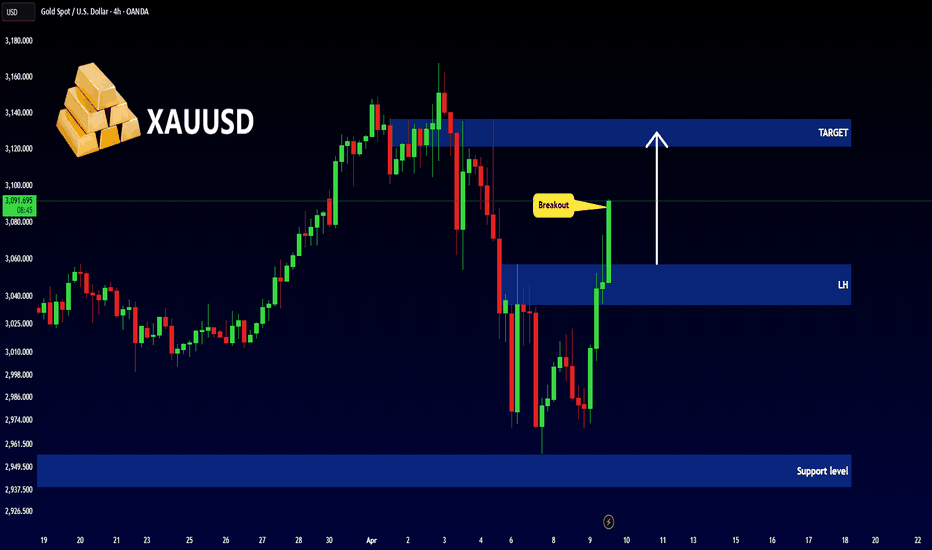

Gold Rebounds Off Key Support — Next Leg to $4,200 = 124,000 PIP

View our previous 120,000 PIPs (target hit) Gold trades at the bottom of this page.

Following our previously fulfilled short trade from the top of the ascending channel (TP2 hit at $2,960), gold has now landed precisely at confluence support — aligning with the psychological $3,000 level, ascending channel support, the quarterly dynamic support, and the prior swing high zone. We are now flipping bias long, with a macro continuation in mind, while still respecting the shorter-term range structure.

Structure & Setup:

Another clean reaction from the ascending channel’s lower boundary reaffirms the structure’s technical validity. Price has now tapped the $3,000 round number support, intersecting with the channel base and our prior short target zone — offering strong risk-defined long opportunities.

Macro Context Holds:

Our long-term thesis targeting $4,270 remains intact, backed by structural breakout on the quarterly chart and fundamental gold demand. This move is potentially the start of the next impulsive leg in a broader macro expansion, though we expect the asset to oscillate within the channel boundaries until at least July.

Entry Logic:

This long setup is based on:

– Channel base bounce

– $3,000 psychological round number

- $2,960 quarterly dynamic support

– Reversal at former Take Profit 2 (TP2) short target

– Tight invalidation just below $2,960

– Favourable 1:11+ R:R targeting macro highs

Invalidation:

A clean break and close below $2,960 would invalidate the long thesis and suggest breakdown risk. Until then, structure holds.

Pip Potential:

From $2,960 to $4,200 = 124,000 pips upside potential — aligning with macro projections and Fib extensions from previous cycles (-1.414 & -1.618 zones).

Outlook:

While $4,200 remains our long-term target, we anticipate ranging between $2,960–$3,200 for the next several months. This accumulation phase may precede a breakout leg that targets historical Fibonacci confluence zones.

Summary:

Short trade complete — bias flipped long. We’ve now transitioned from a completed 1:4 R:R short into a 1:11+ macro long off textbook technical levels. Price action is behaving cleanly within the multi-month channel, and this latest support reaction adds further credibility to the bullish continuation thesis.

Let price consolidate — buy positions accordingly. The macro expansion to $4,200 is likely underway.

Previous Short:

75,000 PIP idea (Target hit):

45,000 PIP idea (Target hit):

RSR/USDT: FALLING WEDGE BREAKOUT! 100%+ PROFIT POTENTIAL!!🚀 Hey Traders! RSR Breakout Alert – 100%+ Rally Incoming? 👀🔥

If you’re hyped for big moves and real alpha, smash that 👍 and hit Follow for high-accuracy trade setups that actually deliver! 💹🚀

RSR has just broken out of a falling wedge structure on the daily timeframe—a powerful bullish pattern. The chart’s signaling a potential 100–150% upside move if momentum picks up from here. 📈

📍 Entry Zone: CMP – Add more on dips down to $0.0066

🎯 Target: 100%–150% upside

🛑 Stop-Loss: $0.0054

📊 Trade Plan:

✅ Buy from current levels

✅ Add on dips near breakout support

✅ Ride the breakout wave with tight risk control!

💬 What’s Your Take?

Are you riding this RSR breakout or waiting on confirmation? Drop your thoughts and targets in the comments—let’s ride this wave together! 💰🔥

Bitcoin will continue to fall inside downward channelHello traders, I want share with you my opinion about Bitcoin. If we look at the chart, we can see how the price entered to downward channel, where it once declined to the channel's support line, which coincided with the resistance level and seller zone. Next, the price some time traded inside this area and even little declined below, but then it turned around and in a short time rose to the resistance line of the channel and made a fake breakout, after which it made a correction. Bitcoin long time traded inside seller zone and then broke 82000 level and declined to support level, which coincided with buyer zone. Then it made upward movement, after which it turned around and declined back to 75000 level. Recently, BTC bounced and started to grow, but in my mind, Bitcoin can rise a little more and then continue to decline inside a downward channel. Bitcoin will break the support level and fall to the 71800 support line of the channel, where my TP is located. Please share this idea with your friends and click Boost 🚀

Will 3 Times Be The Charm For GBPUSD??We can see FX:GBPUSD retrace a tad further up to the Volume Imbalance that was created over the weekend of April 4th - 7th. After Price made its High @ 1.3207, it was immediately rejected back down below the Past Level of Support that is now showing signs of Resistance!

- Following that Higher High not only resulted in a Lower Low but also sent the RSI under 50 into Bearish Territory!

Now in the ICT Methodology of Volume Imbalances, Price is likely to Test or Fill the Imbalance, then once satisfied, has a high potential to turn the opposite direction. Now a Pullback to Fill the Imbalance would land Price right at the 38.2% Fibonacci Level @ 1.28984 where if Bulls are unable to push Price back above, would be an excellent Shorting Opportunity for Bears to overcome.

- RSI is now below the 50 suggesting Bulls have lost steam and strengthens the potential for more downside to occur but that would call for a Break and Retest Scenario on the Rising Support.

Fundamentally, the Federal Reserve will be releasing the CPI y/y and m/m results where analysts believe there to be a .3% decrease in inflation forecasting a 2.5% CPI for March from the previous 2.8% for February. Given this, the FOMC " do not plan to come to rescue Trump with rate cuts" and insist that all the Tariff pressure will actually be a reasoning for Inflation to Rise! So if CPI ends up printing Hotter than Expected (Higher), we could see a renewed strength in the USD.

HAPPENING NOW?! HERTZ CUP AND HANDLE BREAKOUT 1D CHART?HERTZ (HTZ) Price rose significantly to $4.26 on the 1 Day chart. Is this a sign of an impending bullish breakout? My personal target opinion for bullish movement is $5.50. Will this be a major bullish turning point for Hertz? Or will it be a easy grab for traders running short positions?

Bond Futures Back At SupportTrade is fairly simple here. Go long treasuries and if it breaks down cut.

- A bounce and push back up could be another ugly catalyst for the US stock market.

- A breakdown however would push yields up (and economic growth forecasts) which would be quite bullish for stocks especially down at these levels

GBP-USD Strong Breakout! Sell!

Hello,Traders!

GBP-USD made a bearish

Breakout of the key wide horizontal

Level of 1.2851 then made a

Pullback so we are bearish

Biased and a further bearish

Continuation is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ETHEREUM BEARISH BREAKOUT|SHORT|

✅ETHEREUM keeps falling

Down and the price made a

Bearish breakout of the

Key horizontal level of 1600$

And the breakout is confirmed

So we are bearish biased

And we will be expecting a

Further bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.