Let's always put our trust in BTC, mate.Bitcoin Market Analysis

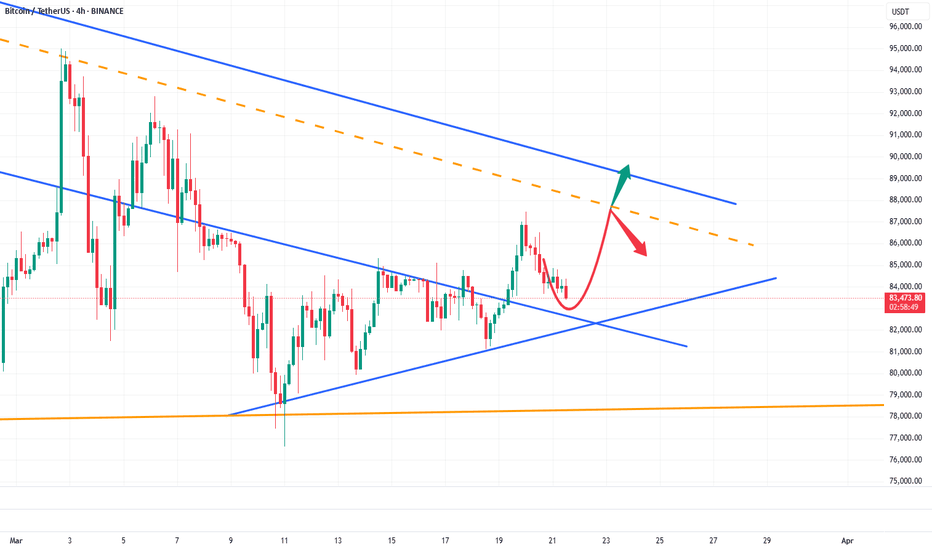

BTC price hovers around 84,000 in consolidation. Bulls and bears battle at this price.

Support Level

Support is in 81,000 - 82,000. Strong buying emerges there. It stopped drops in past corrections. Dense holdings mean many cost - bases are in this range, propping up support.

Resistance Level

Resistance at 87,000. K - lines show heavy selling near it. Past break - throughs failed. Trapped or profit - taking positions sell as price nears, creating resistance.

Bullish Outlook

I'm bullish. Global recovery raises risk appetite for BTC. More institutions hold BTC, boosting price. Positive sentiment on long - term prospects, due to blockchain growth, helps. Upward - diverging moving averages show uptrend. Lower volume in consolidation, but activity stays. New positives may push price to resistance.

💎💎💎 BTC 💎💎💎

🎁 Buy@83500 - 84000

🎁 TP 86000 - 87000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

Btctrend

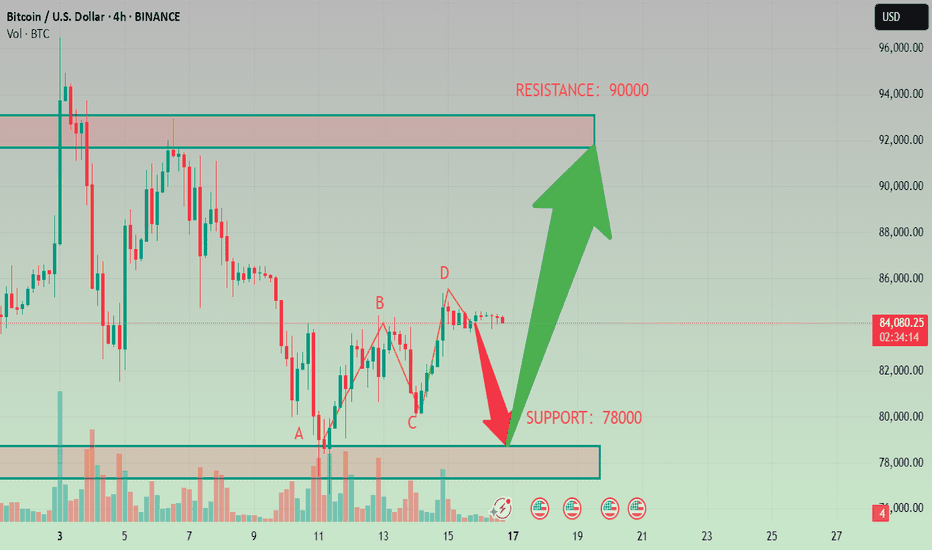

BTC: Accumulate energy for the rise and soar into the sky!📍BTC's volatility has narrowed, with selling pressure showing signs of weakening. Throughout the choppy price action, the 84000-83500 zone has established itself as a critical support area in the short-term structure. This level now serves as a key defensive line.

📍Following this consolidation phase, BTC may stage a rebound from this support region. If the price manages to break through the resistance around 84800 with strength, further upside momentum could drive it towards the 90000 level.

🔎Trade Idea:

BTCUSD:Buy at 83500-83000

TP:84500-85000

SL:Adjust according to risk tolerance.

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

BTC Breaks Structure - Key Levels to Watch PLUS Trade Idea!Bitcoin has broken structure to the upside on the daily timeframe, confirming a bullish trend 📈. I’m considering a buy opportunity, but only if the key conditions discussed in the video align.

Right now, BTC is in a strong uptrend, with a well-defined higher highs and higher lows structure on the 4-hour timeframe 🔍. In this video, we break down the trend, price action, market structure, and other essential aspects of technical analysis to navigate this setup effectively.

⚠️ Not financial advice.

Bitcoin Index-3 Strength index. Tells us what ? Bull Or Bear ?This post will include the same chart as a Month, Weekly, Daily and 4 hour

The 3 indicators are

RSI - RSI, or Relative Strength Index, is a momentum oscillator used in technical analysis to identify overbought or oversold conditions in the price

TSI - The True Strength Index indicator is a momentum oscillator designed to detect, confirm or visualize the strength of a trend. - the True Strength Index (TSI) does show trend direction.

ADX - the Average Directional Index (ADX) shows the strength of a market trend, NOT its direction. The base line is 25 - Above is strong trned, below is weaker trend

ADX is Yellow - DI + is orange ( positive price index) - DI - is Red ( Negative price index

MONTHLY

The main chart is the monthly chart - the vertical lines Mark Years

Note how ATH's are all Above the Rising upper trend line.

From the Left,

2013 ATH - Note how RSI and TSI both peaked BEFORE ATH, as did the DI+ on the ADX indicator. The ADX itself turned down Later

2017 ATH saw a similar pattern

2021 was slightly different. RSI and TSI peaked on the March ATH but the true cycle ATH was in Q4 ( Nov) , as are most BTC Cycle ATH - Note the sudden drops in both ( probably due to deleveraged)

The DI+ on the ADX did the same but note how the ADX itself peaked in NOV - The ADX seemingly being more accurate on showing us Cycle Top by Trend.

Currently,

The RSI has not entered Fully OVERBOUGHT as in previous cycles. Has Fallen below Overbought entry line in recent weeks. Maybe leveling out

TSI ( orange) is falling since Jan, showing a bearish trend - Falling towards its own average.. PA has been falling in this time.

ADX has also slowed and flatten out, showing a weakening of trend. NOTE - ADX does not show us Trend direction...So, in recent months, we have seen a DROP in PA.

Weakening of this trend could be pointing towards a reversal ?

Also look at the orange DI+ line in ADX....It is getting Lower on each ATH, harder to move higher as Price increase makes BTC harder to move

THE WEEKLY begins to show us more info

This starts to get interesting here

Note that in 2021, It was as we saw in the monthly Except the ADX fell after the March ATH and did not rise again untill half way through 2021 when the Bear Kicked in Fully. The ADX here is showing the strength of that Bear Market as Luna, FTX and 3 arrows collapsed.

The RSI and TSI remained flat Till Jan 2023, when we saw PA beginning to recover. Notice I said RECOVER. I said it at the time and I say it again..Jan 2023 till September was recovery from avery deep Bear market. This is backed up by the fact that the ADX remained Flat untill Late August 2023. Showed No TREND

Then we saw ADX rise, TSI rise off Neutral and RSI begin to head towards Overbought.

All 3 then Dipped in Mid 2024, Rose again to End of 2024 and since then, we have seen the RSI and TSI drop below their averages, head to Neutral

ADX continied to rise as DI+ Dropped, showing us this was a Bearish Trend after all.

However, since beginning of March, the ADX has been showing a weakening of this trend. Still Bearish as the rise in DI - shows, but it is getting weaker.

DAILY begins to show us what could be heading for a new trend, maybe

BTC PA dropped since Feb as did the RSI and TSI, though they have recently stopped doing that and have tried to bounce but still remain below Neutral.

The reason for this is shown in the ADX that has continued to rise untill March, Keeping that Bearish trend Active and strong. This is confirmed by the DI - ( red ) being above the DI +

Even though this trend has weakened, DI + remains flat showing that a change in trend does not appear to be happening to quickly.

Note how the ADX has turned and is beginning to rise higher as the TSI and RSI flatten out

Hpwever. DI - also remain flat.

Change could be near. It is not happening yet but......

The 4 hour chart is full of Noise but given whet we just seen, it may be relevant to see it

It is Volatile but we can see on BTC PA how PA slowed its drop from March and has ranged with a reducing high Low.

We can see how the RSI and TSI rose, dipped and Rose to their current positions near Neutral.

We can see on the ADX, in the centre , was the Last Bearish push, BTC PA Dropped sharply but the trend weakened quickly. the Bears are getting tired.

We see the attempt by the BULLS around the 11 march to push PA higher.

This failed..but showed us the bulls are still here.

The Fact that the ADX is below the DI lines is a sign that a Trend no longer exists or is very weak

The previous Bearish Trend is possibly exhausted.

We have signs that Price recovery is possible from here though I think we will wait a bit longer before we see it.

My conclusion is that we maybe seeing the beginning of a change , a reversal, but it may take a little while before we see the Fruits fully. Possibly up to 5 - 6 weeks or more.

The shorter term data shows we could make a push to top of range ( or near) but that could get rejected.. We need more strength for the long term

But I suggest you read this, look at these charts and make up your own mind.

Because they are hard to read in many ways, Trends can spring up any time, in any direction.

We can only look at them and think..

I wish you well

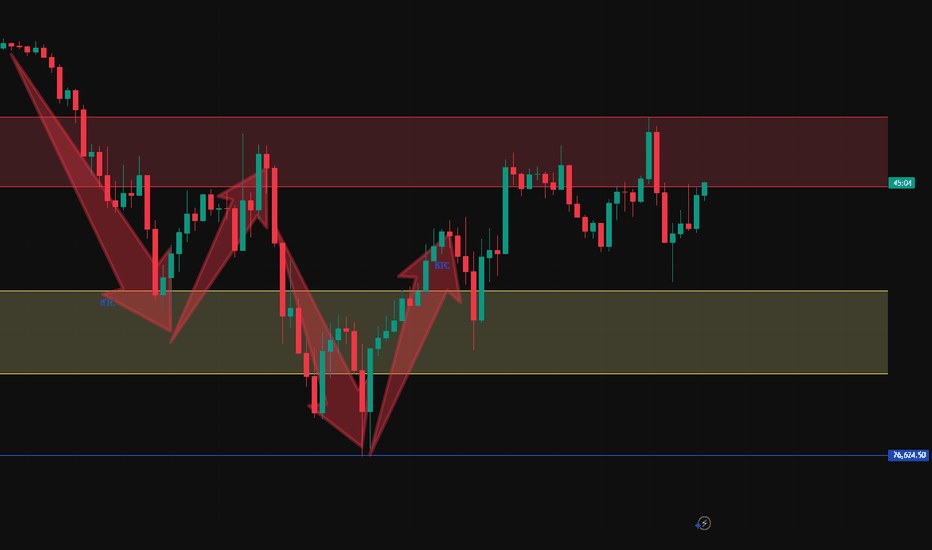

BTCUSD Analysis StrategyToday's Bitcoin market shows the dual characteristics of technical correction and cautious market sentiment. The short - term risk is inclined to the downside, but there is still rebound potential in the medium - and long - term.

The fact that the price of Bitcoin has fallen below $84,000 does not mean the end of Bitcoin. Instead, it is just a part of the market operation. For investors, the key to success lies in understanding the underlying factors of the market and correctly assessing the risks and opportunities. In a market full of uncertainties, only by staying calm and conducting rational analysis can one seize the future opportunities.

Bitcoin Trading Strategy

sell @ 90000

buy @ 78000

Finally, I'd like to remind every investor that the cryptocurrency market is inherently highly volatile, and every decision you make may have an impact on your investment returns. In this rapidly changing market, what we need is not just luck, but also a keen mind. You are all welcome to follow me. Let's discuss the future of Bitcoin together. Perhaps it is through the collision of ideas between you and me that we can gain a clearer understanding of this market.

Bitcoin Reversal or Dead Cat Bounce? Here's My Trading Plan! Analyzing BTC on the higher timeframe, we observe a clear structural shift in the prevailing trend 📊. Dropping down to the 4-hour chart, there is a decisive bullish break 📈, leaving behind an imbalance following the initial move—an area that could serve as a retracement target 🎯. Notably, this imbalance aligns with a Fibonacci retracement into equilibrium 📐, adding confluence to the setup.

I am considering a long position 💰, but only if the key conditions outlined in the video materialize ✅. If those conditions fail to align, I will discard this trade idea ❌.

⚠️ Not financial advice.

Bitcoin's market share rises despite decline in active usersThe data shows that Bitcoin's dominance has been rising steadily since 2022. It also highlights that Bitcoin's market share of active users has fallen over time. The data shows that on-chain activity in Ethereum and other layer 1 (L1) networks has increased.

OnChain data shows that Bitcoin's dominance has increased since 2022, and the upward trend is the longest in history. The data also shows that Bitcoin's active user market share has fallen as on-chain activity on the Ethereum network has increased.

Amid declining users, Bitcoin dominance has increased;

Matrixport shows that Bitcoin dominance has increased to a new high of over 61%. The analytics platform put the dominance higher, which was stronger than expected in the US jobs report. It said that the increased job rate indicates that the economy is recovering. COINBASE:BTCUSD BITSTAMP:BTCUSD BYBIT:BTCUSDT.P BINANCE:BTCUSDT

Heiken Ashi Bitcoin chart shows us near Bottom of Range I have posted this chart before so this is an UPDATE

As we can see, PA has come down and now bumped into the rising line of long term support and at the expected % of drop ( -24 )

Does this mean that PA will bounce ?

NO but it does have a higher chance of doing so as the lower Timef rames are now oversold.

The weekly MACD is still falling Bearish and has a few more weeks to go before reaching Neutral.

The Lower Oversold time frames should give PA the energy to rise off this trend line and aim towards Range high

However, as we saw in 2023, PA can drop below and so we need to remain cautious and watch PA closely.

Tomorrow , March 12, we have the USA inflation data being released and this will most likely act as a catalyst to a move in either direction, depending on the data

So, Hang on , Be optimistic while being cautious.. Bitcoin is at a turning point....We are just notto sure in which direction.

Cold thinking on Bitcoin's "pullback moment"This morning, Bitcoin prices fluctuated again, falling below the $77,000 mark and currently fluctuating around $80,000. The market seems to have entered the "pullback moment" again. Faced with price fluctuations, I believe many friends are thinking about the same question:

Is it "getting off the train to avoid risks" or "entering the market at a low point" now?

This question seems simple, but it is actually complicated. Especially in the cryptocurrency market, short-term fluctuations are drastic, and various information noises are intertwined, which can easily make people lose their way. When we are in the "pullback moment", we need a calm thinking, and we should take our eyes off the price fluctuations in front of us and put them into the larger "trend" and "cycle" framework to examine.

Let's take a closer look at what a trend is and what a cycle is.

1. What are trends and cycles?

To understand any market, we should first distinguish between the two key concepts of "trend" and "cycle", and the crypto market is no exception.

Trend: Trend is the long-term direction of the development of things and a grand and lasting force. It represents the most essential and core trend of things, just like a surging river, once formed, it is difficult to reverse.

Cycle: The cycle is the short-term fluctuation in the development of things, and it is the rhythmic change of swinging around the trend line.

Simply put, the cycle is in the trend. However, simple inclusion is not enough to express the complex relationship between them. If the "trend" is compared to the trunk of a tree, the "cycle" is like the rings on the trunk.

When 96% of the world's population does not yet hold Bitcoin, when sovereign funds begin to include crypto assets in their balance sheets, and when blockchain technology becomes a new battlefield for the game between major powers - this galloping "digital ark" has just sailed out of the dock where it was built. COINBASE:BTCUSD BITSTAMP:BTCUSD BYBIT:BTCUSDT.P PEPPERSTONE:XAUUSD BINANCE:BTCUSDT

Tips to make a profit of 5000+ on BTCUSDShort-term accurate signal analysis shows support near 76300. The current price rebounded to a maximum of 82000, with a profit margin of 5000+. The current price has rebounded to a maximum of 82,000, and the profit margin has reached 5,000+. There is no chance or luck in the transaction, and only strength can lead to victory.

If you don’t know when to buy or sell, please pay close attention to the real-time signal release of the trading center or leave me a message, so that you can quickly realize the joy of profit. COINBASE:BTCUSD BITSTAMP:BTCUSD BYBIT:BTCUSDT.P BINANCE:BTCUSDT

BTCToday's strategyShort - term Trend

Recently, the price of Bitcoin has been fluctuating significantly. On March 11, it rebounded from the oversold area but struggled to rise when facing the resistance level. If the bulls can continue to exert force and break through the current resistance level of $80,375.59, it may further climb to $84,119.82. If it fails to break through, it may decline again and even fall below the key support level of $76,605.75.

Long - term Trend

From a long - term perspective, since its inception, Bitcoin has generally shown an upward - trending price, despite experiencing several significant pullbacks on the way. Some financial institutions and experts are also optimistic about the long - term value of Bitcoin. For example, Standard Chartered Bank predicts that Bitcoin could reach $500,000 by 2028.

Market Sentiment and Capital Flow Analysis

Market Sentiment

Investors' attitudes towards Bitcoin are divided. On one hand, companies like MicroStrategy continue to increase their Bitcoin purchases, demonstrating the firm confidence of some investors in its long - term value. On the other hand, the market's sharp fluctuations have also made some investors worried and cautious, remaining on the sidelines.

Yesterday, I bought near 79,000, and then the lowest fell near 76500, and then increased the position at 77000, and now sell at 81500, waiting for the next buy point

BTCUSD sell @81500-82000

tp: 78000-78500

BTCUSD Buy @77500-78000

tp: 81500-82000

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad

If you also aspire to achieve financial freedom,Follow the link below to get my daily strategy updates

BTC/usdtFirst, the decline reaches the 66,865 range, then the 87,000 range to fill the CME gap, and then the decline continues until the liquidity accumulation at the price of 45,000. From this price, we are accompanied by an upward wave of excitement to the 133,000 range, which is the target of the cup and holder pattern that was formed in the past. The final visit to the middle of the channel and the discount that Bitcoin will give us for the last time, and flight and flight and flight...

BTCUSD latest important newsThe U.S. government recently announced that it will not sell nearly 200,000 Bitcoins obtained from the Silk Road case. Instead, these holdings will be included in the strategic reserve.

The decision eased concerns about a potential large-scale sell-off that could add further pressure to the market. Meanwhile, large investors, often referred to as “whales,” continue to accumulate Bitcoin despite the market’s continued volatility.

Some market observers believe this may be a sign of confidence in the asset’s long-term potential. However, the continued volatility shows that uncertainty remains a key factor in the current crypto landscape. COINBASE:BTCUSD COINBASE:BTCUSD BINANCE:BTCUSDT BYBIT:BTCUSDT.P

El Salvador Increases Bitcoin Reserves Despite IMF RestrictionsDespite IMF restrictions, El Salvador Bitcoin Investment continues to grow and expand, demonstrating President Nayib Bukele’s current strong commitment to cryptocurrency policy. At the time of writing, the Central American country has managed to increase its Bitcoin holdings to 6,111.18 BTC, worth approximately $504 million in current markets, while also engaging in complex relationships with various major international financial institutions.

El Salvador’s government has persisted and even accelerated its Bitcoin accumulation strategy despite an agreement with the International Monetary Fund, which has significantly restricted its cryptocurrency activities. The December 2022 deal, which was established after lengthy negotiations, involves a $1.4 billion loan as part of a broader financial package of more than $3.5 billion. ]

At the time of writing, El Salvador Bitcoin Investment has catalyzed and spearheaded an increase from 6,072 BTC in February to 6,111.18 BTC in March 2025. This strategic acquisition, such as it is, demonstrates the government’s unwavering resolve to maintain and optimize its cryptocurrency policy despite external pressure from various major financial institutions as well as a number of key regulators that have implemented several restrictions in the current market environment. BITSTAMP:BTCUSD COINBASE:BTCUSD BYBIT:BTCUSDT.P BINANCE:BTCUSDT

Bitcoin crash to $80K is normal, not the start of a major declinData confirms that the latest Bitcoin crash may be the result of a natural correction, rather than the start of a major downtrend.

Bitcoin has once again fallen below $80,000 for the second time this year, sparking investor panic. As fear spreads, many are questioning whether this drop marks the end of the Bitcoin bull run or if it is just a natural correction in the ongoing uptrend. The decline in peak losses shows Bitcoin in a natural correction; in recent analysis, even though Bitcoin has revisited the $80K range, the extent of realized losses is still significantly lower than previous corrections.

While CRYPTOCAP:BTC has revisited the $8.0K range, peak losses are still significantly lower than the late February to early March correction.

Total peak losses:

February 25: $933M

February 26: $897M

February 28: $933M

BITSTAMP:BTCUSD BINANCE:BTCUSDT COINBASE:BTCUSD BYBIT:BTCUSDT.P

Bitcoin at Critical Support: Technical Analysis and Trade Idea📊 Bitcoin (BTC) is currently trading at a critical support zone, offering potential opportunities for both counter-trend trades and short setups! 🚀 In this video, we break down Bitcoin's price action and market structure on the daily and four-hour timeframes, focusing on key areas such as liquidity zones, bearish imbalances, and Fibonacci retracement levels. Discover how to identify higher highs, higher lows, and potential trade setups for both long and short positions. 💹 Whether you're an experienced trader or just getting started, this analysis will give you the tools to navigate Bitcoin's current market dynamics with confidence. 🔄 As always, this content is for educational purposes only—trade wisely and stay safe! 💡

(BTCUSD) – Bearish Continuation or Institutional Accumulation?Technical Analysis:

Bitcoin is currently trading within a descending channel, struggling to break above resistance. The price has rejected the upper boundary and could continue its downtrend toward $72,000 - $73,000 if support around $83,000 fails.

Key observations:

• Lower highs & lower lows confirm a bearish structure.

• A break below $83,000 - $82,000 could accelerate selling pressure.

• The next major support zone is $72,000 - $73,000.

Fundamental Analysis – Institutions and Governments Increasing Reserves:

• The U.S. government now holds around 200,000 BTC (~$17 billion), primarily seized from criminal cases. Their decision to maintain these holdings instead of liquidating suggests a potential shift in long-term Bitcoin adoption.

• MicroStrategy continues to accumulate BTC, now holding 423,650 BTC (~$42.43 billion), reinforcing corporate adoption of Bitcoin as a treasury asset.

• Coinbase now custodies 12% of the total Bitcoin supply, making it the largest Bitcoin custodian. This highlights institutional confidence in Bitcoin’s long-term value.

• Despite these bullish fundamentals, ETF inflows have slowed down, and macroeconomic uncertainty (such as potential Fed rate hikes) could put pressure on Bitcoin in the short term.

Will BTC reach 80,000 or 90,000? 10,000-point trading signalBTCUSD analysis and observation, 88600, 89800, 90500 are short-term resistance, and 86500, 86000, 84200 below are support. If this structure is broken, the market will enter the next stage.

BTCUSD 91000 trading opportunity has been opened, and tonight will usher in a 5000-10000 point fluctuation range

Trading is risky, positions should be reasonably controlled, when the opportunity comes, if you don’t know when to enter the market, want to get accurate transactions and huge profits in advance, please leave me a message, I will make you feel t COINBASE:BTCUSD INDEX:BTCUSD BITSTAMP:BTCUSD BINANCE:BTCUSDT hat this is true.

Bearish scenario for BTCIn trading and crypto world you have to be open to all possibilities. As we are seeing significant drop among alts and market makers manipulation. Money is withdrawed from markets and price is failing.

BTC price action reminds me 2021 year when after ATH there was a 50% drop.

Lot of similarities there - completed 5 waves, bearish div on higher timeframes, greed above 70/75, bullish sentiment, news etc.

On the other hand, current drop already liquidated more than 2b usd in one day...

We need to watch it closely and do not overtrade or do stupid FOMO.

In these time lev trades are not recommended.

THIS IS NOT A FINANCIAL ADVICE

MANAGE YOUR RISK AND ALWAYS USE STOPLOSS

Trading opportunities tonight have started at 91000Despite recent market concerns, whales continue to withdraw BTC from exchanges.

Volatility in crypto markets continued as the broader market saw 24-hour liquidations of over $500 million, with long liquidations accounting for $400 million.

The source of the US strategic reserve is the confiscated Bitcoin. The market has been prepared for this and it is not lower than expected. In the long run, it will have a great impact. BINANCE:BTCUSDT INDEX:BTCUSD BITSTAMP:BTCUSD COINBASE:BTCUSD